Beer Report 2024

Expert Insight

Consumers are prioritising value over quality amid the current economic headwinds facing the nation, according to insights service Lumina Intelligence. This increase in value-led consumers is mainly driven by 45 to 54-year-olds.

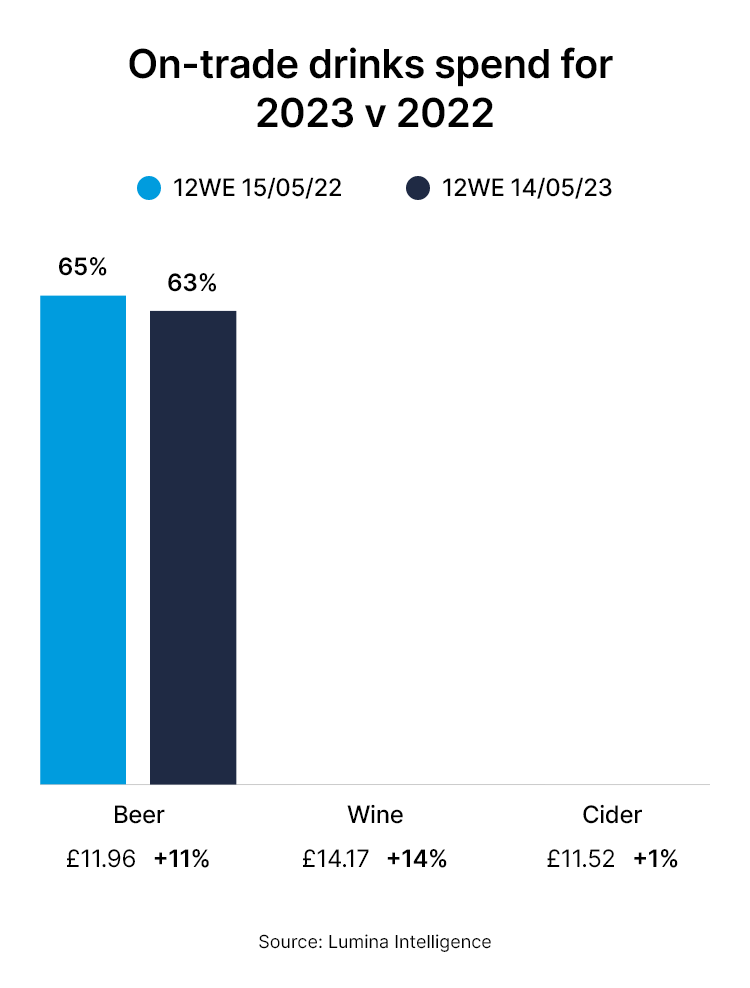

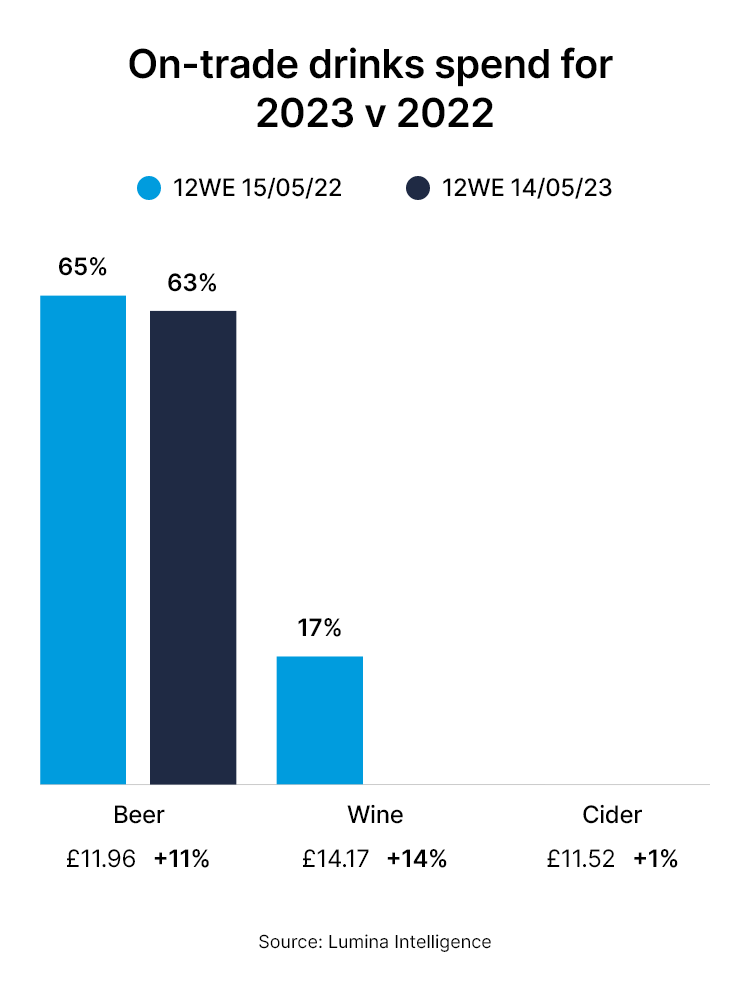

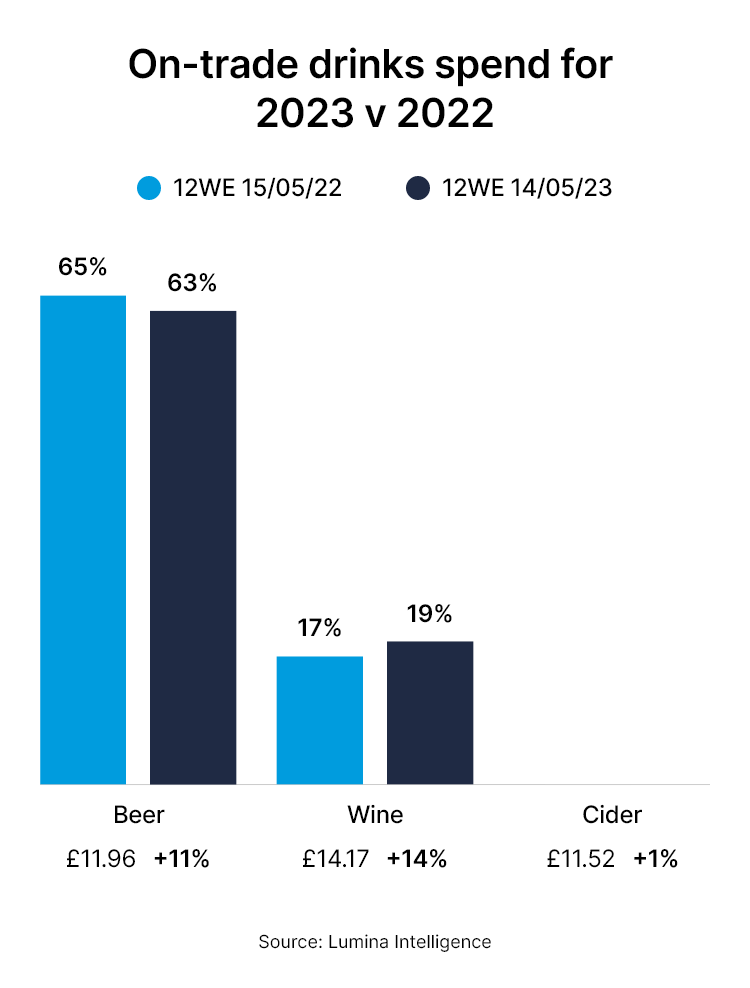

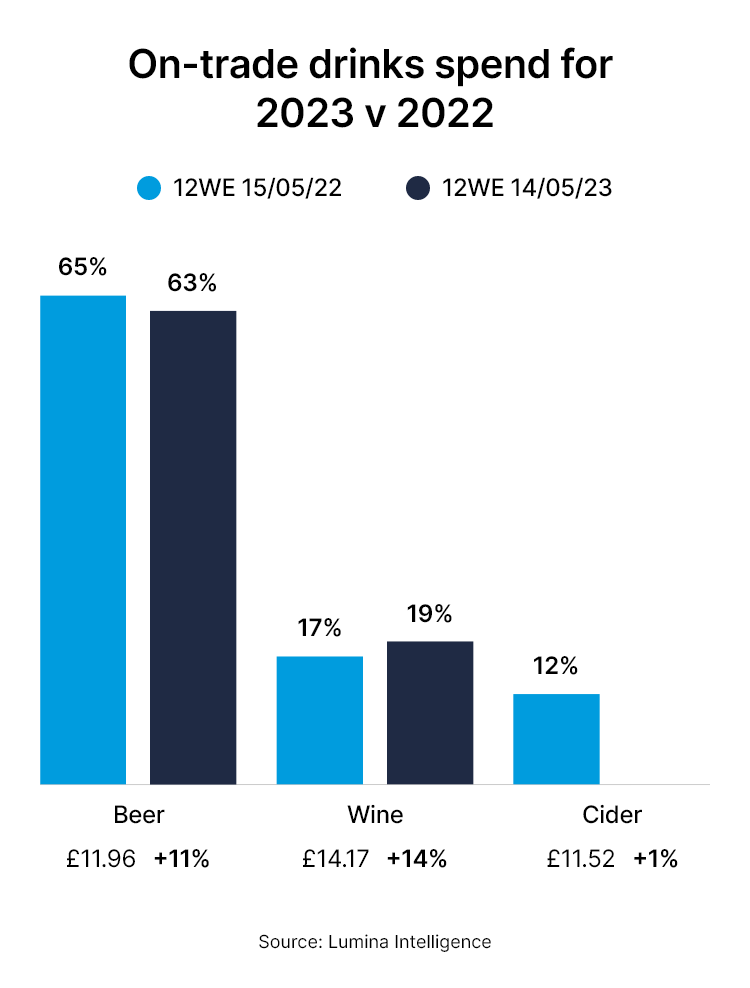

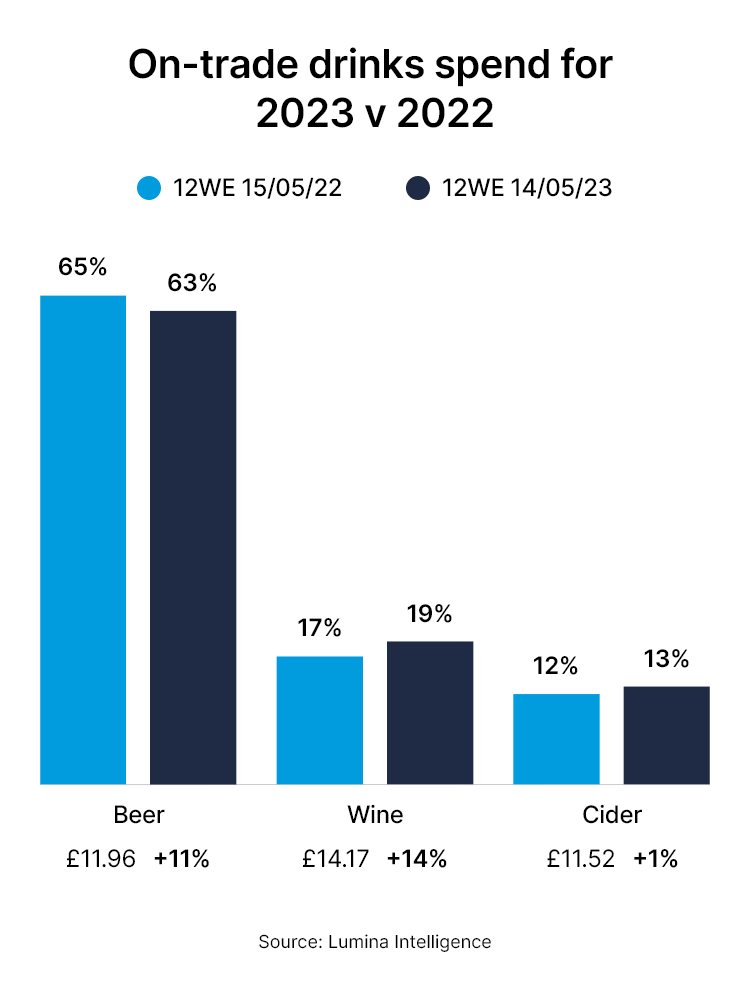

Furthermore, on pricing, drinkers opt for fewer beer occasions year on year, however, they spent more when they did go out for a pint.

Lumina stats show while in the three months to 14 May 2023, occasions fell from 65% to 63%, spend increased by 11% to £11.96.

Research from CGA by NIQ in February this year echoes this with three in five (60%) consumers telling the insight firm they would buy one or two high-quality drinks – more than the number (40%) who would buy three, four or five cheaper ones.

The popularity of low and no beer is still continuing with consumers as the Lumina data shows alcohol-free beer sales up 5% in the 12 weeks to 15 May 2023.

In fact, CGA by NIQ also identifies a similar trend in the low and no segment but shows overall beer sales were hit by the cost-of-living crisis and more than a fifth (22%) of consumers told CGA’s Consumer Pulse survey in late 2023 that it had led them to choose pints of beer or cider less often – double that (10%) of those who were buying them more.

Some of these sales migrate to cheaper no or low alternatives or soft drinks with almost one in five (19%) now buying these more often compared to 18% who say they are buying them less.

Elsewhere in CGA’s research, it shows while overall drinks categories value sales were flat in 2023, beer outpaced this trend with 3% growth, despite a 4% distribution decrease and a 1% drop in sales by volume.

Moreover, it shows world lager is being boosted by the premiumisation trend with the category seeing a 23.3% share of long-alcoholic drink sales in 2023 – up 2.6 percentage points year on year.

However, standard lager is the opposite, dropping 1.4 percentage points to 20.8%. At the end of last year, draught world lager was stocked in almost seven in 10 (69.1%) of outlets.

Stout is another sub-category winner, according to CGA, as its volumes grew by 18% and now has an 8.1% share of the long-alcoholic drink market.

The research reveals how beer sales tend to spike around big sporting occasion such as an average uplift of almost a quarter (23%) on matchdays during the World Cup.

Asahi UK

Asahi UK is a subsidiary of Asahi Europe & International and is responsible for sales, marketing and customer operations across the UK and Ireland.

With its portfolio of super-premium beer brands, Asahi UK enriches consumer experiences through innovation, high-quality service and an exceptional portfolio of premium beer, ale, and cider brands, which include Peroni Nastro Azzurro (PNA), Asahi Super Dry (ASD), Meantime, Fuller’s London Pride and Cornish Orchards.

In the on-trade, premium lager is currently the only price segment in the lager category experiencing growth, at 2.7%, and now makes up 38% of the category by volume sales.[1] In lager, Asahi Super Dry and Peroni Nastro Azzurro are significant profit drivers for the category, with an average price per pint of £6.11 and £5.87 respectively, vs the average price of a premium lager at £5.40.1

The business is focused on creating profitable partnerships with premium outlets through its quality brands and delivering commercial value in the marketplace.

We urge any operator who is passionate about growing their sales of quality beer and cider to get in touch on communications@asahibeer.co.uk