Beer Report 2025

Brought to you by

Sponsored by

Overview

In The Morning Advertiser’s Beer Report 2025, which is sponsored by BrewDog and Greene King, there are positive moves for value in total beer sales in the on-trade and noticeable gains in volume and value sales for low & no beers, stout and world lager while other categories have suffered losses in both volume and value sales.

A lot can happen in a year, according to CGA by NIQ client director Nick Riley.

Nick Riley, client director, CGA by NIQ

Nick Riley, client director, CGA by NIQ

In this overview, Riley takes a look at the on-trade beer market and explains what the figures compiled by the insights expert mean for pubs and bars across the country…

Thinking back to this time 12 months ago and, more specifically, in trying to figure out how 2024 might stack up against 2023, the expectation was for ‘business-as-usual’ from a trend perspective.

Hot topic areas like cost-of-living, premiumisation, quality over quantity and moderation had continued to grow or persist over the few years prior without much let-up – and seemed to set the scene for what was to come.

That said, this time last year we didn’t realise an early election was on the horizon. But it was. And with it came a new landlord at No.10 and a proverbial ‘under new management’ sign hanging above the door.

This fuelled optimism for many. But, in the latter half of last year, as the Autumn Budget drew closer, we saw a drop in on-trade market confidence among operators, as the uncertainty of the announcement loomed, reaching its lowest level (20%) since October 2022 (8%) (Source: CGA by NIQ Business Confidence Survey).

We ended up therefore straddling the line between ‘business as usual’ and ‘unsure of what’s to come’. And so, with 2024 put to bed and the first few months of 2025 under our belts, how did those expectations around consumer trends play out? And what does the on-premise market, especially for beer look like now as we head into the second quarter of the year?

Well, despite those confidence levels falling further still off the back of the Budget and with mounting concerns about the measures that were scheduled to land in early April, over the course of the year, the trade showed some positive movement.

And, to December 2024 versus the previous year, there was net growth in total outlet numbers for the first time in several years. It wasn’t anything too fancy, but growth is growth is growth, after all.

We saw little hotbeds of activity, particularly in cities and urban centres, as working habits continued to normalise in a world that watched Covid edge further and further into the distance.

This was good news for high street pubs, increasing in number by 3.7%, with independent and managed operators fuelling growth across the pub sector, while leased sites saw their numbers fall.

Cost of living was certainly still a factor that drove and dictated consumer behaviour. While the proportion of consumers impacted by rising living costs eased slightly in 2024 (88% vs 90% in 2023), the majority still felt the pinch. Of those going out less often than usual (33%, December 2024), cost-of-living increases were the overwhelming driver of this, with more than 6 in 10 consumers citing it as a reason.

It was this continued squeeze on budgets and subsequent tightening of purse strings that saw overall visits to the on-trade, and consumption when out in it, fall.

Total visits were down 6% in 2024 versus the previous year (source: CGA by NIQ OPUS June 2024 vs 2023) and, as such, so were volumes across the board.

Total alcohol sales (including beer, cider, wine and spirits) were down almost 3% in the 12 months to February 2025. Fortunately for beer, the category ‘outperformed’ all others in seeing its volume sales take a smaller 2.2% dip.

This performance was largely driven by the general popularity of key categories like world lager and stout. However, beer, like cider also benefited from category-switching as consumers looked to maximise the bang for their buck and chose longer serves in pints and bottles that were seen to represent better value for money than categories like spirits, that saw far heavier declines.

The Morning Advertiser team of Gary Lloyd, Nikkie Thatcher and Rebecca Weller report more below and there’s vital input from CGA by NIQ client director Nick Riley and beer expert Caroline Nodder from the Society of Independent Brewers & Associates (SIBA).

Category breakdowns

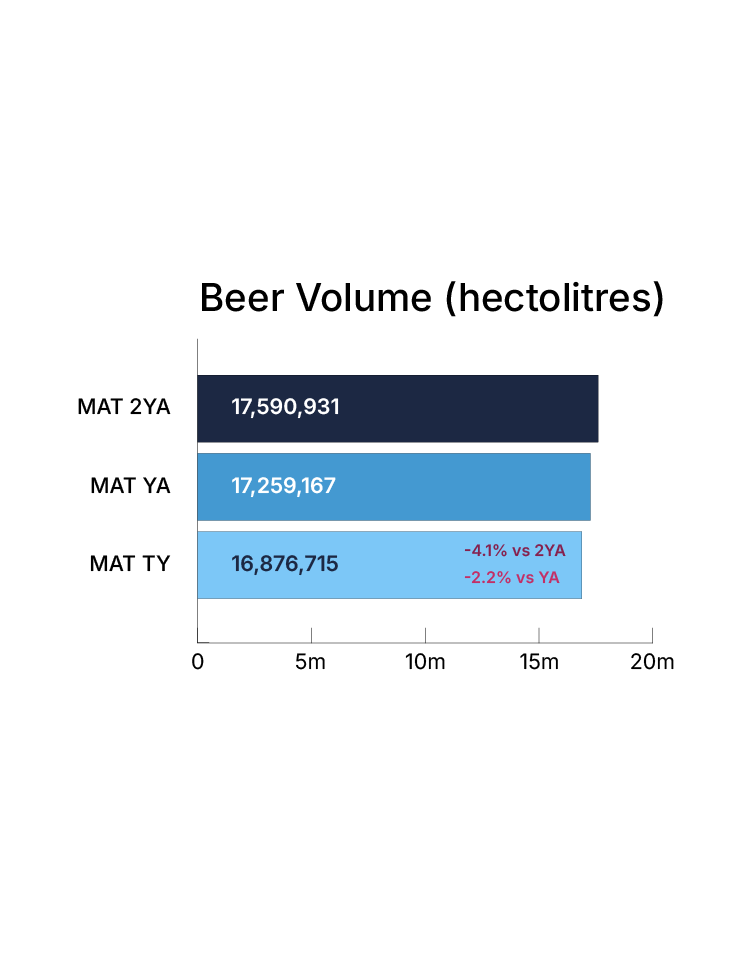

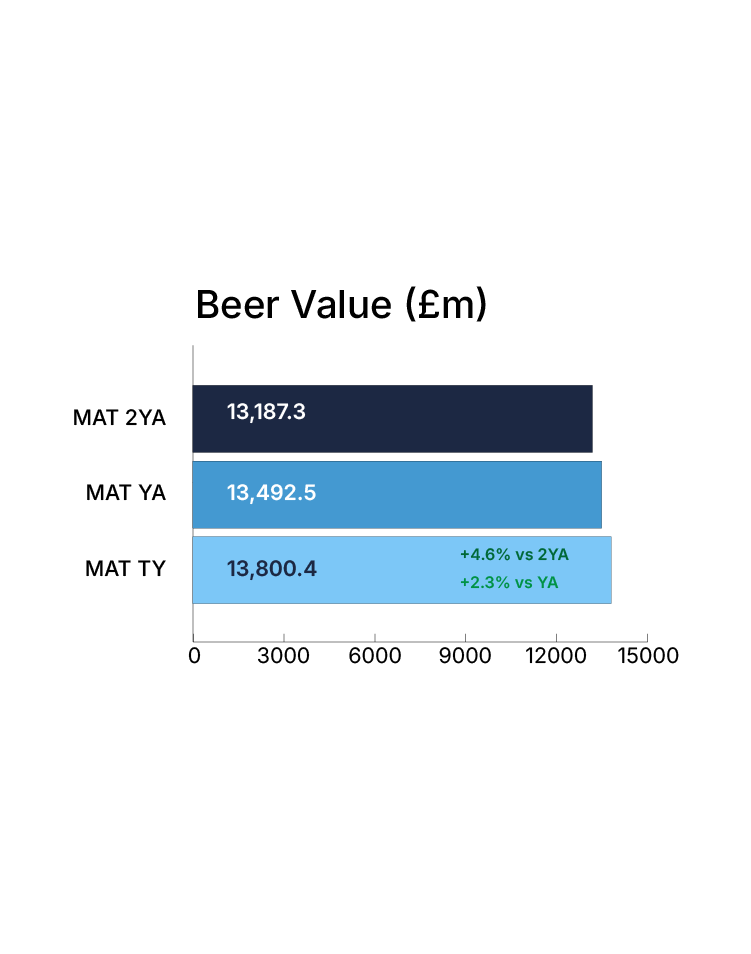

Statistics from CGA by NIQ show the total beer market in the on-trade has dipped in volume sales but risen slightly in value sales.

Volume sales of beer have fallen 2.2% from 17.26m hectolitres (HL) a year ago to 16.88mHL and this has dropped 4.1% from two years ago when it was 17.60mHL.

The story for value sales has improved though. From £13.19bn in 2023 to £13.50bn last year and up to £13.8bn in 2025 – representing a 4.6% lift from two years ago and a further 2.3% rise from 2024.

CGA by NIQ client director Nick Riley says the improved performance was mainly driven by the popularity of key categories such as world lager and stout. However, pub customers helped sales by switching categories to get more “bang for their buck” and chose longer serves in pints and bottles that were seen to represent better value for money than categories like spirits, that saw far heavier declines.

Riley adds: “More generally, the rest of 2025 will likely see the spotlight focused more on operators within the trade than the consumers going out into it.

“With the cost increases from things like national living wage, national insurance and business rates relief that came into effect at the start of April, the sector has a swathe of challenges and uncertainties to navigate.

“Operators will be looking to eke as much time and money spent in venues as possible. So, alongside some inevitable closures, trimmed trading hours and scaled-back offers, also expect a rise in efforts to get you through the door and encourage you to stay.

“One thing is for certain, operators will be focused on ‘giving the people what they want’ and at the moment that’s world lager, it’s stout and increasingly it’s low and no alcohol. So, expect more of the same on this front.”

Low & no alcohol beer

Low & no alcohol beer is the definitive winner when it comes to on-trade sales in volume and value.

The category has enjoyed giant rises as demonstrated by data that showed a 51% lift in volume sales from 121.7k hectolitres (HL) in 2024 to 183.7kHL this year. Volume sales of 89.7kHL in 2023 represented a 105% uplift to 2025.

Value sales have rocketed too: in 2023, £81.9m was the market figure, which rose to £118.3m last year and is now £184.7m – this represented a 56.1% boost from 2024 and 125.4% from two years ago.

The volume and value share of the total beer market was in the green too as volume sales have gone from 0.5% to 0.7% to 1.1% from 2023 to 2025 respectively. Meanwhile, the share of value sales are now 1.3% having been 0.9% last year and 0.6% the year before that.

CGA by NIQ client director Nick Riley says: “Over a third of GB consumers report drinking less this year versus last year (source: CGA by NIQ BrandTrack October 2024) and of those cutting back, almost 4 in 10 are ‘trying to be healthier’.

“This is not only the main reason but it’s got a decent lead on the second and third-placed reasons (25% saving money and 24% going out less). So, moderation is definitely a thing, that we can all agree on.

“The growth figures for low & no alcohol beer certainly look impressive too, at over 50% up on the year to February and over 100% over the past two years.

“Granted this is from a smaller base and low & no does still account for a negligible slice of total beer, but in what could be a bit of a watershed moment, that slice is now over 1.0% of the pie. And given that Rome wasn’t built in a day, this is great momentum for the category.

“There are now a couple of draught products each stocked in over 1,000 outlets and with more being introduced to the market on a seemingly weekly basis, expect the growth of draught low & no in particular and the availability of permanent 0% taps on bars to go from strength to strength in 2025.”

Ale (Cask)

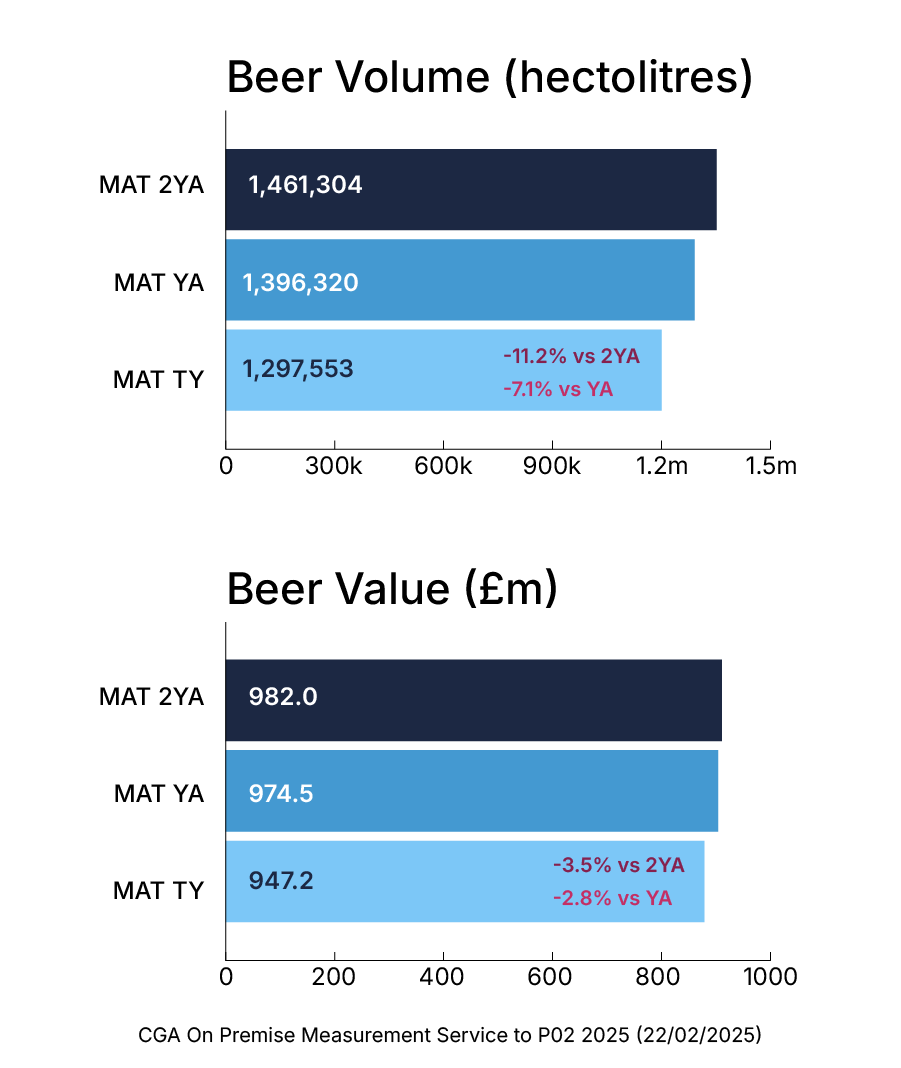

The long-term, yet steady, decline of cask ale has been well documented over previous years and although volume sales have fallen over the past two years, value sales have only dropped slightly.

The volume statistics show 1.28m hectolitres (HL) were sold in the on-trade this year but that is a 7.1% fall from 1.40mHL a year ago – and an 11.2% drop from two years ago when volume sales made up 1.46mHL.

The financial fall has not been as far with £982m worth of sales in 2023 becoming £974m last year and £947m now. These drops have been worth 3.5% and 2.8% respectively.

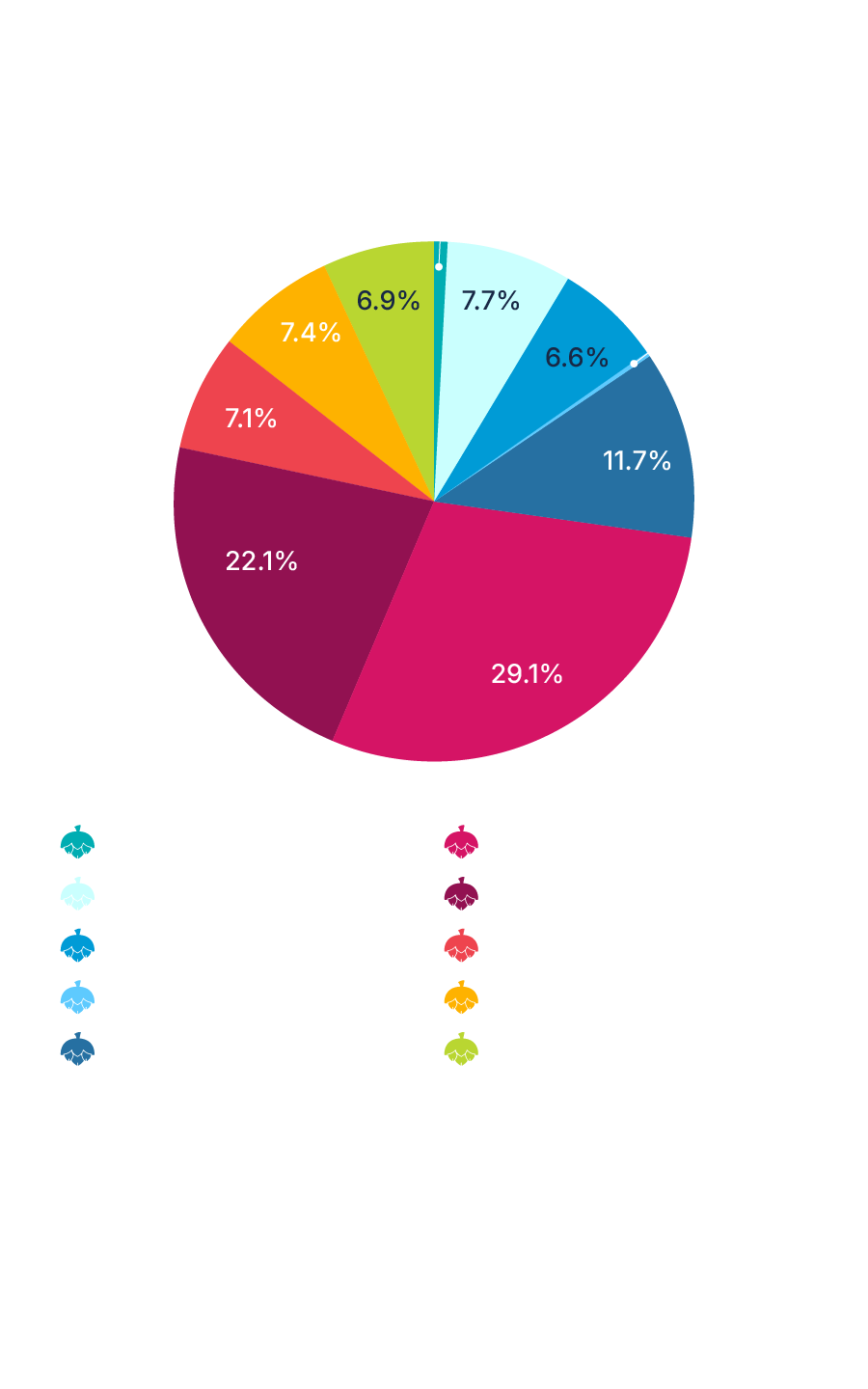

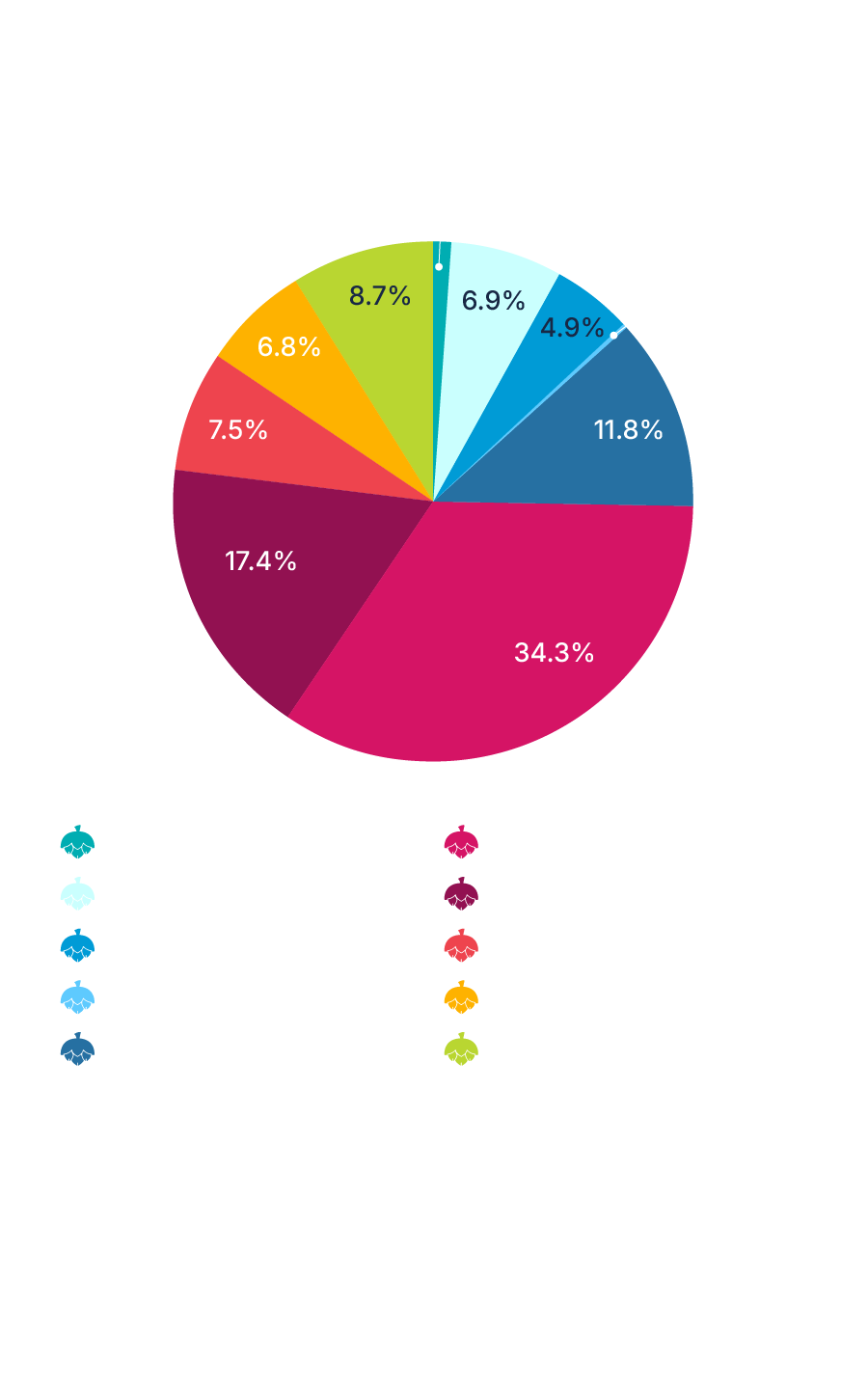

In terms of market share of the total on-trade beer market, cask ale volumes used to represent 8.3% of volume share two years ago, which dropped to 8.1% in 2024 and is now 7.7%.

The story with value is similar as 6.9% of total share is the current figure, having been 7.2% a year ago and 7.4% a year before that.

CGA by NIQ client director Nick Riley says despite the falls, “there are shoots of hope with a handful of brands having a better time of it”.

“And with initiatives and innovation coming from brewers to support the category there is scope (and hope) for some positive movement here in the coming few years.”

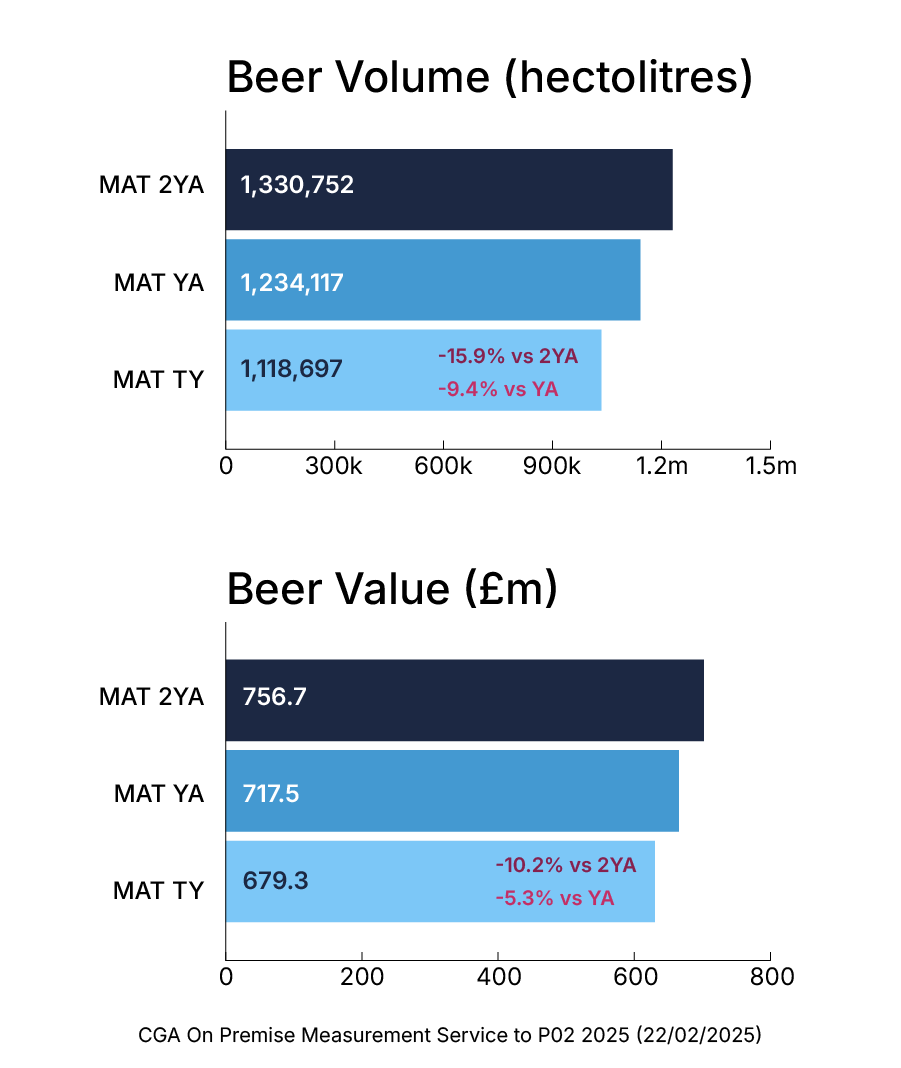

Ale (kegged)

Kegged ale has suffered a heavier drop in volume and value sales than its cask counterpart but hope springs eternal as the major players continue to consolidate.

A 9.4% fall in the past year in volume sales has resulted in kegged ale selling 1.12m hectolitres (HL) – down from 1.23mHL last year – and 1.33mHL two years ago (representing a 15.9% fall).

Value sales for kegged ale have also declined but at a lower percentage. The category was worth £757m in 2023 and £717m last year but that figure now stands at £697m, which works out at a 5.3% loss from last year and a 10.2% drop versus 2023.

Likewise, kegged ale’s share on the on-trade beer market has fallen too.

While volume sales have declined by one percentage point from two years ago, they are down 0.6 percentage points from 2024. The category used to have 7.6% of volumes in 2023 and 7.2% a year ago but now own 6.6% of the total market.

Value sales were 5.7% of the market two years ago but have fallen to 5.3% in 2024 and are now at 4.9%.

In early 2024, ‘Fresh Ale’ – a kegged ale product – was introduced to the on-trade by then named Carlsberg Marston’s Brewing Company (CMBC) with the premise being a cask-style beer sold in keg format.

While cask ale, which undergoes a secondary fermentation in the barrel, should be at its optimum quality for just three days, Fresh Ale stays at its peak for 14 days – and may hold some hopes for the category for years to come.

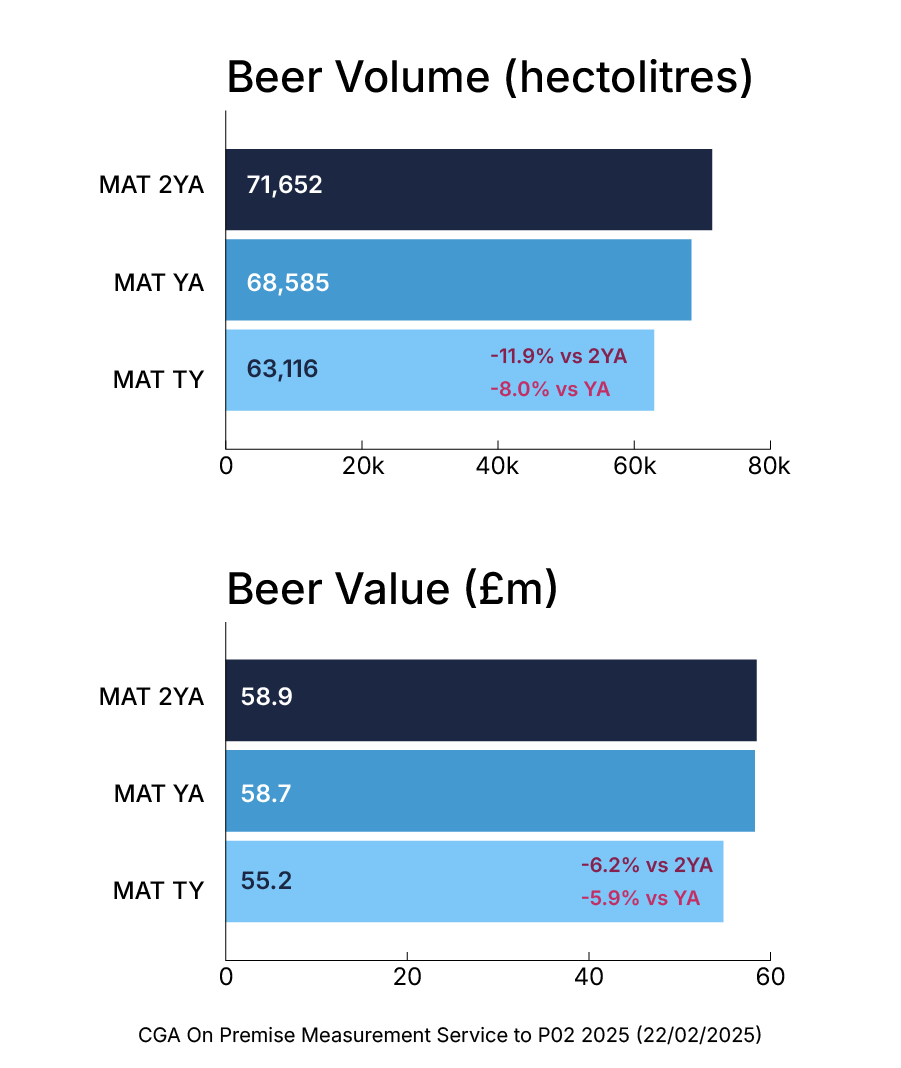

Total ale (packaged)

Overall, total ale in packaged formats, which is the smallest segment of the beer category, saw declines across the board. Volume sales slipped in the year to 22 February 2025 by 8% however, this was a lower drop than the two-year period, which was 11.9% down.

In terms of value, this also fell but was a smaller drop at 6.2% compared to two years ago and 5.9% against last year.

This means currently, volume sales for total packaged ale stand at 63k hectolitres (HL) and £55.2m for value.

Packaged ale is the smallest beer style in terms of volume and value sales, even compared to its counterparts as keg stands at 1.12mHL in volume sales and £679.3m in value while cask is at 1.30mHL for volume and £947.2m in value.

Nick Riley of CGA by NIQ outlines how the segment could learn from other beer styles that are seeing growth.

He says: “Notably, the big heritage play that has benefited stout may well pave the way for some category-stalwarts coming out of retirement or having a ‘glow up’. Watch this space!”

Furthermore, according to the data, the packaged ale segment’s market share has remained the same across both the previous 12 months and compared to two years ago at 0.4% in volume and value, meaning it has the smallest share of all the beer segments.

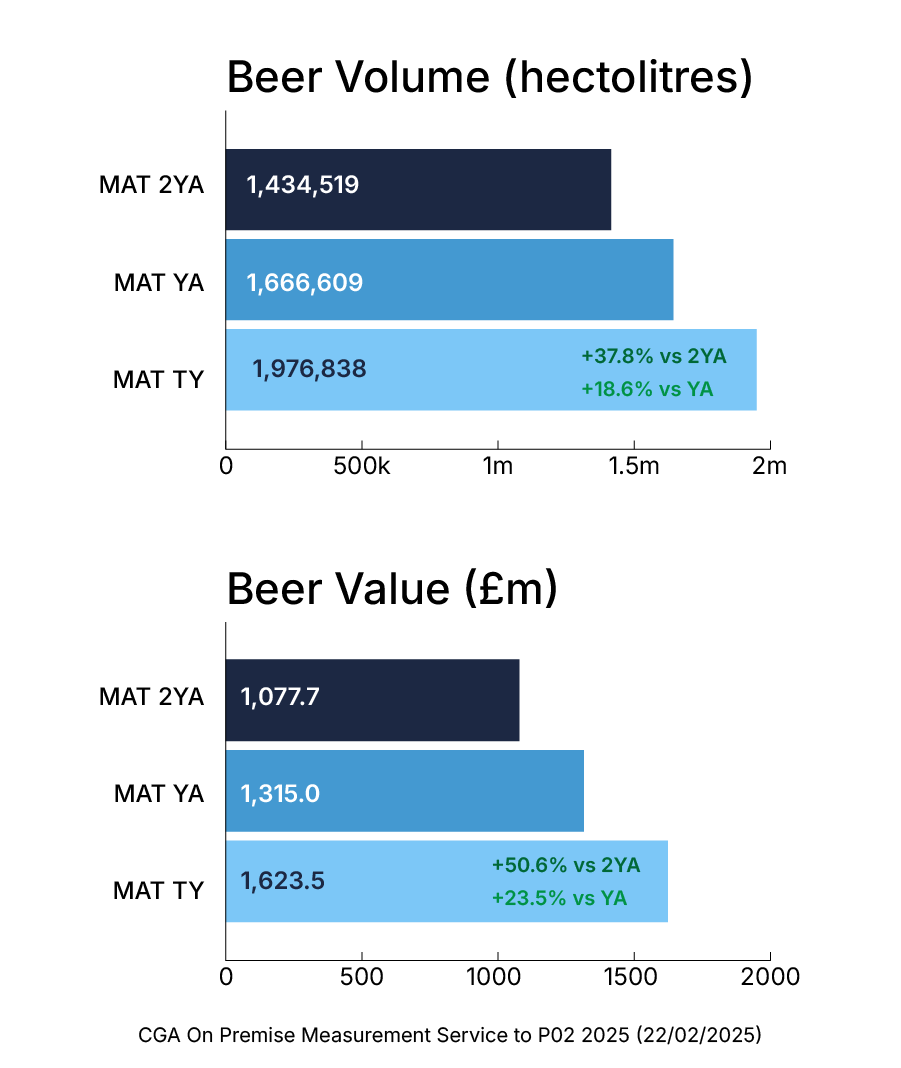

Stout

It’s no surprise stout was one of just three beer styles reporting growth in the latest data. Currently, volume sales of stout are at 1.98m hectolitres (HL) with value at £1.62bn.

Compared to last year, this is up 18.6% in volume and 23.5% in value and even more so against two years ago – 37.8% in volume and 50.6% in value.

The segment’s market share has also risen with it currently standing at 11.7% for volume – up 3.6% against two years ago and 2.1% compared to last year.

This was also the case in value where it currently has 11.8% of the market, increases on 2024 and 2023 – rises of 2% and 3.6% respectively.

CGA by NIQ’s Nick Riley says: “For stout, we all know there was a clear winner. You can’t move in the trade now without seeing attempts at ‘splitting the G’ to varied levels of success.

“It was this viral trend, alongside savvy marketing that played on heritage and quality, and close ties to sport, that saw the recruitment of a younger, more female and highly engaged on-premise consumer at a time when others were lamenting the rise in moderation and ‘stay at home’ habits among the next generation of drinkers.

“In fact, that recruitment was so successful (wholly deliberately or not) that 25% of current stout drinkers report having only starting drinking it in the past 12 months (according to CGA by NIQ BrandTrack February 2025) and that figure climbs to a whopping 82% for 18 to 24-year-olds.

“What will be exciting to see this year is whether other stout brands will be able to capitalise on these successes. Other major brewers seem to be betting more of their chips on the stout brands in their portfolio, be that through reinvigorating older brands or bringing new ones into the fold.”

World lager

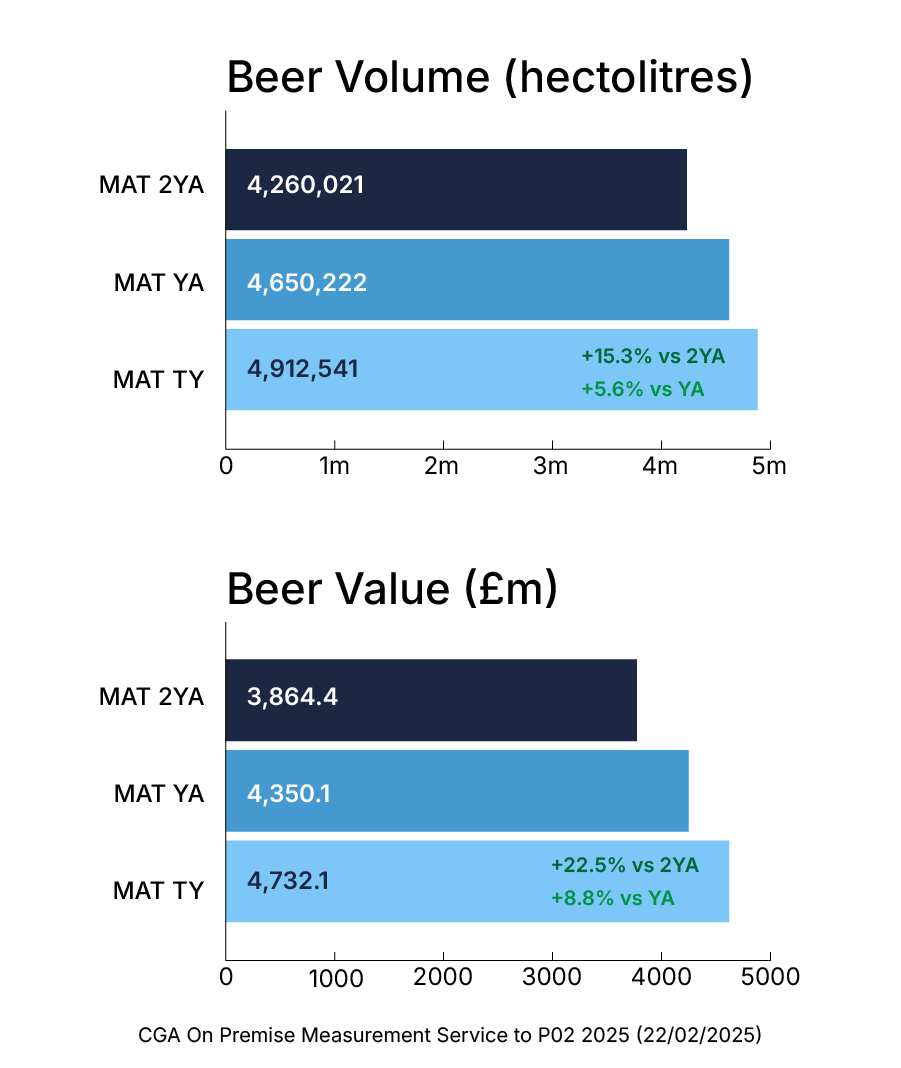

World lager was another of the three segments reporting positive figures in the latest data. Volume sales were up to 4.91m hectolitres (HL) this year – a rise of 5.6% against 2024 where figures were at 4.65mHL and 15.3% on 2023 (4.26mHL).

Value sales saw a bigger increase to £4.73bn – this was up 8.8% on last year and a rise of almost a quarter (22.5%) on two years ago where the stats showed sales of £4.35bn in 2024 and £3.86bn in 2023.

However, the segment saw the lowest sales increases of the three categories reporting rises (world lager, low & no alcohol beer and stout) but, was the only lager segment that reported positive growth with core, premium and premium 4% all seeing declines.

The segment is also the largest of the overall beer category with 29.1% of volume share and 34.3% of value – up on last year by 2.2% and 2% respectively and compared to 2023, it was a rise of 4.9% and 5%.

CGA by NIQ client director Nick Riley says: “World lager further cemented its place as the biggest beer category, now accounting for almost three-in-10 pints poured (29% volume share of total beer) and over a third of pounds spent (34% value share of total beer).”

He outlines how this is set to continue for a variety of reasons including producer innovation and consumer behaviour.

“For world lager, this momentum shows no sign of slowing, with activity throughout the category and brewers looking to continue capitalising on consumers’ preference for premium, continental-style beers,” Riley says.

Core lager

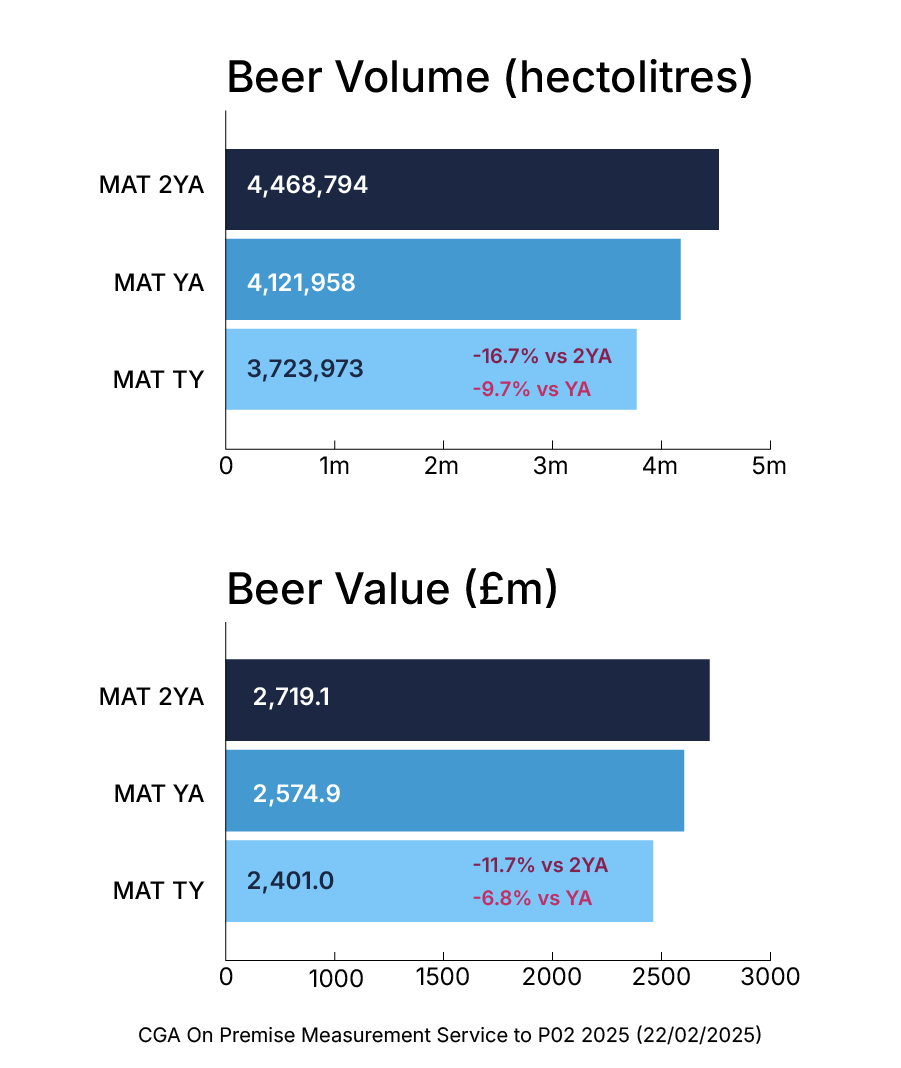

The second largest segment of the beer market is core lager, despite seeing drops in its sales in recent years.

Volume sales are at 3.72bn hectolitres (HL) – this is down by 9.7% against last year when sales of 4.12bnHL were recorded and 16.7% down compared to 2023 (4.47bnHL).

It was a similar story for value sales, which currently stand at £2.40bn but, this is a decrease of 6.8% from 2024 when sales were at £2.57bn and 11.7% against two years ago when they stood at £2.72bn.

With regards to market share, the core lager segment has retained a large part of the pie, holding more than one fifth (22.1%) of it in terms of volume and 17.4% in value.

However, this was down compared to previous years. Last year, the category was at 23.9% of volume share and more than a quarter (25.4%) two years ago.

In terms of value, again core lager has reduced its share as two years ago, it stood at 20.6% and last year was 19.1%.

It’s a fair way behind world lager, which accounts for almost three in 10 pints poured (29% of volume share of total beer) and more than a third of pounds spent (34% value share of total beer).

Core lager is one of the categories being particularly hard hit by the less but better trend where consumers are cutting back on consumption due to cost pressures, according to CGA by NIQ client director Nick Riley.

Premium lager

Sales of premium lager saw a double-digit fall in volume sales during the year to February 2025.

According to data from CGA by NIQ, the category has dropped 10.4% in volume sales compared with a year ago, decreasing from 1.33m hectolitres (HL) to 1.19mHL.

Though this was a smaller decline than two years ago, when volume sales fell from 1.61mHL, which represented a 25.8% drop to now.

The moving annual total (MAT) in value sales for premium lager stood at £1.12bn last year compared to £1.04bn this year, representing a 7.2% fall in value.

Meanwhile two years ago, the category’s MAT was £1.30bn, representing a 20.2% drop to the current figure.

It means premium lager’s total volume share of the overall beer category has fallen from 9.1% two years ago to 7.7% last year and now sits at 7.1%.

Meanwhile, value share has also consistently declined, falling from 9.8% in 2023 to 8.3% in 2024, sitting at 7.5% this year.

Premium lager, premium 4% lager and core lager have felt the sharpest declines over the past two years as consumers look to trade up to more expensive beers, such as world lager, and opting for a ‘less but better’ approach to drinking, according to CGA by NIQ client director Nick Riley.

Premium 4% lager

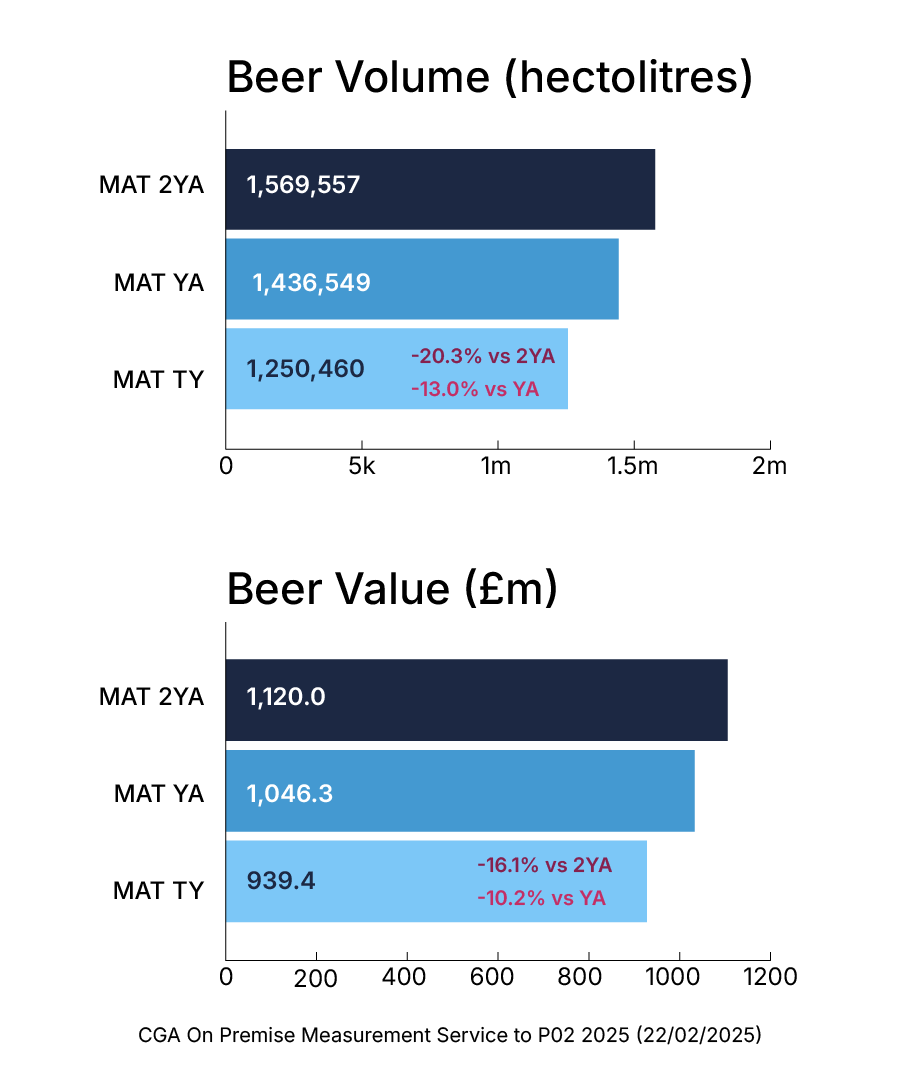

Sales of premium 4% lager have seen the second biggest decline in volume sales over the past two years.

Figures from CGA by NIQ showed the category saw a 20.3% drop in volume sales compared with two years ago, decreasing from 1.57m hectolitres (HL) in 2023 to 1.25mHL in 2025.

Year-on-year, the segment saw a 13% downturn in volume sales, dropping from 1.44mHL.

It marked the second biggest decline in volume sales of all the beer categories measured, with premium lager having been hit hardest.

The moving annual total (MAT) for premium 4% lager stood at £1.12bn two years ago compared to £939m this year, representing a 16.1% fall in value. Year-on-year the category has dropped 10.2% in value, from £1.05bn.

It means premium 4% lager’s share of the total beer market has dwindled by 1.5% over the past two years and 0.9% year-on-year.

Craft beer

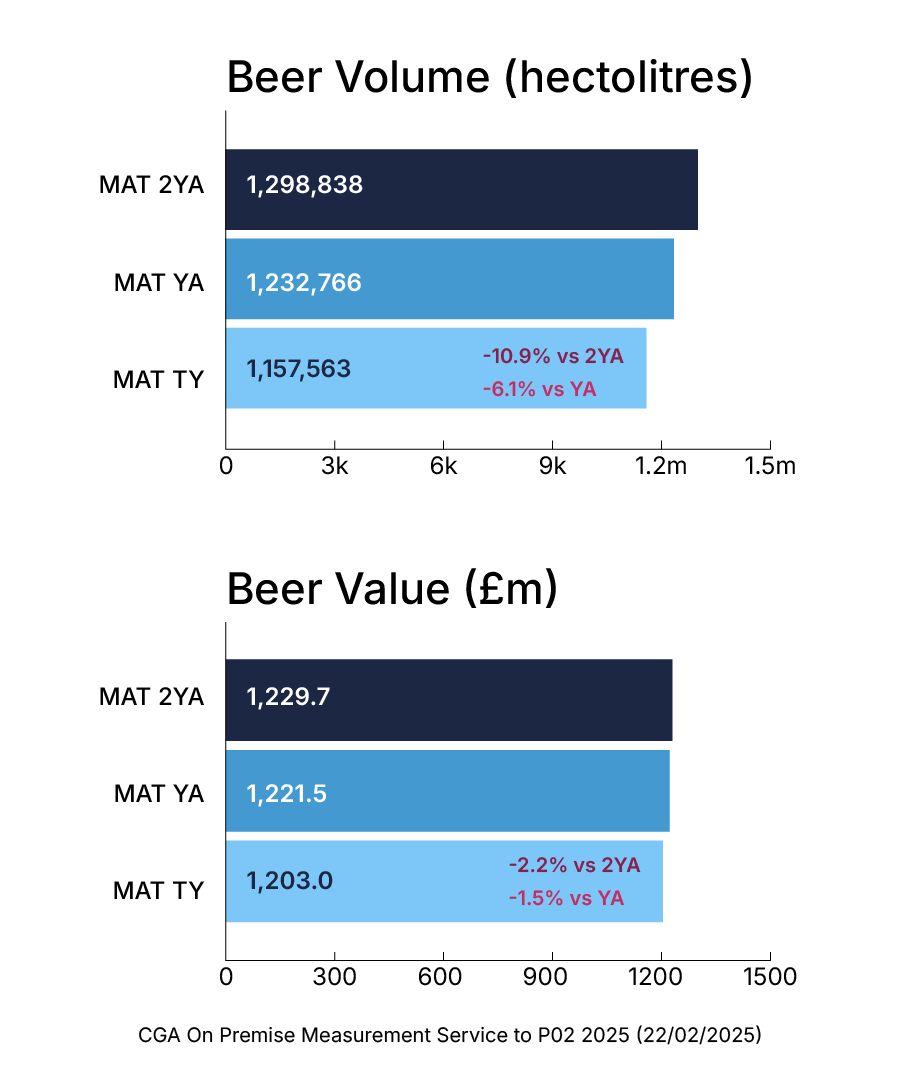

Despite its soaring popularity over the past decade, craft beer also saw dwindling sales in the year to February 2025.

However, the segment was not as hard hit as others, such as premium lager. According to data from CGA, craft beer saw a 1.5% downturn in value during the 12-month period, dropping from £1.23bn to £1.20bn.

In addition, volume sales declined by 6.1% year-on-year, decreasing from 1.23m hectolitres (HL) to 1.16mHL

Compared to two years ago, the category has dropped 10.9% in volume, from 1.3mHL, and 2.2% in value, from £1.30bn.

It means craft’s share of the total beer category has dwindled by 0.3% over the past year and 0.5% since 2023.

CGA by NIQ client director Nick Riley said: “Craft is a category that, on the face of it, should have been perfectly placed to take advantage of consumers’ premiumising tastes.

“But it too has seen volumes fall in the 12 months to February 2025, albeit to a lesser extent.

“It seems, in craft’s case, that it’s actually just too expensive, with more than a fifth of occasional craft drinkers put off from drinking it more often due to its price.”

Price Data

Exclusive data from a survey by The Morning Advertiser has unearthed the average prices of pints across the different areas of Great Britain.

As described throughout The Beer Report 2025, stout, world lagers and low & no are faring strongly but here we can see some hard numbers for the first two of those categories, thanks to a survey in April 2025.

Guinness has seen prices rise by an average of 3.58% from the same survey carried out in January 2025. Its price point is £5.56 with London being the most expensive at £6.45 on average while operators are charging £4.95 in the north-east.

In world lagers, Peroni, Asahi and Birra Moretti are achieving more than £6 per pint serve with just downturns in pricing for San Miguel and Estrella Damn versus the January survey.

Core lagers gaining an increased average price include Carling, Amstel, Tennent’s and Stella Artois, with the latter commanding the highest price point in the category of £5.27.

On the craft beer front, four of the five brands publicans were surveyed about are still reaching average pint prices in excess of £6 with Camden Hells and BrewDog Punk IPA tipping the scale at a juicy £6.34 each.

Cask ale may be enduring a steady decline but some brands are ensuring pubs are still making money from their sales with evergreen Timothy Taylor’s Landlord climbing to an average selling point of £5.12 with Pedigree commanding a £5.16 fee.Price

Scotland

Premium Lager (Price per pint)

Cruzcampo £4.25

Birra Moretti £7.50 (£5.38 in 2024)

Standard Lager (Price per pint)

Tennent's Lager £4.68

Craft Beer (Price per pint)

Beavertown Neck Oil £5.80 (£5.81 in 2024)

Cask Beer (Price per pint)

Doom Bar £4.00

Stout(Price per pint)

Guinness £5.21 (£4.96 in 2024)

North East

Premium Lager (Price per pint)

Heineken £5.26

Madri £5.02 (£4.73 in 2024)

Asahi £5.60

Cruzcampo £5.24

San Miguel £5.23

Birra Moretti £5.34 (£5.04 in 2024)

Staropramen £5.20 (£4.64 in 2024)

Estrella Damm £5.00

Standard Lager (Price per pint)

Carling £4.33 (£3.88 in 2024)

Fosters £4.29 (£3.84 in 2024)

Carlsberg £4.13

Amstel £4.30

Stella Artois £5.17

Pravha £4.40

Coors Light £4.58

Craft Beer (Price per pint)

Camden Hells £6.20

Camden Pale Ale £6.00

Beavertown Neck Oil £5.49 (£5.36 in 2024)

Cask Beer (Price per pint)

Doom Bar £4.30 (£4.39 in 2024)

Greene King IPA £4.10 (£3.77 in 2024)

Tribute Pale Ale £4.20

Wainwright £5.00

Hobgoblin £5.00

Timothy Taylor's Landlord £4.89 (£4.30 in 2024)

Stout(Price per pint)

Guinness £4.95 (£4.65 in 2024)

North West

Premium Lager (Price per pint)

Peroni £6.15 (£5.74 in 2024)

Heineken £6.17

Madri £5.26 (£5.04 in 2024)

Cruzcampo £5.58

San Miguel £5.31

Birra Moretti £5.71 (£5.45 in 2024)

Staropramen £4.93 (£5.12 in 2024)

Estrella Damm £5.62

Standard Lager (Price per pint)

Carling £4.26 (£4.23 in 2024)

Fosters £4.08 (£3.95 in 2024)

Carlsberg £4.22

Amstel £5.29

Budweiser £5.08

Stella Artois £5.14 (£4.20 in 2024)

Pravha £5.03

Coors Light £4.45

Corona £4.60

Tennent's Lager £4.50

Craft Beer (Price per pint)

Camden Hells £6.00 (£5.75 in 2024)

Camden Pale Ale £5.23

Beavertown Neck Oil £5.86 (£5.86 in 2024)

BrewDog Punk IPA £7.30 (£6.40 in 2024)

Cask Beer (Price per pint)

Doom Bar £4.41 (£4.23 in 2024)

Greene King IPA £4.55 (£3.92 in 2024)

Tribute Pale Ale £3.95

London Pride £4.45 (£4.24 in 2024)

Wainwright £4.37

Pedigree £4.80

Hobgoblin £4.17

Timothy Taylor's Landlord £4.73 (£4.67 in 2024)

Stout(Price per pint)

Guinness £5.43 (£5.04 in 2024)

Midlands

Premium Lager (Price per pint)

Peroni £5.63 (£5.36 in 2024)

Heineken £3.98

Madri £5.18 (£5.07 in 2024)

Asahi £5.35

Cruzcampo £5.14

San Miguel £4.95

Birra Moretti £5.37 (£5.24 in 2024)

Staropramen £4.96 (£4.81 in 2024)

Estrella Damm £5.75

Standard Lager (Price per pint)

Carling £4.45 (£4.25 in 2024)

Fosters £3.80 (£4.20 in 2024)

Carlsberg £3.72

Amstel £4.60

Budweiser £3.35

Stella Artois £4.70 (£4.81 in 2024)

Pravha £4.63

Coors Light £4.10

Corona £3.90

Tennent's Lager £3.50

Craft Beer (Price per pint)

Camden Hells £5.97 (£5.55 in 2024)

Camden Pale Ale £5.48

Beavertown Neck Oil £6.19 (£5.93 in 2024)

BrewDog Punk IPA £5.64 (£5.35 in 2024)

Cask Beer (Price per pint)

Doom Bar £4.23 (£4.09 in 2024)

Greene King IPA £3.85 (£4.33 in 2024)

Abbot Ale £4.35

Tribute Pale Ale £4.99

London Pride £4.10 (£4.47 in 2024)

Wainwright £4.60

Pedigree £4.61

Hobgoblin £4.00

Timothy Taylor's Landlord £5.12 (£4.58 in 2024)

Stout(Price per pint)

Guinness £5.38 (£5.02 in 2024)

Wales

Premium Lager (Price per pint)

Peroni £5.85 (£5.79 in 2024)

Heineken £6.36

Madri £5.68 (£5.12 in 2024)

Cruzcampo £4.90

San Miguel £5.10

Birra Moretti £5.15 (£5.21 in 2024)

Staropramen £5.33 (£5.50 in 2024)

Estrella Damm £5.45

Standard Lager (Price per pint)

Carling £4.50 (£4.26 in 2024)

Fosters £4.15 (£4.00 in 2024)

Carlsberg £4.28

Amstel £4.65

Stella Artois £4.50 (£4.28 in 2024)

Pravha £5.10

Coors Light £4.68

Craft Beer (Price per pint)

Beavertown Neck Oil £5.38 (£6.08 in 2024)

Cask Beer (Price per pint)

Doom Bar £5.00 (£4.15 in 2024)

Abbot Ale £4.95

Tribute Pale Ale £4.60

London Pride £4.30 (£4.30 in 2024)

Wainwright £4.60

Pedigree £4.60

Timothy Taylor's Landlord £5.00 (£4.10 in 2024)

Stout(Price per pint)

Guinness £5.13 (£4.91 in 2024)

South West

Premium Lager (Price per pint)

Peroni £6.12 (£5.64 in 2024)

Heineken £5.20

Madri £6.50 (£5.50 in 2024)

Asahi £6.18

Cruzcampo £5.60

San Miguel £5.42

Birra Moretti £5.87 (£5.69 in 2024)

Staropramen £5.64 (£5.59 in 2024)

Estrella Damm £6.06

Standard Lager (Price per pint

Carling £4.86 (£4.50 in 2024)

Fosters £4.79 (£4.78 in 2024)

Carlsberg £4.71

Amstel £5.14

Stella Artois £5.63 (£5.47 in 2024)

Pravha £5.53

Corona £5.70

Craft Beer (Price per pint)

Camden Hells £6.50 (£5.73 in 2024)

Camden Pale Ale £5.60

Beavertown Neck Oil £6.52 (£6.09 in 2024)

Cask Beer (Price per pint)

Doom Bar £5.21 (£4.56 in 2024)

Greene King IPA £4.55 (£4.34 in 2024)

Abbot Ale £4.80

Tribute Pale Ale £4.89

London Pride £4.97 (£4.56 in 2024)

Wainwright £4.80

Hobgoblin £4.80

Timothy Taylor's Landlord £5.13 (£4.76 in 2024)

Stout(Price per pint)

Guinness £5.89 (£5.41 in 2024)

South East

Premium Lager (Price per pint)

Peroni £6.47 (£5.76 in 2024)

Heineken £5.36

Madri £5.68 (£5.38 in 2024)

Asahi £6.75

Cruzcampo £5.99

San Miguel £5.65

Birra Moretti £6.21 (£5.94 in 2024)

Staropramen £6.05 (£5.59 in 2024)

Estrella Damm £6.15

Standard Lager (Price per pint)

Carling £4.62 (£4.27 in 2024)

Fosters £4.98 (£4.69 in 2024)

Carlsberg £5.02

Amstel £5.50

Budweiser £4.70

Stella Artois £5.52 (£5.03 in 2024)

Pravha £5.60

Coors Light £4.61

Craft Beer (Price per pint)

Camden Hells £6.29 (£5.96 in 2024)

Camden Pale Ale £6.12

Beavertown Neck Oil £6.86 (£6.35 in 2024)

BrewDog Punk IPA £6.08 (£5.30 in 2024)

Cask Beer (Price per pint)

Doom Bar £4.82 (£4.56 in 2024)

Greene King IPA £4.74 (£4.24 in 2024)

Abbot Ale £4.69

Tribute Pale Ale £4.98

London Pride £5.21 (£4.73 in 2024)

Wainwright £5.10

Pedigree £5.00

Hobgoblin £4.89

Timothy Taylor's Landlord £5.37 (£5.00 in 2024)

Stout(Price per pint)

Guinness £6.04 (£5.49 in 2024)

London

Premium Lager (Price per pint)

Peroni £6.63 (£6.70 in 2024)

Heineken £6.36

Madri £6.23 (£5.97 in 2024)

Asahi £6.65

Cruzcampo £6.45

Birra Moretti £7.17 (£6.20 in 2024)

Staropramen £6.60 (£5.76 in 2024)

Estrella Damm £5.90

Standard Lager (Price per pint)

Carling £5.35 (£4.87 in 2024)

Fosters £5.23 (£4.65 in 2024)

Carlsberg £3.50

Amstel £6.66

Stella Artois £6.20 (£5.90 in 2024)

Pravha £6.05

Coors Light £6.03

Craft Beer (Price per pint)

Camden Hells £7.05 (£6.43 in 2024)

Beavertown Neck Oil £6.82 (£7.00in 2024)

Cask Beer (Price per pint)

Tribute Pale Ale £4.50

London Pride £5.88 (£5.37 in 2024)

Pedigree £6.80

Timothy Taylor's Landlord £5.63 (£5.62 in 2024)

Stout(Price per pint)

Guinness £6.45 (£6.01 in 2024)

Beer trends

Caroline Nodder has been writing about and commenting on the pub and beer sectors for almost 30 years, as a former editor of The Publican, and current freelance beer writer and industry consultant.

The author of the latest SIBA Independent Beer Report lives in West Sussex with her husband and two cats, and spends rather more time in her local pub than is strictly necessary for her work.

Here, Nodder talks about the trends the pub and bar sector is seeing currently and what’s to come.

Caroline Nodder

Caroline Nodder

All change at the bar

The beer offering in the UK in 2025 is evolving rapidly, driven by a period of substantial economic and societal change - and brewers are having to be nimble to adapt and pivot in this challenging environment. While overall beer sales in the UK fell by 1% in 2024 (Source: BBPA), that is by no means the bigger picture. CGA data suggests the value of the beer category in the on-trade grew 2.5% in 2024 with certain beer styles offering new opportunities for brewers and retailers.

Stout success

One of the big winners over the past year has been stout, with CGA data suggesting the value of the stout category rose 23.9% in 2024, and craft stout rose a staggering 121.7%. Stout sales have surged in the years since the pandemic, driven initially by a consumer seeking comfort in Guinness, a brand they trust on quality and couldn’t enjoy during lockdown. But this story doesn’t stop there for stout, and 2025 sees the category rapidly expanding, with regional and local breweries launching stout brands left, right and centre to take advantage of the style being, well… in style!

Lager, lager, lager

Where the story until now has been about the meteoric rise of world lager, that story is now translating into a more adventurous consumer willing to try more unusual speciality lagers (the speciality lager category grew by more than 10% in 2024 according to CGA). Smaller brewers have latched onto that trend and broadened the lager category with 60% of small brewers now brewing at least one lager style (Source: SIBA).

Cask opportunity

The decline in cask beer sales is a tale as old as time. But there has been some interesting movement in the category, with cask’s lower price point on the bar attracting new drinkers in the 18 to 24-year-old age group – the group arguably most affected by the cost-of-living crisis and therefore most price-conscious. A recent YouGov poll by SIBA shows 25% of 18 to 24-year-olds now drink cask, which is up almost 10% on 2024 figures. Could cask now benefit from this new audience and act as a gateway to other beer styles among this younger generation?

Low & no grows

While still making up only a tiny percentage of overall beer production (the BBPA estimates 1%), low & no now gets more than its fair share of bar space and there is no doubt it will continue to grow. And with 21% of consumers saying they never drink alcohol (Source: SIBA), you can see the appeal. However, low & no beer does have big competition from other non-alcoholic products like kombucha or even traditional soft drinks, especially when it comes to the younger drinker who has not grown up with beer drinking at the heart of social occasions.

Wellness wins

Consumer preoccupation with all things health and wellness is no doubt altering their drinking habits. This doesn’t just extend to the increase in moderation among UK adults – with research by KAM finding 74% said they were reducing their alcohol intake in 2024 – it has also led to a new trend for beer that is low alcohol, low calorie, low carb and addresses other health and lifestyle choices like being gluten-free. There has also been an explosion, globally, in drinks containing CBD that claim to help support your mental wellbeing - CBD beers are still comparatively niche in the UK but could grow on the back of this trend.

Buying British

The Trump effect cannot be overlooked here. As America isolates itself, consumers across the globe have re-focused on their own local market much more, and this could easily translate into more sales for local and regional British beers. A recent Attest Trend Report found 41% of consumers were seeking out more local products in 2024 and this number is likely to have grown in 2025. The key here for brewers is clearly communicating provenance at the point of purchase so consumers can make that choice.

Positive power

With everything that’s going on in the world, it is perhaps no surprise that consumers are looking for the positives in the purchases they make. Beers from a brewer with amazing sustainable credentials, impressive history and heritage, that has B-Corp status, brews organic beer, or has a reputation for supporting local charities and its community, for example, are going to be increasingly attractive to consumers, who are willing to pay more if they share the ethical values of a business they buy from. Beer brands that effectively sell that story to their customers are sure to win loyal customers in return.

BrewDog

Meanwhile, Ellon-based pub operator and brewer BrewDog believes there will be further improvements in the stout division.

BrewDog head of customer marketing Hannah Corker says: “Stout is a category with clear momentum. With more choice now available, including BrewDog Black Heart, which is attracting a younger, more affluent drinker, we expect this will only continue in throughout 2025 and beyond.

“Black Heart represents a significant opportunity to drive sales and grow margin for operators.

“In terms of ranging for the greatest profit, it’s important to avoid duplication wherever you can. You want to offer your guests the greatest breadth of range possible, with obvious ladders for premiumisation and clear roles for every beer on the bar.

“Don’t fall into the trap of pouring too many lagers that are close to being the same or having all your craft taps pouring similar IPAs. Think about using national craft to anchor the category before layering on top a New England IPA like Hazy Jane, or something local, and consider whether alcohol-free on draught could be something memorable that enhances the experience for your site.”

She also believes Session IPA is also “having its moment” and cites the brewer’s Wingman as “a high-quality product for the modern drinker, with casual and playful positioning and fantastic stand-out”.

Meanwhile, BrewDog is rolling out its Cold Beer Lager (3.4% ABV) to the on-trade following a successful launch into the off-trade.

Greene King

Kirsten Alexander, brand manager for the Old Speckled Hen family, said: “We see growing consumer appetite for low & no beer and also for lower ABV beer in general across the category.

“Drinkers are looking for beers that taste great at lower strengths, particularly around the 3% to 4% ABV mark, where they can enjoy one pint or more.

“Innovation is key to keeping up with drinkers’ preferences and following the success in retail, we spotted that Old Session Hen – a 3.4% ABV golden ale - offered the perfect opportunity for a new permanent cask ale. The new cask beer is aimed at recruiting new drinkers into the category with its lower ABV and also offers golden ale fans something new and full of flavour to enjoy.

“We also continue to look at our existing portfolio to adapt to changing preferences while maintaining the quality and heritage of our beers.”

Molson Coors

Molson Coors Beverage Company on-trade category management controller Stephen Groucott is hoping for good weather to help sell more beer at pubs.

He says: “Nothing drives people to beer gardens quite like a heatwave. When the sun is out, not only are people more likely to head to their local pub, but they also tend to spend longer soaking in the atmosphere with their favourite drinks.

“A recent survey we conducted found that British beer and cider drinkers are willing to sit outside and enjoy a drink, even in less-than-ideal conditions. Some 65% of these said they’d happily sit outside at 18 degrees, while a third (36%) would enjoy an alfresco pint at temperatures as low as 15 degrees.”

Groucott also talks about the low & no division. He says: “The category continues to evolve to meet the rising demand for low & no-alcohol options.

“Between 2016 and 2023, 2.2m more people have embraced moderation, with more than half (53%) of 18 to 34-year-olds, and 41% of Britain’s total adult population now trying to drink less alcohol. Some 51% of these low & no drinkers do so in pubs, bars and restaurants (source: Kantar).”

Vocation

Vocation Brewery marketing manager Chris Mitchell says despite ongoing economic challenges, the brewer is still seeing a clear trend of people drinking less but better – with premium and modern craft beers helping to keep the category dynamic and relevant to evolving tastes.

He adds: “We also see pubgoers are more selective, choosing brands that align with their values. They also don’t stick to one style; their choices reflect their individual preferences and shift with the occasion depending on who they are with, when and why they are drinking.

“That’s why our core portfolio – Hilltop Lager, Crush Hour, Heart & Soul and Bread & Butter – consists of more sessionable and lower-ABV options with broad appeal, while our special editions cater to more select and distinctive tastes.

Mitchell also says while the ‘Guinness effect’ has reignited interest in stout, the craft beer movement has also played a significant role – introducing stout to a new generation through innovative takes, a focus on quality, and a more premium image, such as its Naughty & Nice Chocolate Stout, which is available in cask.

Sponsors

Beer is the second most consumed category behind soft/hot drinks in the On Trade[1], so it is vital that operators get it right to succeed. It is also a category where consumers like to experiment and are open to trying something new[2]. Offering a choice of styles and clear ladders from mainstream to premium, world and craft beers, as well as low and no options, that appeal to a wider array of consumers, is key to the delivering the perfect range. To help, BrewDog has a range to suit all.

Headquartered in Ellon, Scotland, BrewDog has been brewing beer that blows people’s minds since 2007- led by the “Headliner series”, including the flagship Punk IPA – which this year celebrates its milestone 18th year – as well as Lost Lager, Wingman and Hazy Jane, plus crowd pleasers Black Heart Stout and Cold Beer Lager (3.4% ABV).

From humble beginnings, where friends, James Watt and Martin Dickie, tired of a lacklustre beer scene, took out a bank loan and started brewing their own beer in their mum’s garage, BrewDog is now an international, independent brewer and hospitality business, with a simple mission; “To make people as passionate about great beer as we are”.

For more information or to find out how BrewDog can help drive beer sales, visit https://drink.brewdog.com/uk/enquiry

Address: BrewDog, Balmacassie Industrial Estate,

Ellon, Aberdeen, AB41 8BX

[1] CGA Cost of living Pulse March 2025

[2] CGA Cost of living Pulse March 2025

Greene King and Belhaven Brewery’s free trade service, Value for Venues, is an all-encompassing package for independent venues designed to optimise operations and enhance every aspect of a free trade business, ensuring venues stay ahead in a competitive market.

As part of the service, customers can access an extensive range of products and services, including a premium selection of beer, cider, wine, spirits and soft drinks, along with logistics, business management and financial support services.

With Value for Venues, independent businesses gain the support of a trusted partner backed with 300 years of hospitality experience, to help with all aspects of the business and are committed to driving growth with every independent venue.

The Value Hub, part of the Value for Venues platform, gives customers access to exclusive offers and that could help independent outlets save over £5,000 per year. From discounts on garden furniture and solar panel installation to savings on payment terminals, the Value Hub can help customers save in all areas of the business.

Free trade venues can learn more about the support available from Greene King and Belhaven either by calling 0345 850 4545 or visiting www.valueforvenues.co.uk/