Beer Report 2024

Overview

If there has been a theme to the popularity of beers being consumed in the on-trade since Covid, it has been that people want to trade up.

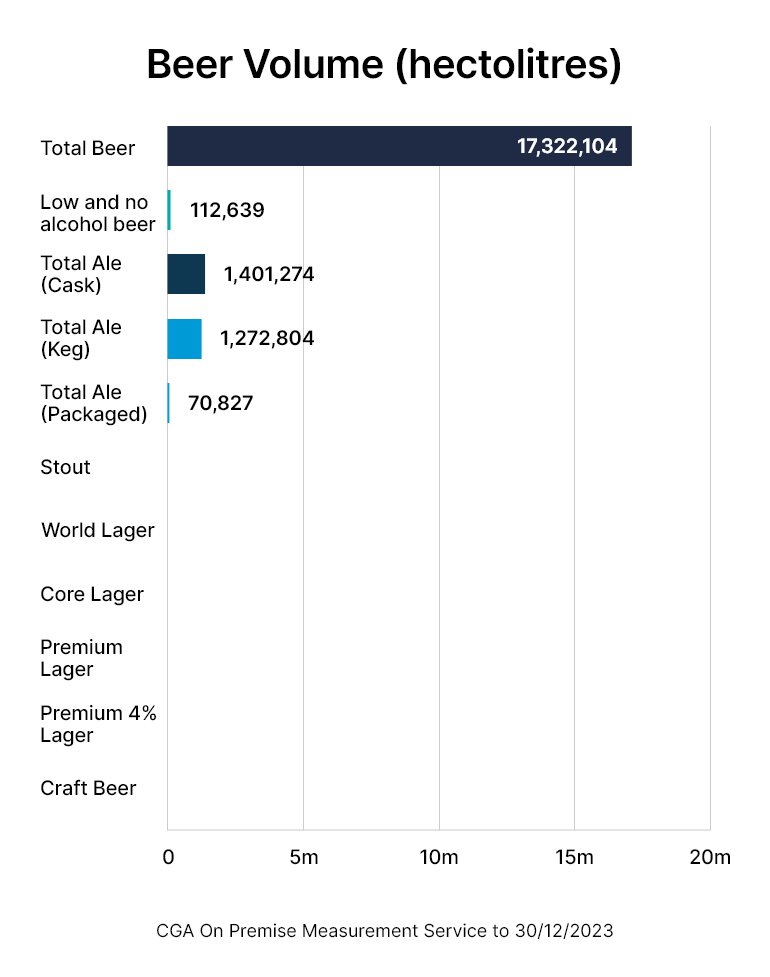

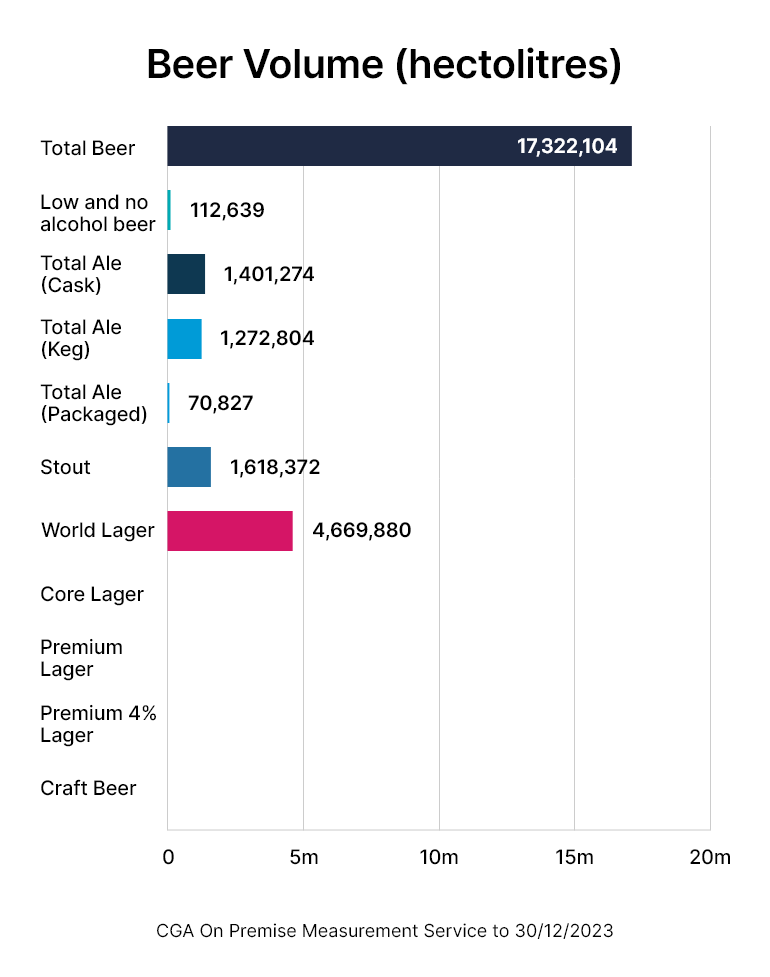

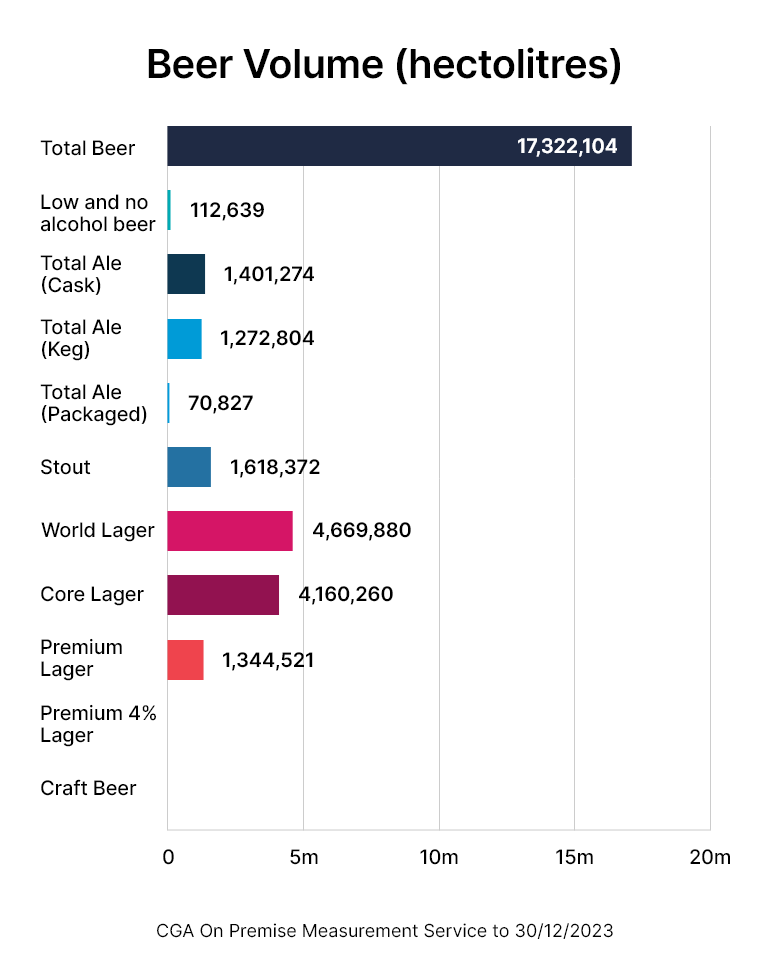

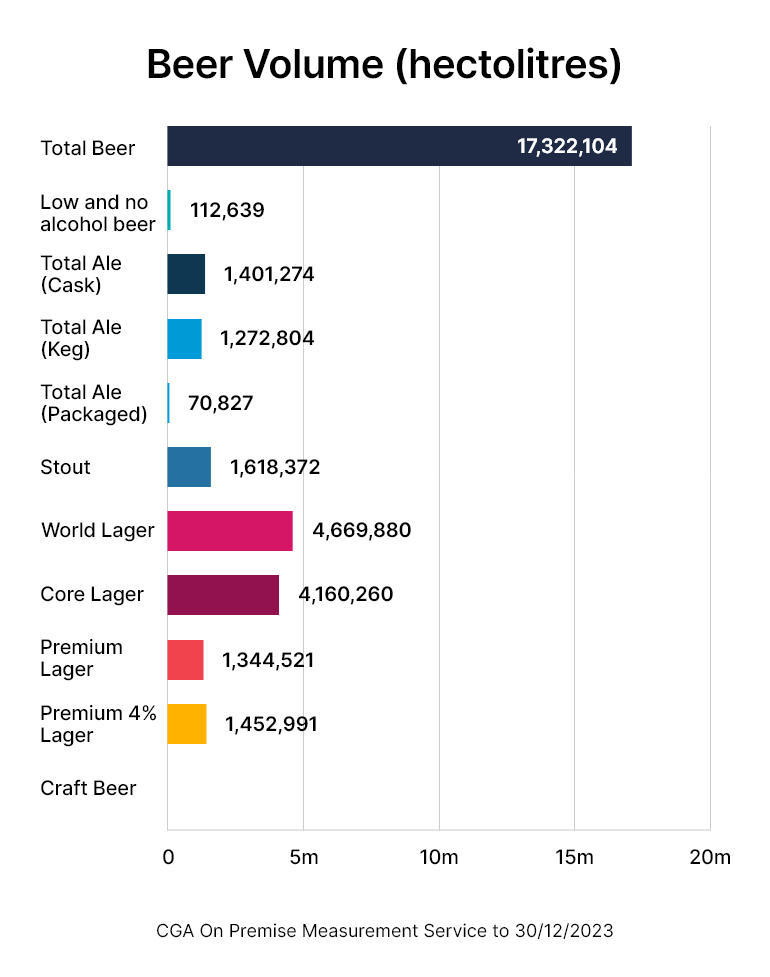

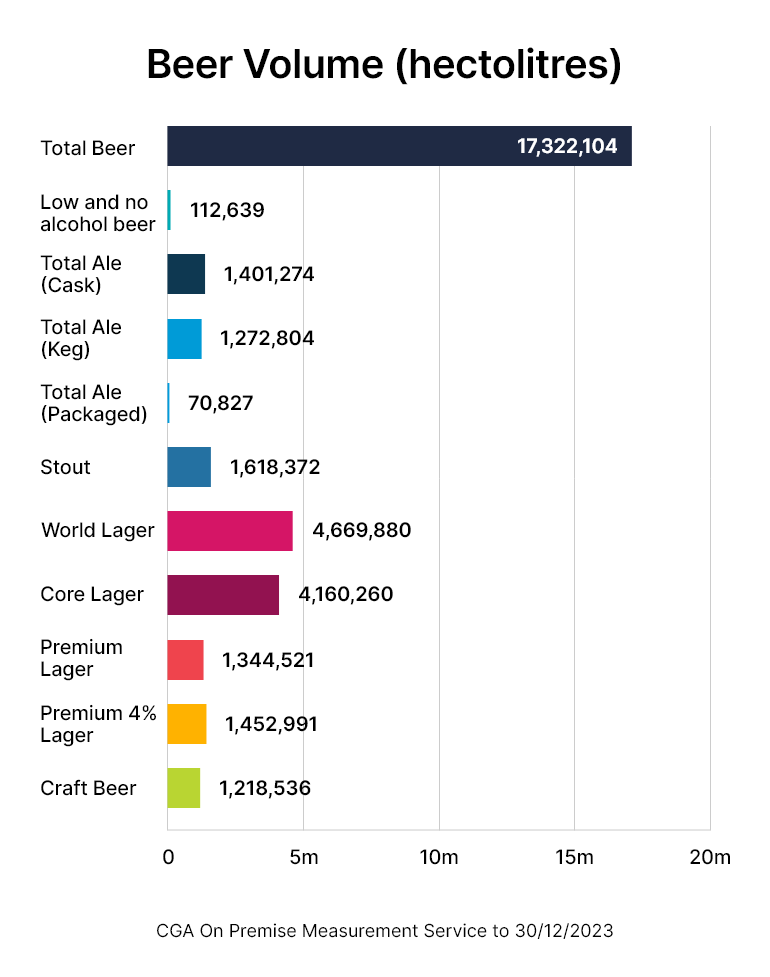

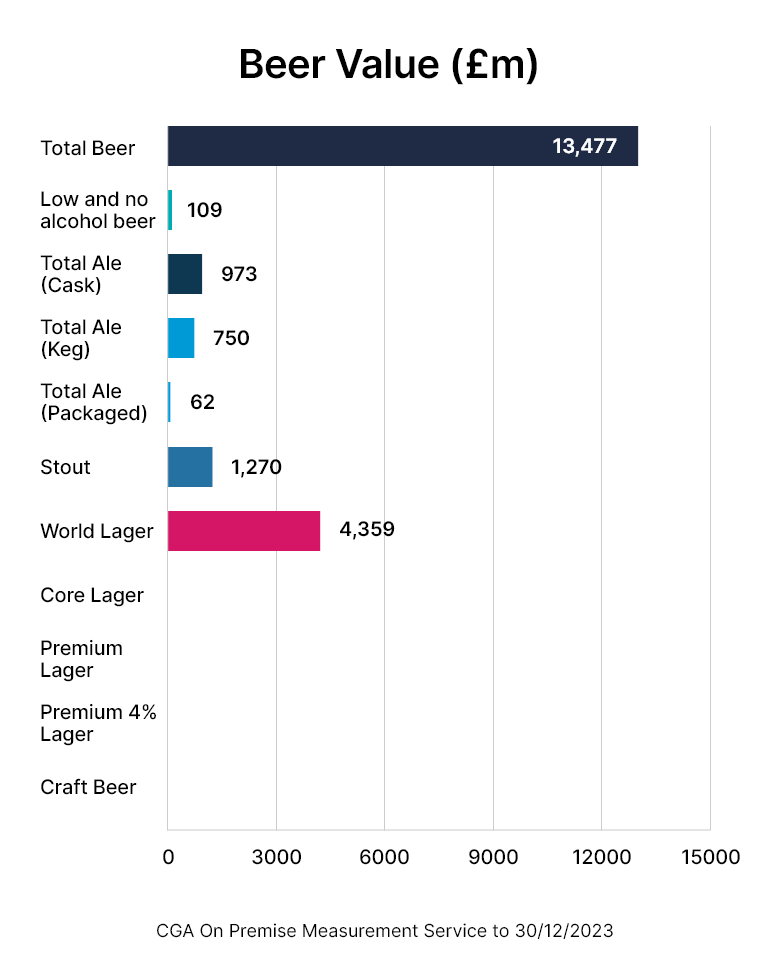

Premiumisation was the word last year and the trend has not abated with world lager enjoying an 11% boost in volume sales in 2023 and 15% in value versus 2022, according to CGA data for the year ended 30/12/23.

So prolific has the rise been for world lagers – a category that includes San Miguel, Madri, Cruzcampo, Moretti, Estrella Damm, Peroni and Asahi Super Dry – volume and vales sales are up a staggering 65% and 78% respectively on pre-pandemic figures five years ago.

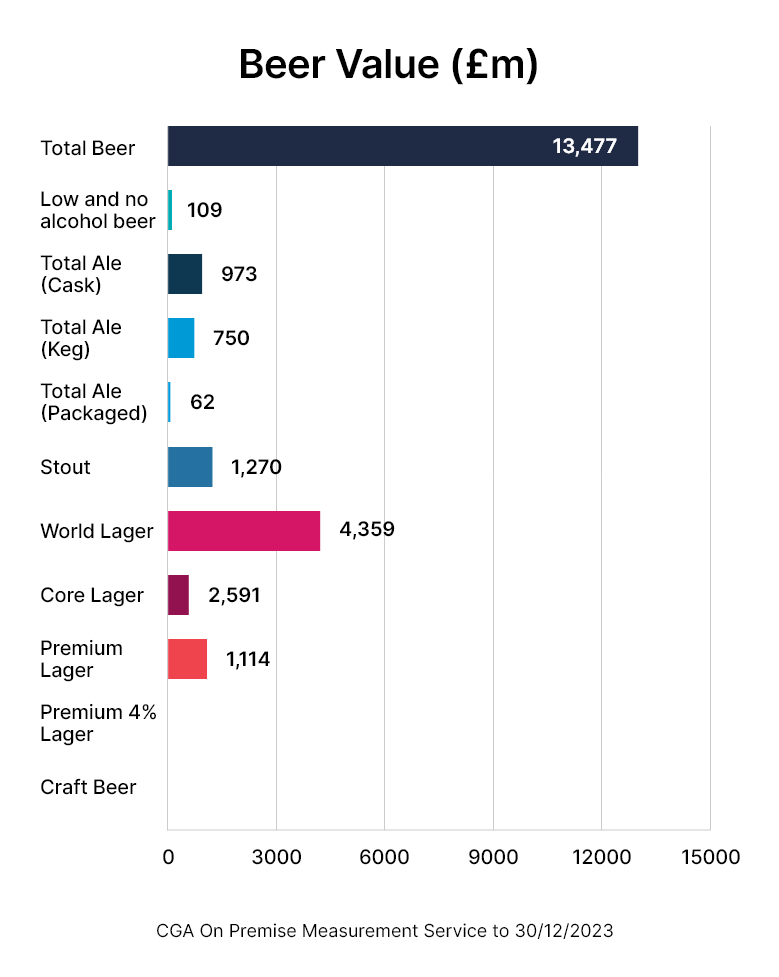

Meanwhile, low & no alcohol beers have enjoyed a greater rise in sales from a year ago with an eye-popping 31% boost in volumes and 39% in value sales.

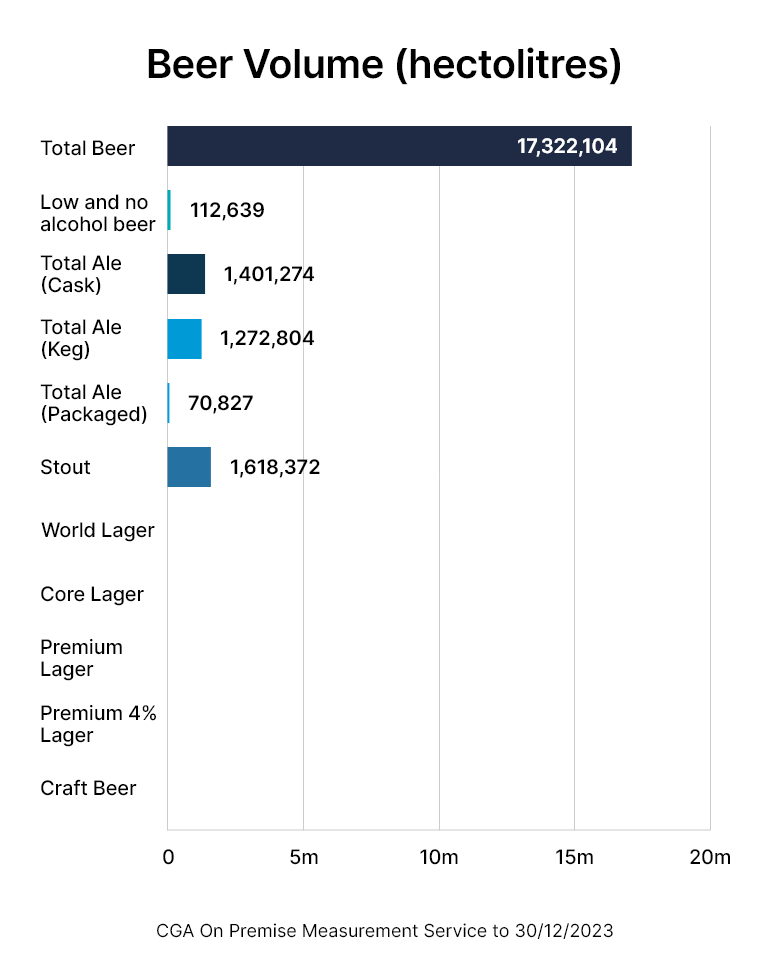

Another category enjoying great times is stout with 16% and 22% upticks in volume and value sales.

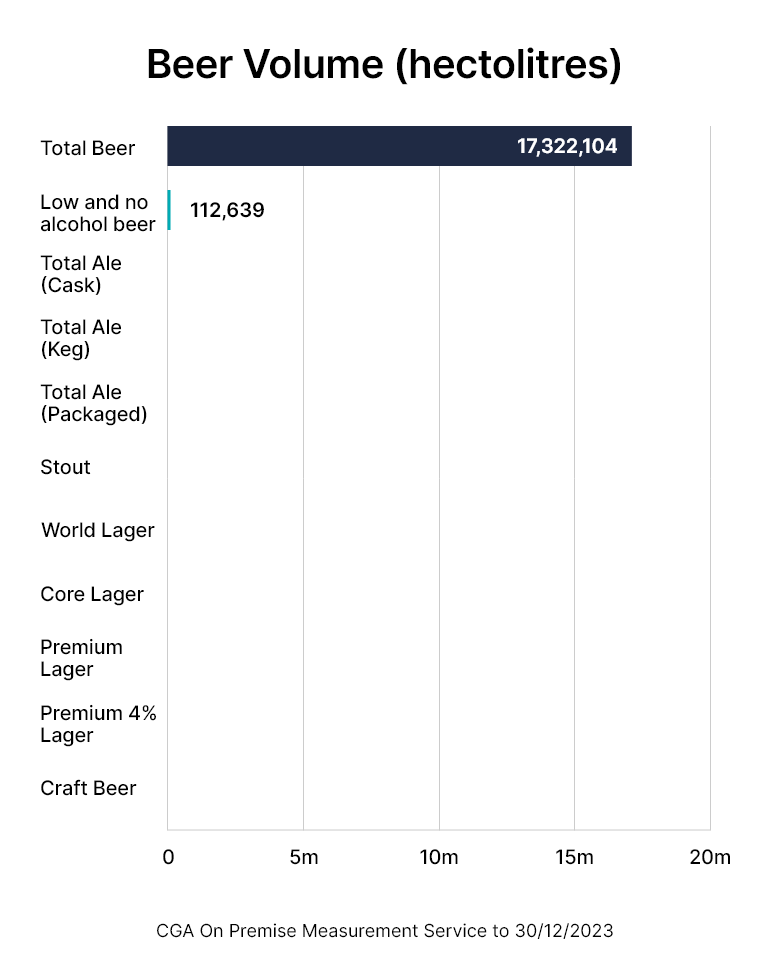

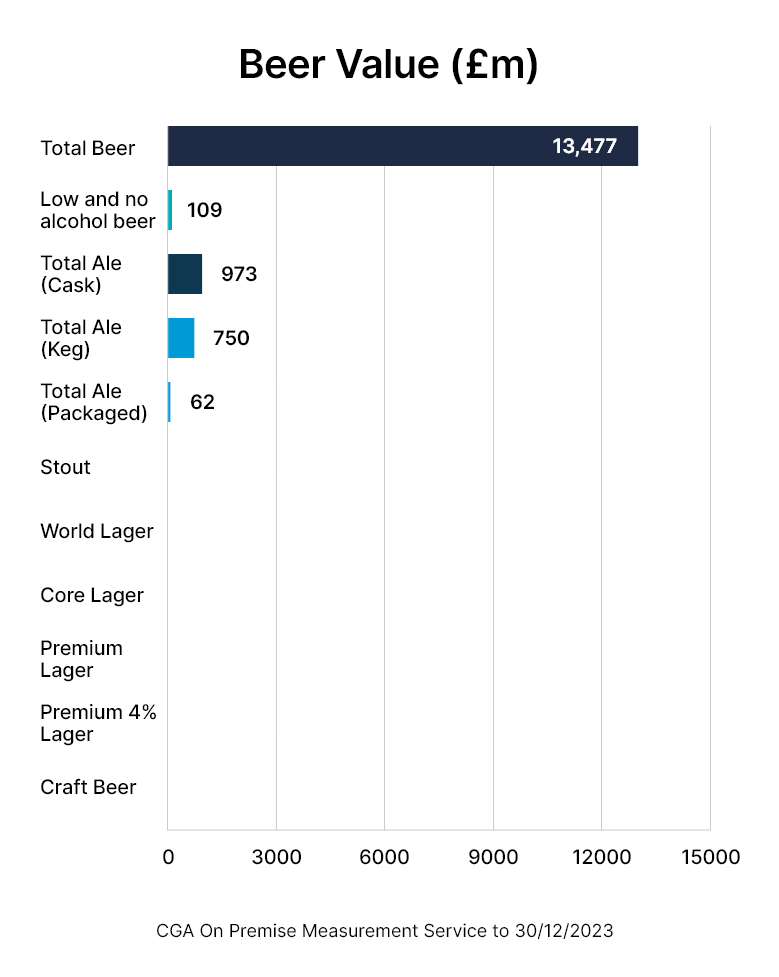

To put these into perspective, world lager volume sales have reached 4.67m hectolitres (HL) and £4.36bn in value, low & no alcohol sold 112,639HL with a value of £109m and stout volumes are at 1.6mHL and value is £1.27bn.

The overall beer market is marginally down on last year for volumes produced but experts believe not only are there success stories within the sector, there are uplifts awaiting in the future.

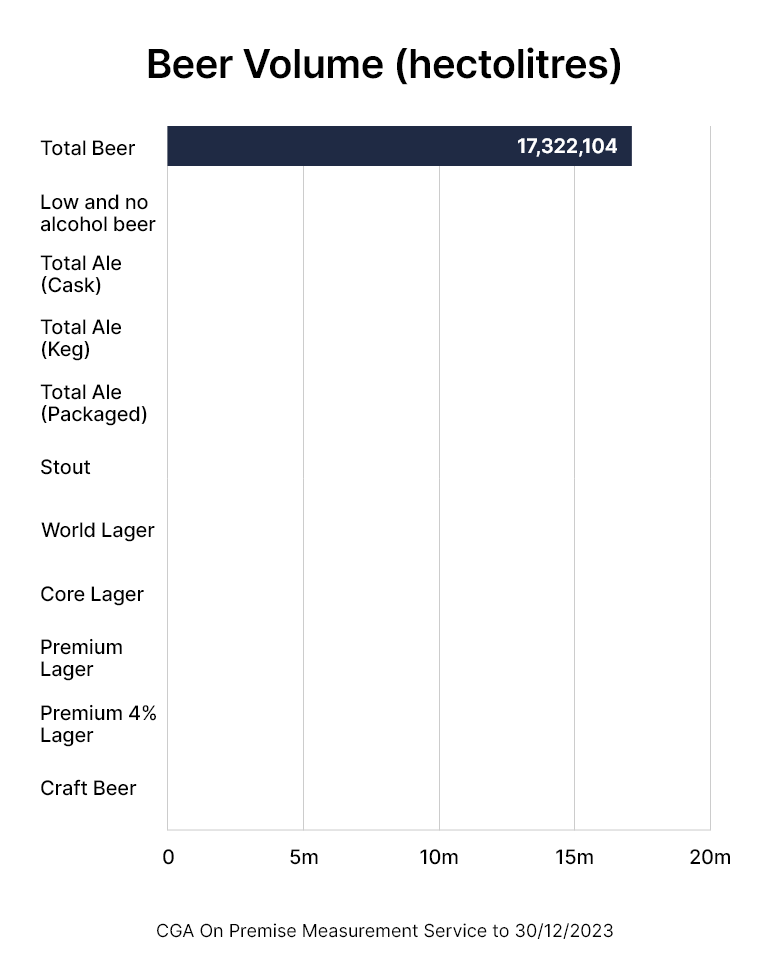

Pre-Covid, CGA statistics show the volume of total beer volumes was 19.28mHL with last year sitting at 17.55HL and the 2023 total at 17.32HL.

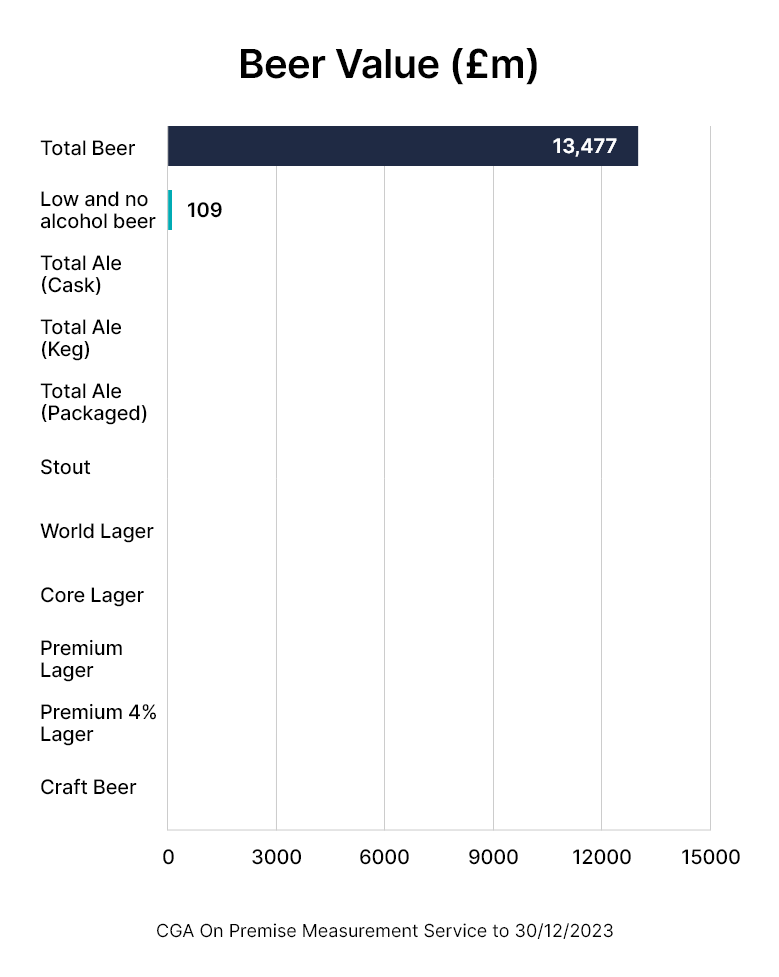

However, the value of these sales is the reverse with the latest figures sitting at £13.48bn, ahead of the previous year’s figure of £13.07bn and pre-pandemic at £12.98bn.

CGA by NIQ’s Christopher Sterling says: “In terms of the overall market, there have been a lot of headwinds and a lot of doom and gloom regarding the cost-of-living crisis that both consumers and operators have been facing.

“We’ve had some pretty high-profile casualties in the pub market particularly, but beer has had a really good year in in 2023.

“We’ve only seen a marginal decline from a volume perspective while value is up versus 2022 so that has to be considered a success and, when we look at the data from an overall market perspective, beer is the category that’s really driving that whereas other categories such as spirits, in particular, are dragging it down.

“There is a really good story for beer in 2023 and it’s helped the market stabilise itself and despite all the issues we’ve seen from an operating and consumer perspective.”

Meanwhile, Neil Walker, head of comms at the Society for Independent Brewers & Associates (SIBA) adds: “We’re still in a recovery period. The volumes for small independent breweries are still not quite back to pre-Covid levels but there’s been a massive improvement over the past 12 months.

“When you look at national figures, there seems to be a suggestion that cask beer being in decline and cask beer is dying, it is simply not true for independent breweries. In the independent sector, we’ve seen double-digit growth. It’s now over 10% growth in cask beer over the past 12 months so there are really positive signs for the future.

“Another thing I read about is brewery closures. There’s a lot of doom and gloom in the market, and there’s definitely been a big churn over the past 12 months, but there’s been lots of new breweries opening and, unfortunately, lots of breweries closing.

“As of 1 January this year, the number of operating breweries was about 1% down on 12 months before. That’s not good and we want it to back in growth but it’s not as big a drop as it may seem when you read some of the papers.

“There’s also been some high-profile losses in that market as well, which makes it feel like there’s been a bigger impact. We’ve recently had our BeerX event and it was, by far, our biggest year ever. That event is now bigger than it was before Covid so it just goes to show the industry is getting back out there and getting on with it.

“There’s lots and lots of positives we’re the hope is we are moving into a growth period.”

For more details on how each category of the on-trade beer market has fared, see the Category breakdowns section below.

Challenges and Opportunities

The beer market has faced many challenges in recent years, including a squeeze on consumers’ purses and rising costs across the board, but the segment still offers operators plentiful opportunities when it comes to premiumisation.

Here, we talk to Asahi and Lakedown breweries about the challenges and opportunities offered to each brewer, which are differentiated by their sizes.

Asahi UK sales director Steve Young says while the overall beer and cider category saw a 1.4% decline in volume in 2023, premium draught lager, stout and no & low serves present “major growth opportunities” for pubs, growing at 10%, 17% and 32% respectively, according to data from CGA.

Young continues: “Consumers are prioritising their disposable spending in the on-trade but reducing how often they visit venues, cutting down on the number of drinks they buy, and switching categories.

“The latter has had a positive effect for draught lager, while spirits and cocktails are losing share. These behaviours mean that, for many, the quality of their drink and venue of choice is maintained.

“We expect to see these growth areas continue and accelerate in 2024. We are particularly excited about the continued growth of no & low, with 49% of beer drinkers telling us they are trying to moderate their alcohol intake, versus 47% last year.”

Within Asahi’s brands, Young explains Peroni Nastro Azzurro continued to deliver one of the “highest rates of sale” in premium draught lager, around £40,000 pa on average to each outlet.

In addition, the sales director says Peroni Nastro Azzurro 0.0%’s is now the number two no & low brand in the on-trade, with a value RoS 126% greater than the number one brand.

Meanwhile, Asahi Super Dry has driven more than £35m of growth in the on-trade over the past year, up by 47% on last year, he adds.

Young concludes: “We have a strategy to help outlets drive their sales and profits, including helping them to create more occasions, engaging new drinkers, supporting consumers with their lifestyle ambitions, pairing drinks with food, and exceeding customers’ expectations with sustainability and ethical practices.”

While rising material costs have presented the brewing sector with further challenges in managing prices for pub customers, East-Sussex-based Lakedown Brewery has managed this through investing “heavily” in sustainability.

Lakedown partner James Cuthbertson says: “We are looking at adding solar power to the brewery in the coming months.

“This, coupled with an increase in sales and subsequent buying power, has meant we have managed to hold back any price increases in the past six months and have committed to doing that for a further six months, giving our customers some certainty.”

However, Cuthbertson explains while the cost of materials is starting to “normalise”, they aren’t doing so “as quickly as they increased” and are still continuing to rise, putting pressure on smaller breweries like Lakedown.

Moreover, he adds the way pubs are getting “hit” by increased costs is also having an “impact on brewers”.

He continues: “Either they're being forced out of business because of it, and if they are not trading, we aren't selling to them, or they are having to chase margin in other places, such as through wet sales, which I believe, in some cases, is making a trip to the pub less attractive.”

Though the brewing stalwart adds there are opportunities within the market for smaller wet-led sites.

He says: “We are seeing increased opportunities with the rise in small wet-led pubs or bars, who seem to be thriving by operating a simple model, in a low rent space, run by people that really care about their beer.”

Cuthbertson adds another opportunity for growth in the beer market lies with no and low brews, with brands such as Big Drop “doing it brilliantly”, showing with “the right investment and knowhow”, smaller brewers can have a “real say” in the category.

Category Breakdowns

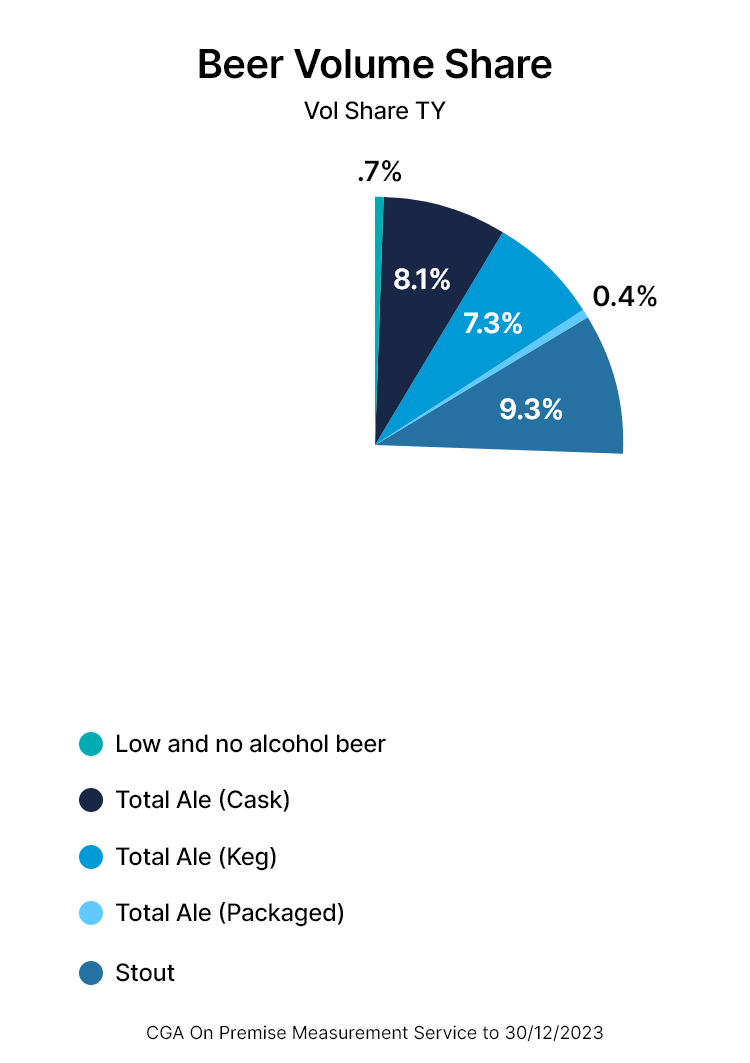

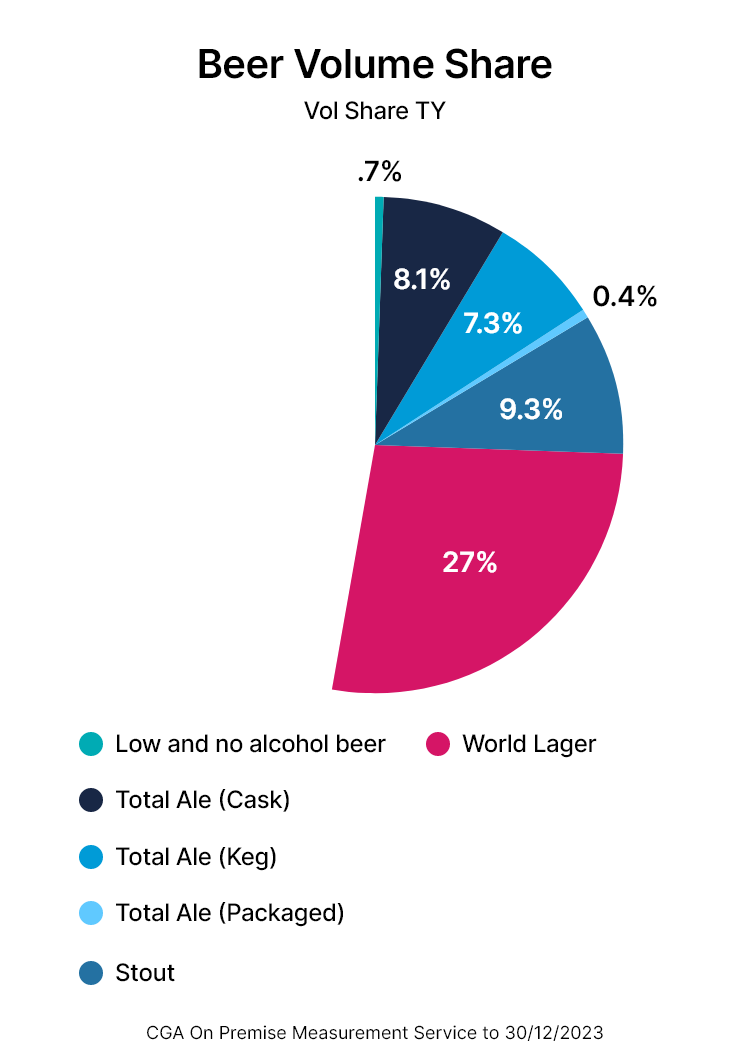

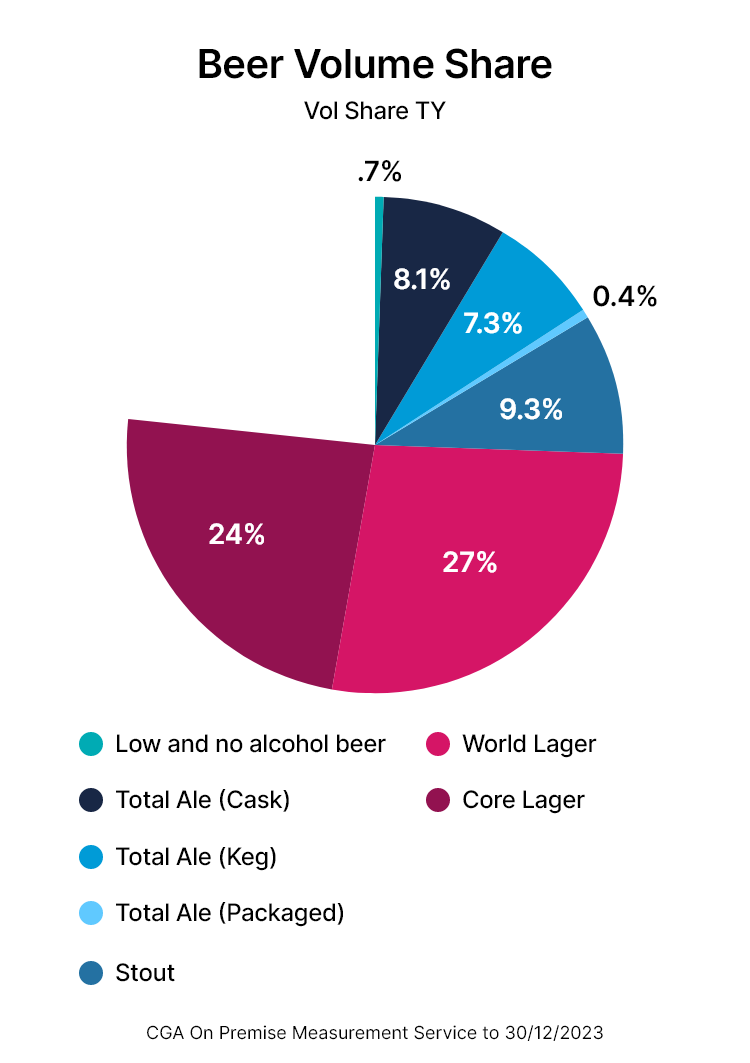

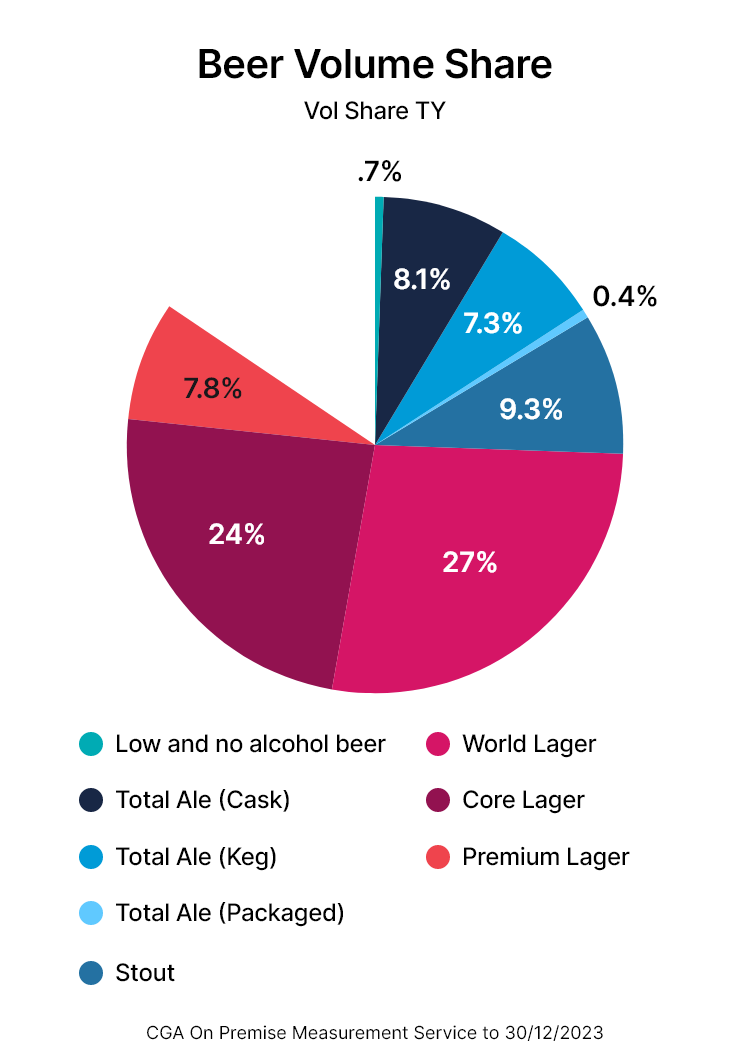

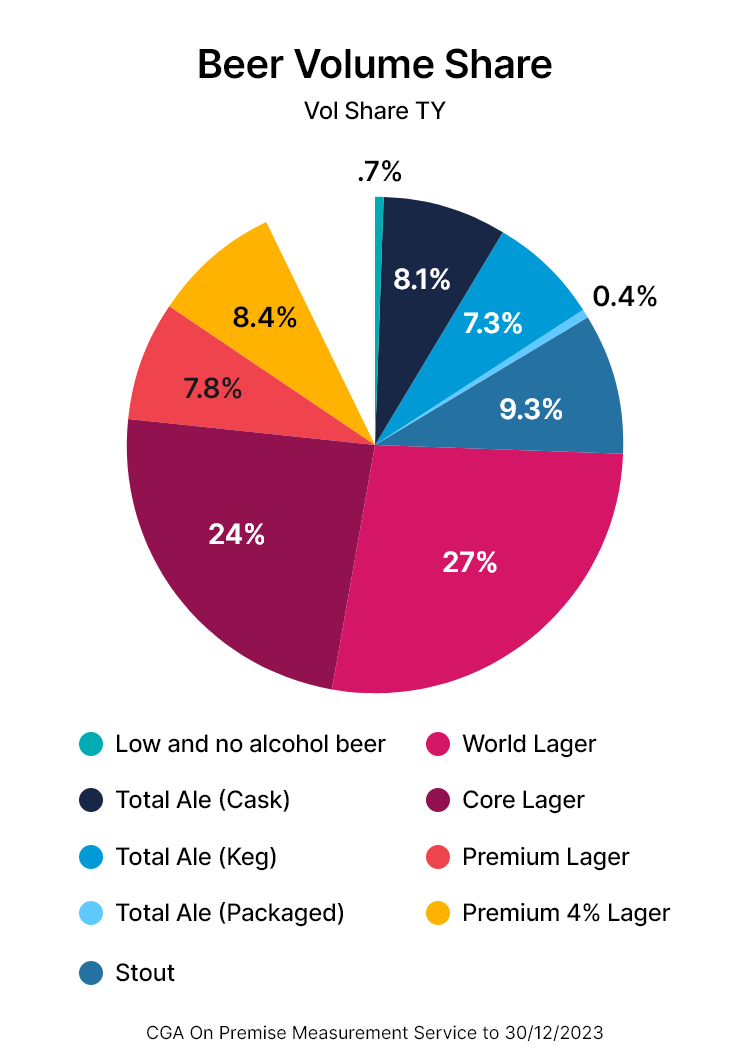

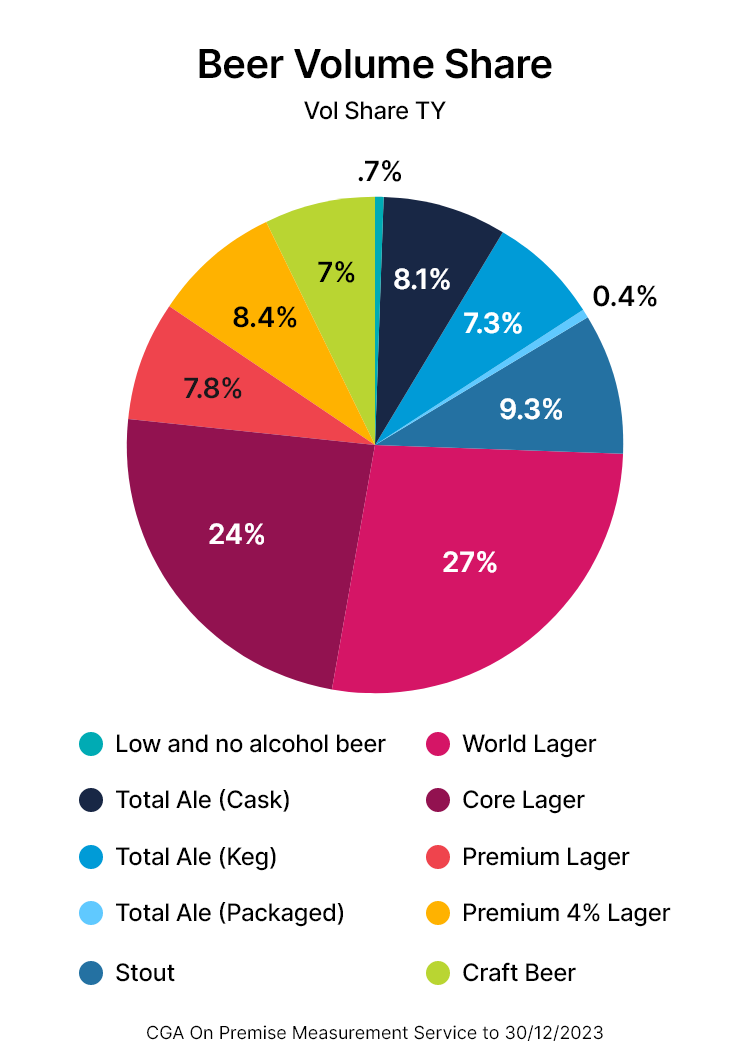

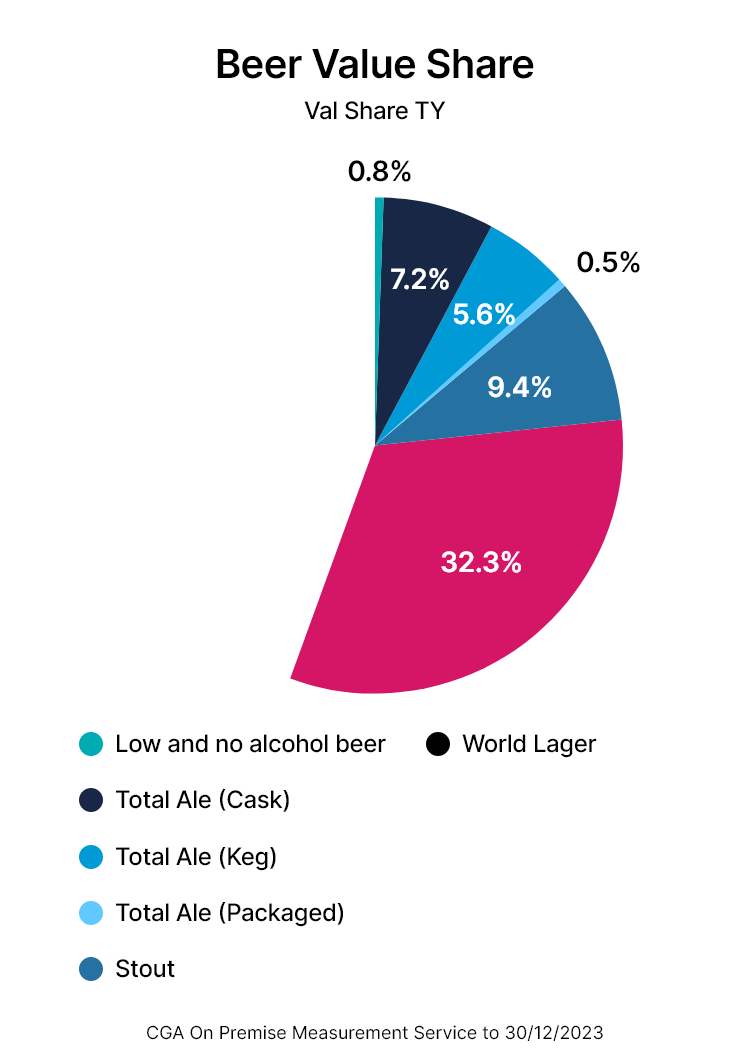

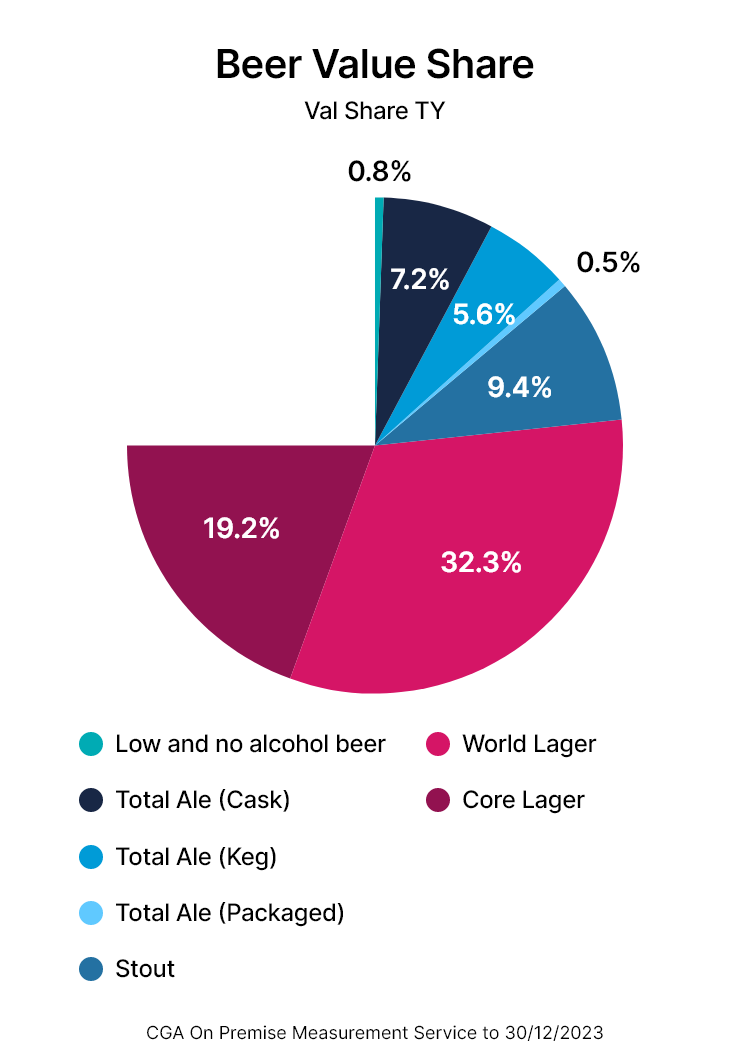

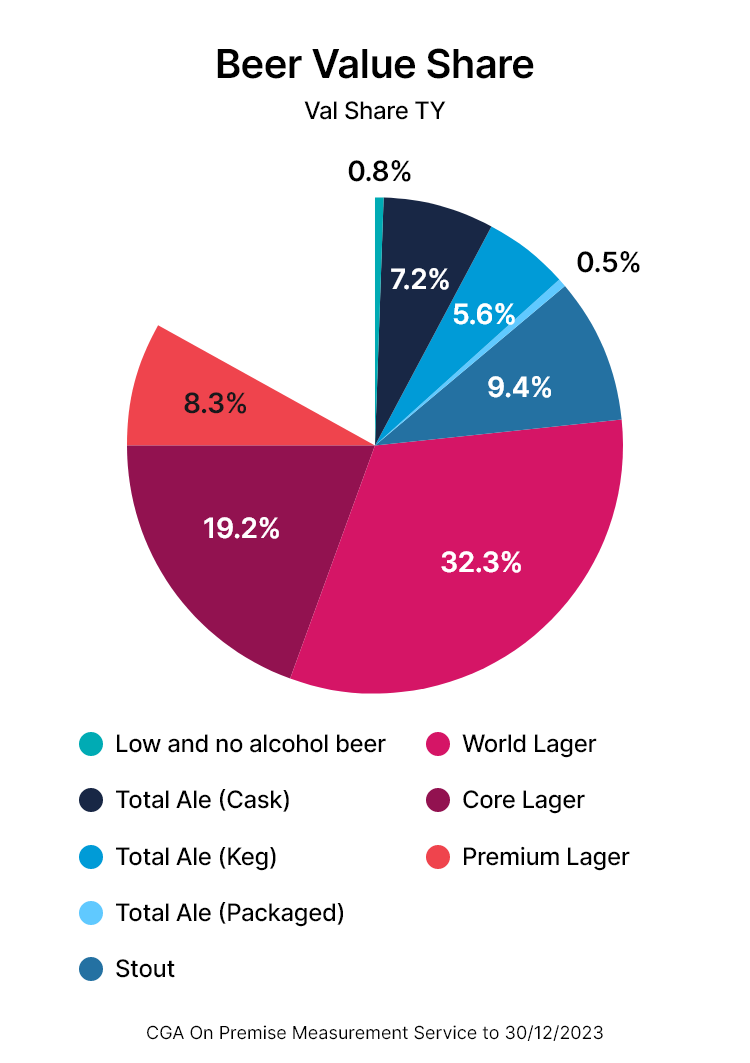

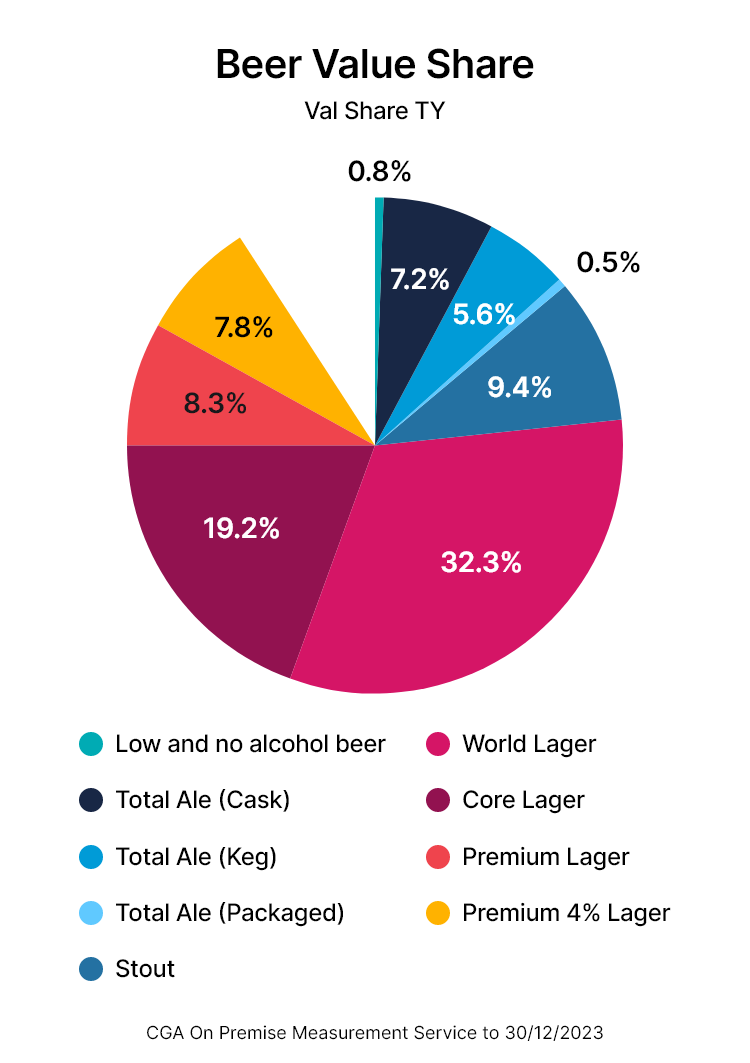

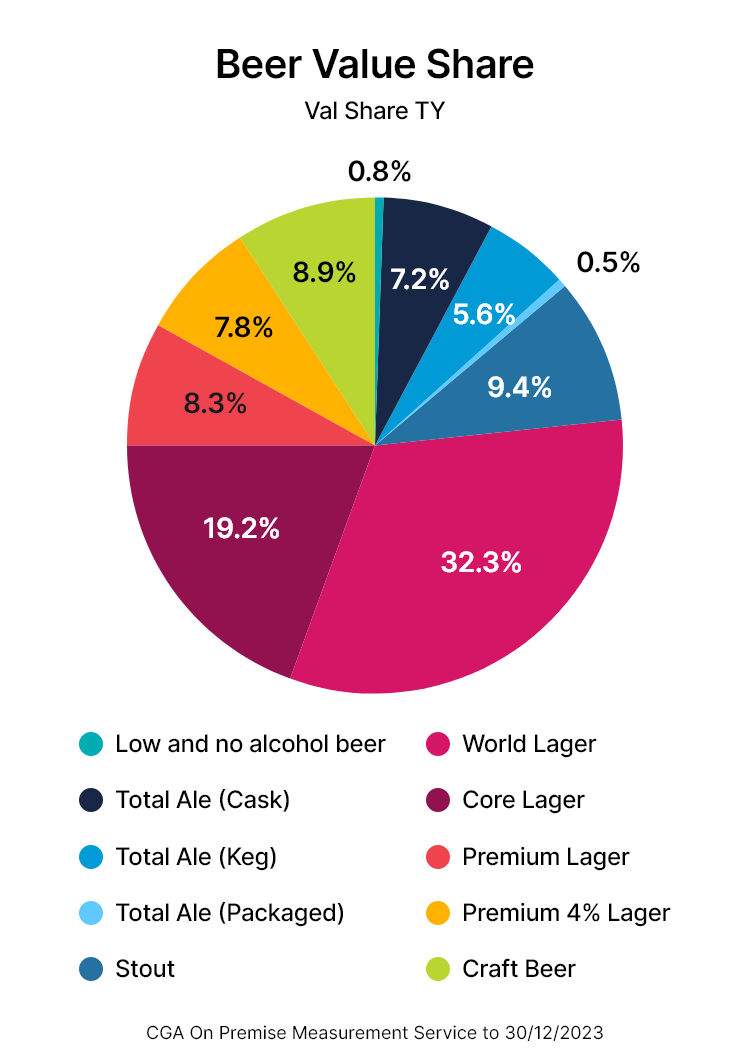

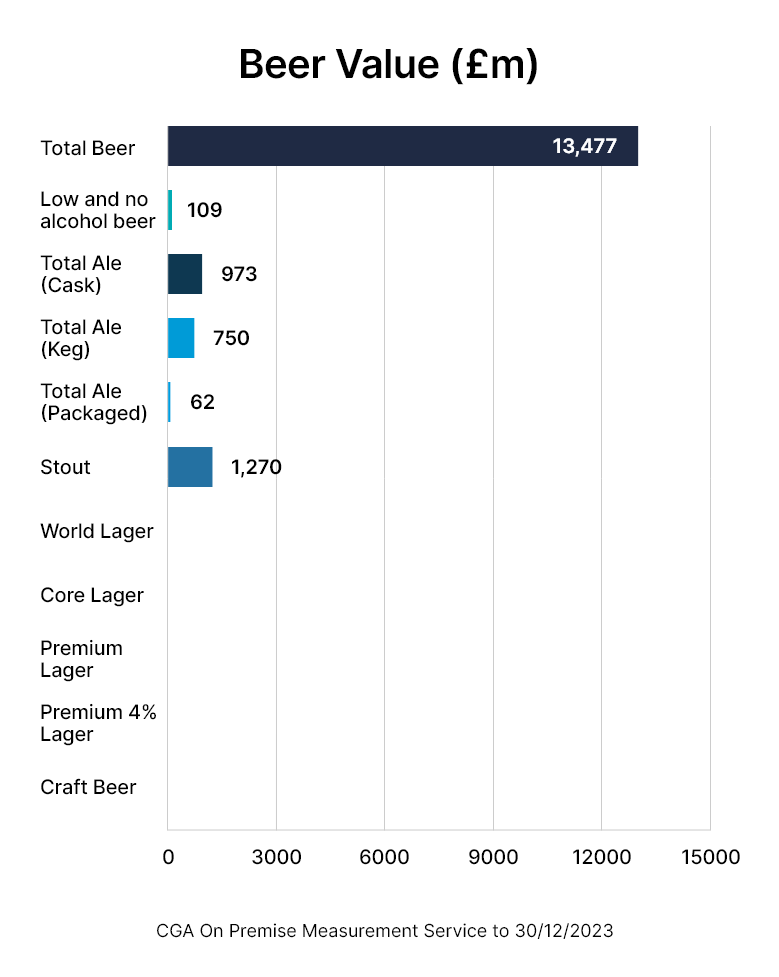

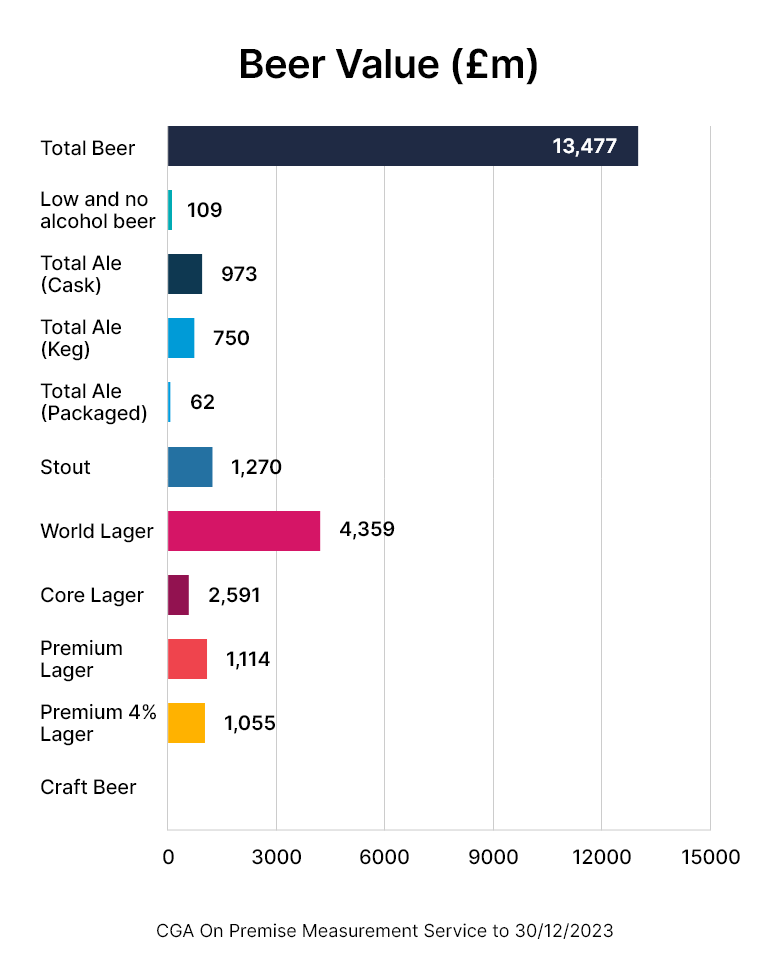

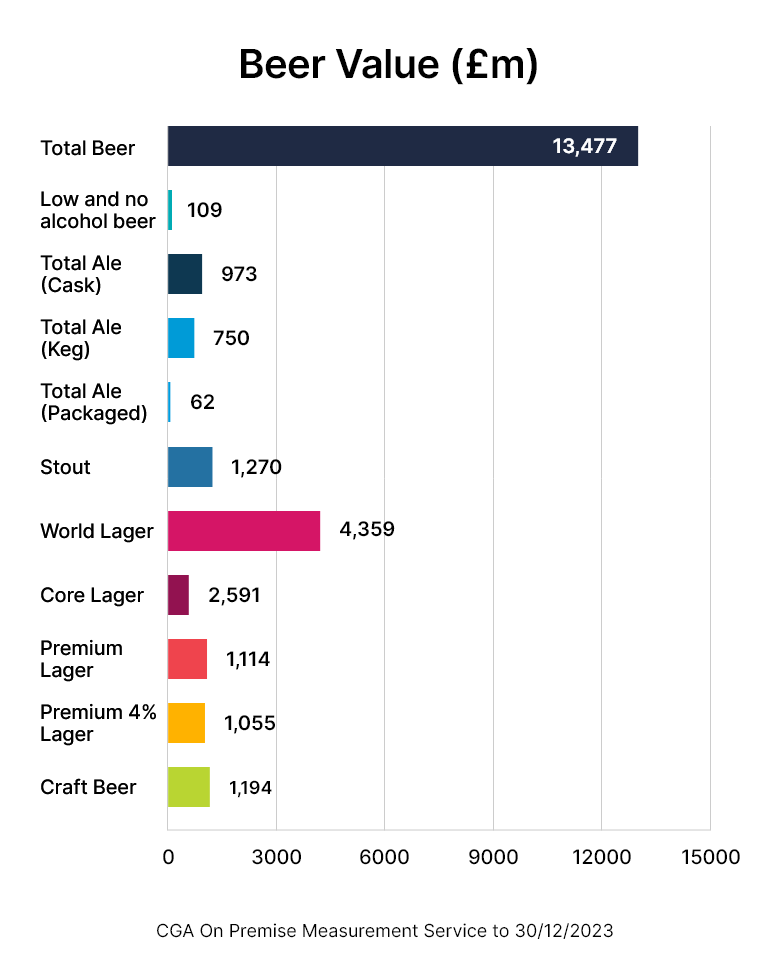

The overall on-trade beer market is made up with volume sales at 17.32mHL and value sales reaching £13.48bn, according to CGA date for the 12 months ended 30/12/23.

But how does that break down into the wide variety of categories?

Christopher Sterling of insight expert CGA by NIQ and the Society of Independent Brewers & Associates (SIBA) heads of comms Neil Walker talked to The Morning Advertiser about the merits and challenges for individual categories and the trends they expect to see in future.

World Lager

Soaking up the largest piece of the beer market is world lager. With volume and value sales at 27% and 32.3% respectively, the category is a behemoth and currently the force all other beer types are trailing behind.

Some 4.67m hectolitres (HL) were sold in 2023, which was 472k more than 2022 and 1.85m more than five years ago (pre-Covid) while its value sales of £4.36bn for 2023 was higher than £3.76bn in 2022 and £2.48bn pre-pandemic.

Sterling says: “What’s driving it is the big continued grower that is world lager. It continues to drive value and volume. A lot of that is down to the category having a lot of success coming out of Covid with people looking for something a bit more premium and pubs and bars can offer that and it’s really continued as the consumer dynamics have evolved.

“We know overall frequency of visit is down in hospitality. We know people are going out less in general but when they do, quite a decent proportion of consumers are saying that they’re spending more and some of that is due to inflation yet the wider trend is around people looking for a really high-quality experience and maybe a treat.

“They want to make sure they’re getting the most out of their visit and that’s where premium drinks and world lager, in this case, has benefited.

“There’s been a lot of new brands in the on-trade marketplace, particularly with the big brewers pushing NPD in the past couple of years and that’s really pushed the trend that operators have got on board with because the margins are higher with world lager brands.

“Also, there’s a lot of variety in the category. You know you’ve got Spanish brands, Italian brands and Asian brands, for example. Ten years ago, pubs might be stocking two or three mainstream lagers that were all pretty much the same.

“There’s even different flavours to some extent and that’s been a huge driver of world lager trend.”

Premium Lager and

Premium 4%

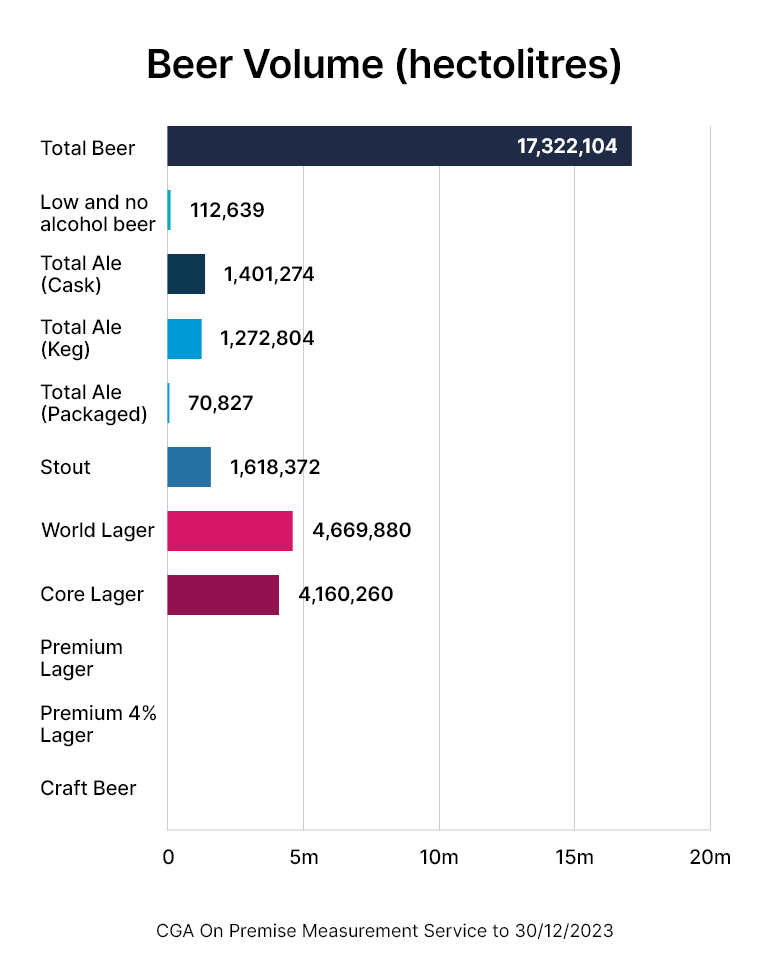

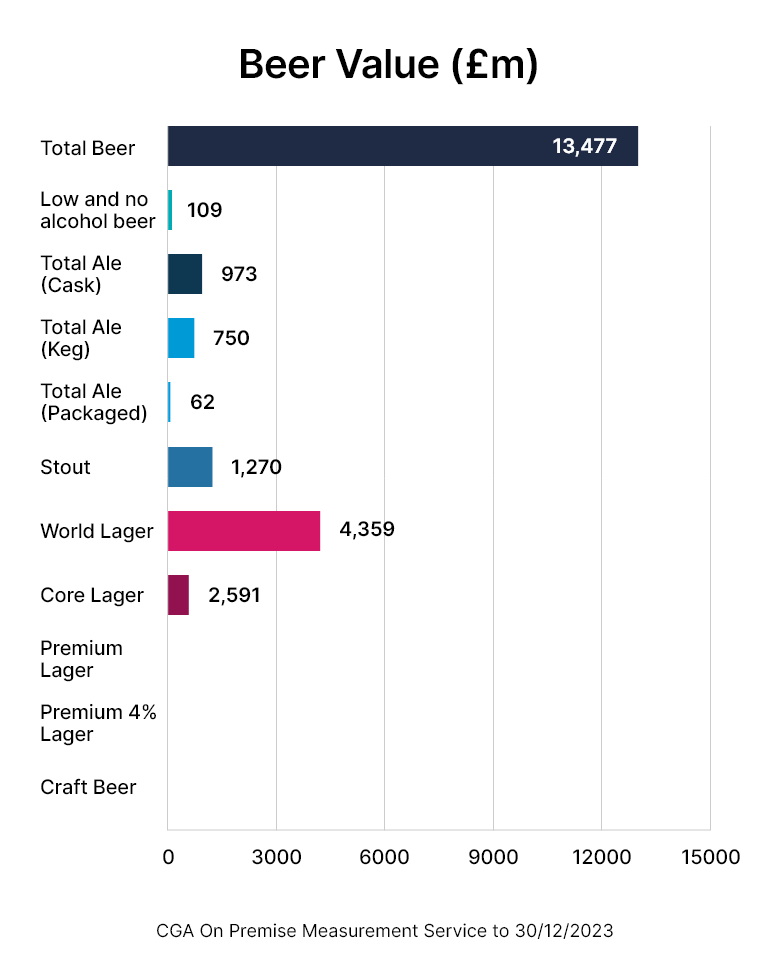

Premium lager and premium 4% make up approximately 15% of all volume and value sales of the on-trade beer market.

The brands in the premium category would include Stella Artois, Kronenbourg 1664 and Heineken, for example, and – along with premium 4% ABV lagers such as Prava and Beck’s – were the traditional trade-up from core lagers.

Although in some decline, volume sales of premium lager (1.34mHL) and premium 4% ABV lager (1.45mHL) are still huge players in the market. Volumes dropped for both from last year by 15.5% and 8% and are down by 32.3% and 10.9% respectively versus five years ago.

Value sales are a similar story with premium lager (£1.14bn) and premium 4% (£1.06bn) seeing declines from £1.27bn (-12.4%) and £1.12bn (-6.1%) from a year prior and from £1.5bn (-25.7%) and £1.09bn (-2.7%) respectively before the pandemic.

Core Lager

Core lagers are effectively entry-level brands that tend to have lower ABVs and have, traditionally, been available to the on-trade market for a long time.

Despite a 35% slide in volumes sales from five years (pre-Covid) and down 30% in value too, this category is still huge and although sales have dropped by almost 2.3mHL before the pandemic and by 350k from 2022 data, it still sold 4.16mHL.

It’s a similar story in the monetary medium too, having value sales of £2.6bn in the latest CGA by NIQ figures, this is down from £2.7bn a year prior and was £3.7bn before Boris was telling the population to clap for NHS workers.

“Core and premium lagers are still massive, and although world lager has taken over in terms of increased sales, we can’t forget about how important they are to pubs, especially to communities, and there’s still some brands in those categories performing well,” explains Sterling of CGA by NIQ.

“I can’t stress enough that core/mainstream and premium lagers are vital. They’ve got a really high rate of sale at many pubs and you can put as many world lagers as you want in some outlets but they’re still going to sell more mainstream than anything else.

“Also the link with occasions is becoming more and more important. For example, whether it’s football, rugby, the Olympics, the Six Nations, and the Euros this summer, it’s massive this year for beer and that is so important because that’s what gets people out into the on-trade and being able to link brands with that or play alongside those occasions is so important – and Guinness has done that incredibly well.

“There’s certainly other examples in lager and that’s going to continue to be needed to be able to grow beer and keep it in decent performance.”

On the lager produced by members of SIBA, Walker says: “Lager as well is continuing to grow. There’s some great lagers being produced by small, independent breweries.

“And looking towards mainstream brands, there’s a reason Camden Hells did so well, a reason Stella launched its Unfiltered variant and it’s because people are looking for something with a bit more flavour and they’re happy for something that has a little bit of haze to it.

“There are some independent breweries where lager is the core of what they do – they’re not an ale brewery that happens to make a lager… lager is what they’re all about.

“There’s regional examples as well. So if you’re looking in the south-west, you’ve got people like Utopia or Lost & Grounded; Bohem in London, which are Czech lager specialists; Geipol in Wales; Donzoko in the north-east and Scotland and also Hofmeister, which is a really interesting one.

“You might remember Hofmeister from the 1980s but now it’s a totally different beer from a British-owned independent company that’s brewed in Bavaria. It’s a really excellent beer.

“There’s a real resurgence of lager in the mainstream and among independents. Crucially, people are looking for something that has got a bit more flavour.”

However, on mainstream, lower ABV and “lower flavoured” lagers he predicts they are set to continue to “fall out of favour”.

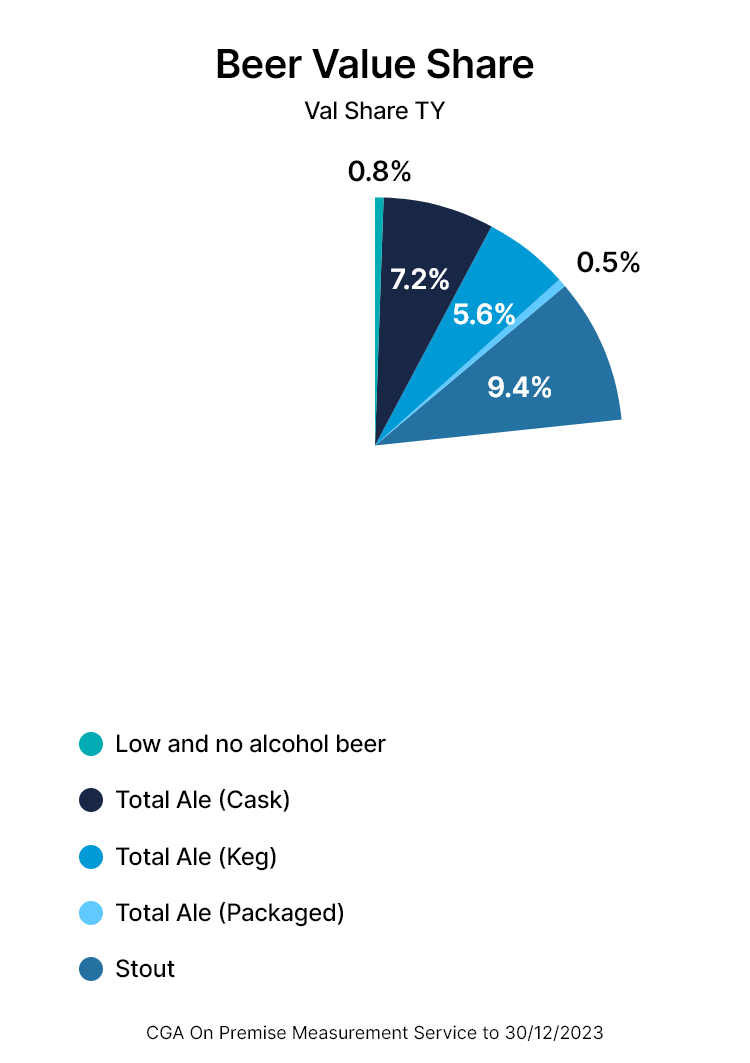

Stout

Not that long ago, stout would have been viewed as a drink you’d never see younger generations getting stuck into – but now that’s changed.

Guinness is the main protagonist in the market but other brewers are getting in on the act too.

Selling 1.62mHL in the year up to December 2023, it was almost 300,000HL more than in the previous year and a cool 352,704HL ahead of pre-pandemic stats.

Value has improved even more so with the category capturing £885m five years ago, £1.04bn in 2022 and £1.27bn in 2023.

CGA by NIQ’s Sterling argues: “Maybe five or six years ago, stout was possibly seen as an older person’s drink and not one you would associate with a growing category but it’s all to do with how Guinness is doing.

“It came on the back of Covid when people were really missing that pint that they couldn’t get at home so when pubs were reopening, it did really well and it’s gained a much younger consumer over the past few years.

“A lot of it is marketing, particularly, from a sponsorship perspective with links to the Six Nations rugby and St Patrick’s Day to being big on social media with influencers and celebrities, in general, such as Kim Kardashian drinking it.

“But also quality is also really key. What Diageo has done well is they’ve kept going into outlets to check the beer is served correctly and there’s a culture of ‘split the G’ and Shit London Guinness so people have become fans of it and can call out when it’s not the way it should be.

“It is also more affordable versus some other beers, consumers might look at a bar and say ‘well, the Guinness is £5.50 but a keg craft beer from my favourite brewery is £7 so I’ll have a Guinness because I know it’s going to be good quality’.

“Plus if a consumer likes ale but a pub doesn’t have any on or it isn’t very good there, Guinness becomes the fall back.

“Guinness has also encouraged a lot of other competitors to want a piece of that pie again and there is essentially some room there but it’s going to be very hard to persuade licensees to remove Guinness for another stout so it’s about how they can ride on its coat-tails rather than ‘how can we remove it?’”

Looking at stout from an independent brewing stance, Walker at SIBA says: “The big one at the moment is kegged nitro stout.

“Guinness is now the UK’s biggest selling beer and, among small independent breweries, we’re seeing a massive growth in nitro stout. Anspach & Hobday in London make London Black, which is now getting towards 70% of all their production I believe, but lots of small independent breweries all over the country are starting to launch their own nitro stouts to get a hold of that Guinness market.”

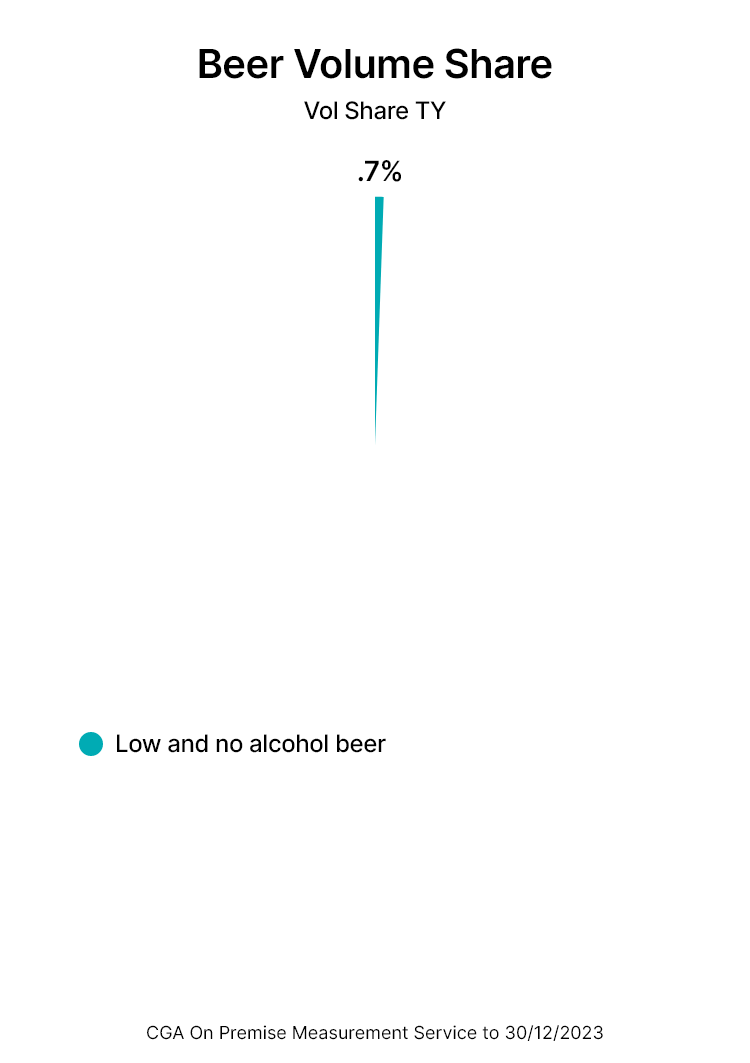

Low and No

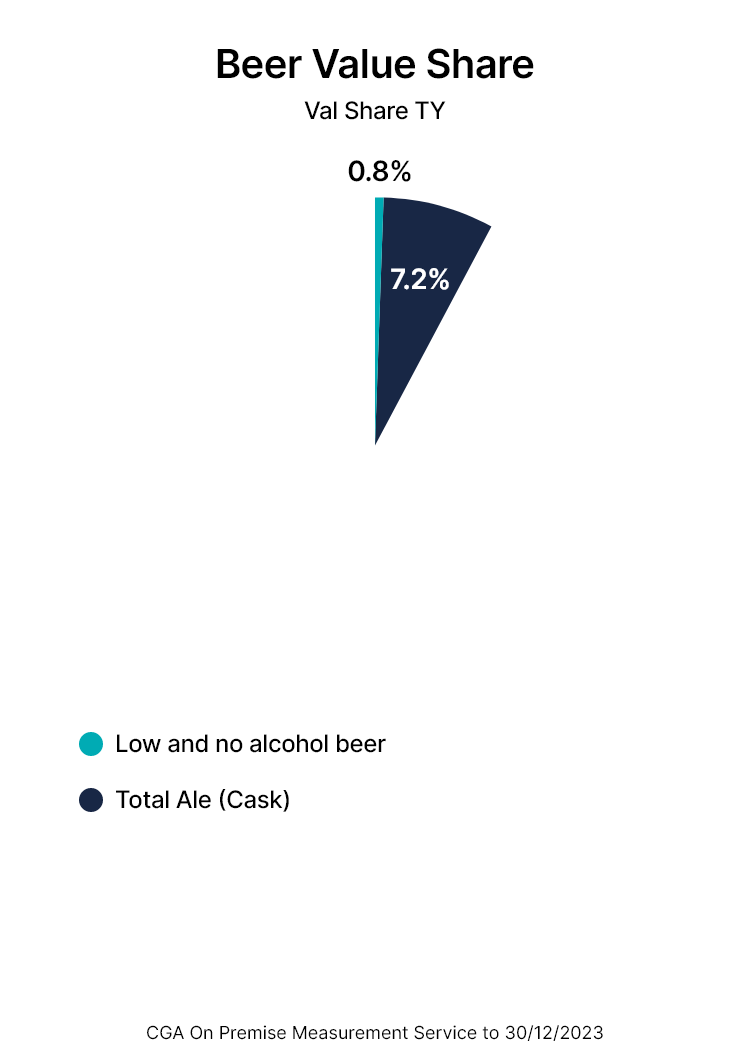

Low and no alcohol may take up a smaller percentage of the on-trade market but it is by far the fastest growing sector in volume and value sales.

While the volume of sales was around the 63,000HL mark pre-Covid, it is now at 112,639HL – a whopping 77.7% uplift. It also achieved a 30.5% boost from 2022 volumes as well.

Value sales have hit £109m in 2023 – that’s a 39% leap from 2022 and 95.3% on pre-Covid levels.

Sterling says: “General moderation trends are really driving that category. There’s a lot more choice now within it. It’s not just one or two brands. Numerous brewers have released NPD in the past two or three years. And the quality, overall, is better.

“The cost of living probably comes into it as well. People are looking to not just moderate from a health perspective but it’s a bit lighter on the wallet generally.

“It also lets them get on with their with their day if they’re nipping out for a quick drink after work or whatever. It has less impact than having a full-strength beer so there’s a lot of buzz in the category on social media and big profile sponsorships as well.

“Brands such as Peroni 0.0, Heineken 0.0 are sponsoring a lot of F1 and sporting events so that’s going to continue to grow as people look to moderate more and I think dry January has been really positive – I think it’s had its best January ever in the on-trade.

“Although it’s small, its share of beer in the on-trade doubled from 0.8% to 1.6%.

“People staying away from pubs in January is obviously negative but if operators can get people into pubs, even if they’re moderating, they’re still getting that spend so it should be seen as an opportunity rather than avoiding talking about low and no at all because it is a chance to drive sales.”

SIBA Walker adds: “Low and no alcohol beers were growing massively pre-Covid. It’s split into two segments: the 0% to 0.5% ABV, which is alcohol-free and then 0.5% to what was 2.8% ABV but now that can go up to 3.4% because the Government has changed the duty border essentially.

“When Covid happened, everyone began drinking at home because they didn’t have to drive to the pub – that hurt the segment but now it’s back on track.

“With the recent alcohol duty changes where the government moved the lower limit banding from 2.8% to 3.4% ABV, you’re seeing lots of mainstream lagers that were already getting close to that percentage moving down to 3.4% to get that tax break.

“But you’re also seeing lots of innovation from small independent breweries who want to produce lower strength beer and get into that 3.4% bracket. It’s not easy to get the body and flavour into a beer with a low ABV but the beers from independent breweries do have loads of flavour and it’s difficult to be able to tell you’re drinking a lower ABV product.

“Some of our members are producing lagers styles such as light lager, which are big in the US and are often made using corn or rice as opposed to malt. They taste lighter and quite often are lower ABV as well at about 3.5%. Light refers to a lightness of body and flavour – they’re meant to be really easy to drink, really refreshing and a great summer beer.

“Quite often they will be lower in calories and certainly lower ABV but that’s not really the aim. It’s about the body of the beer.”

Ale

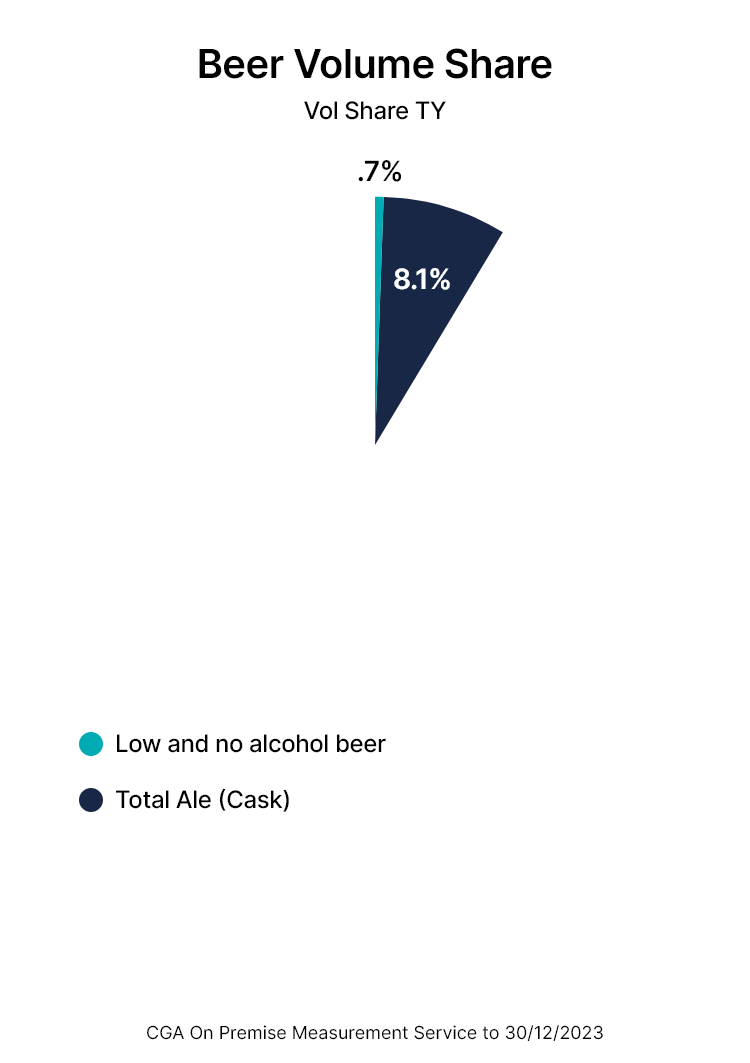

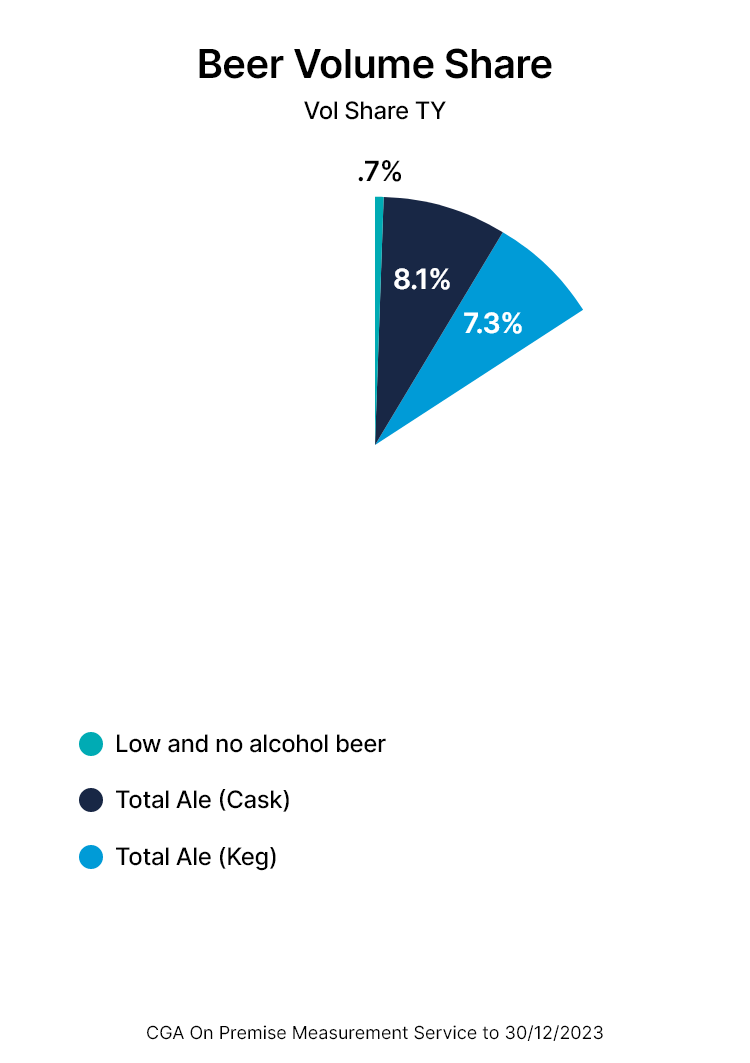

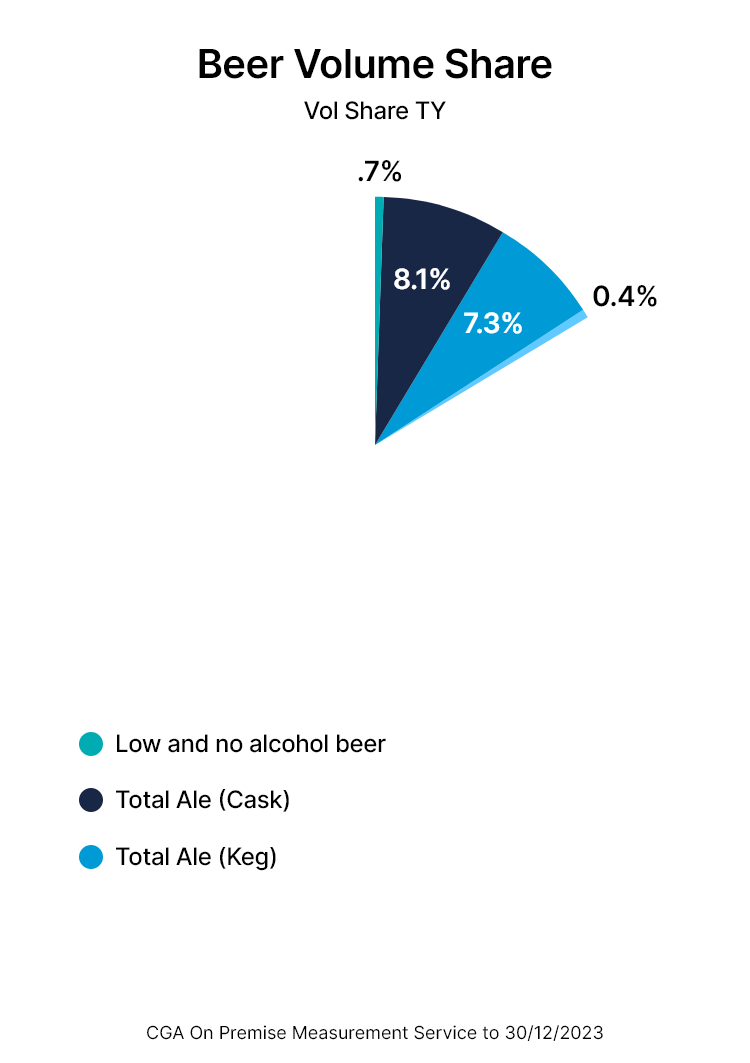

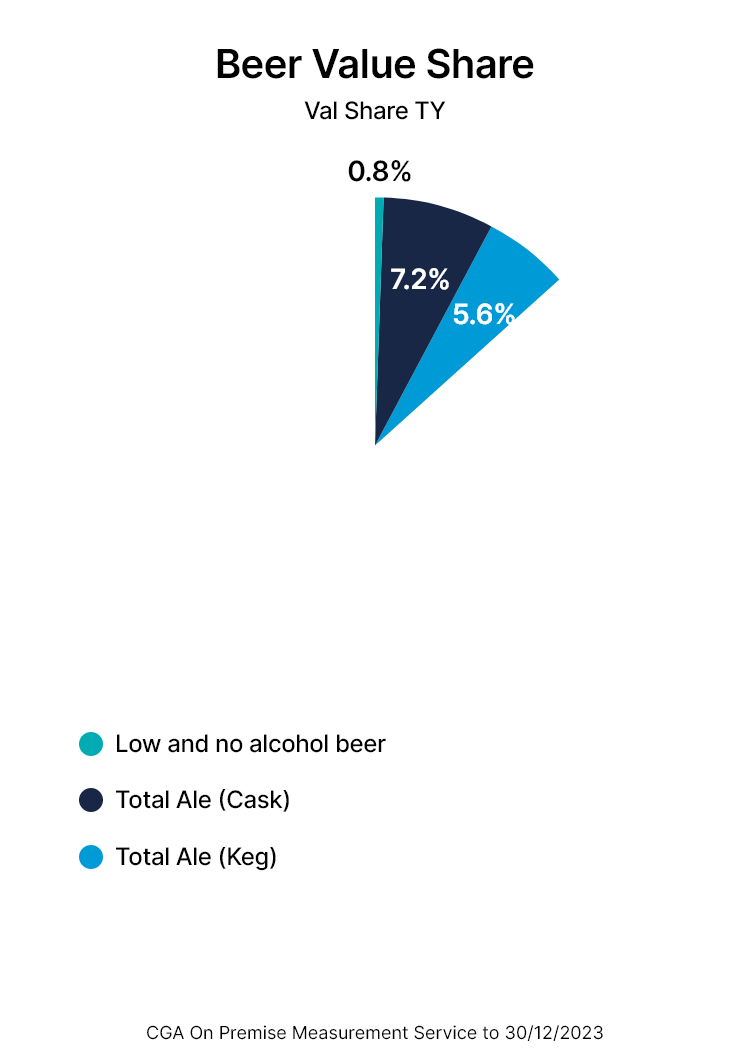

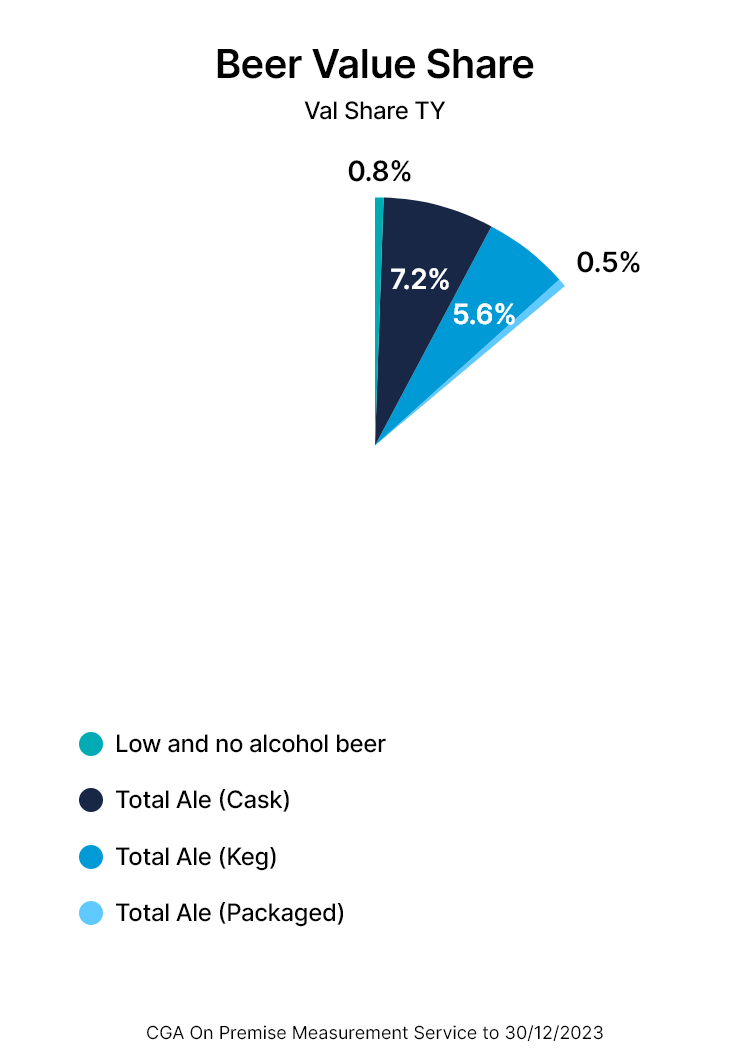

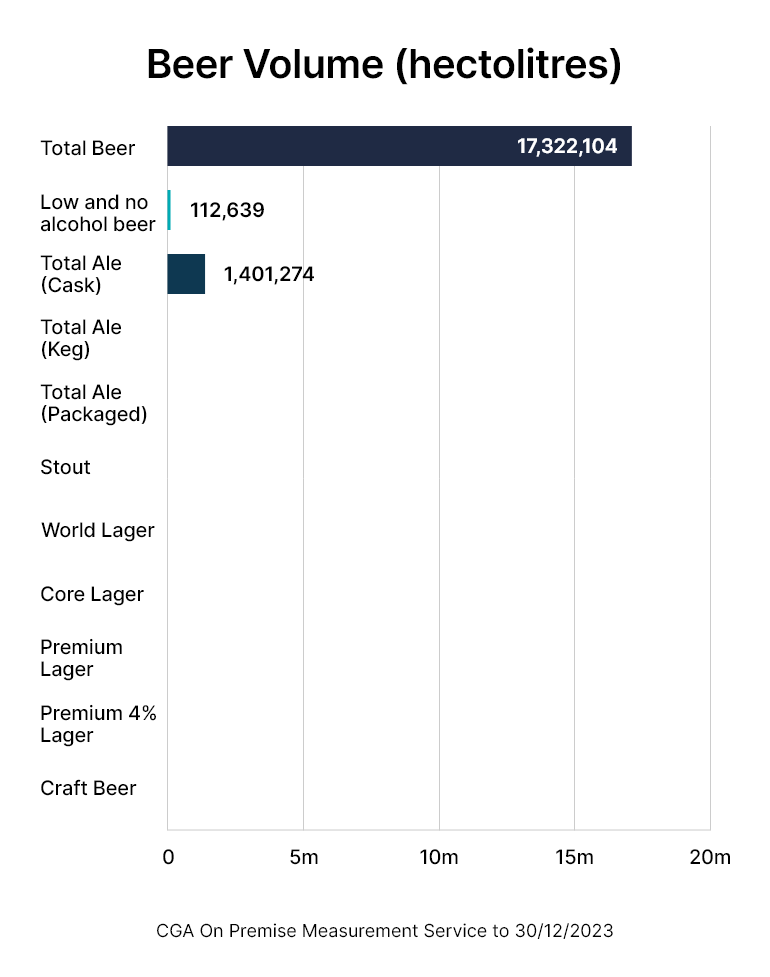

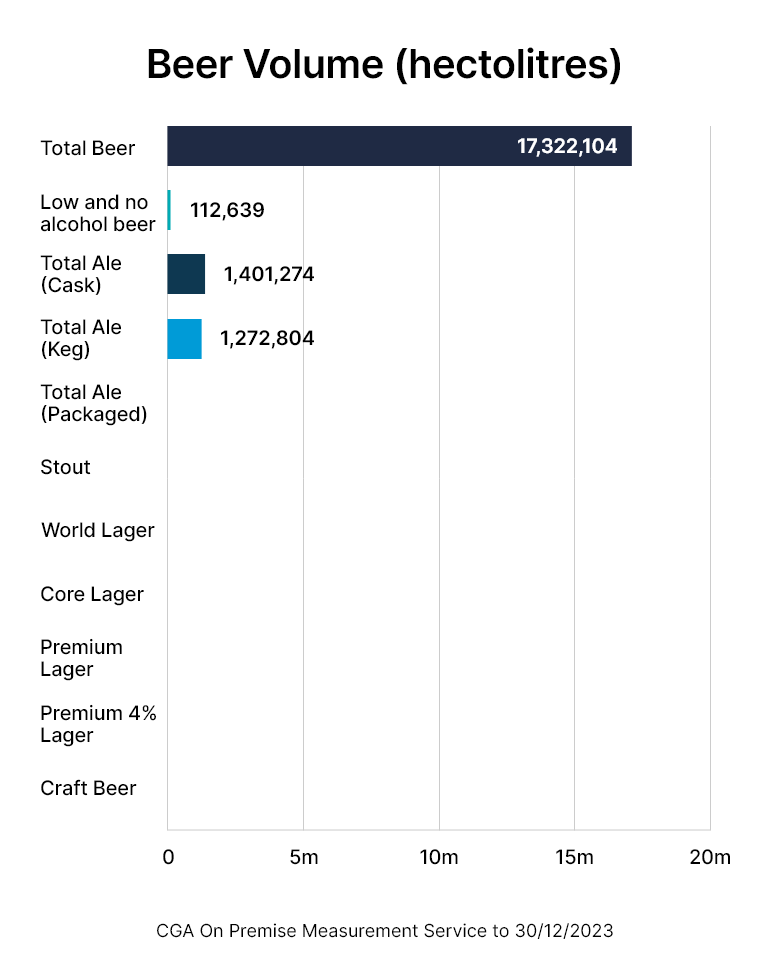

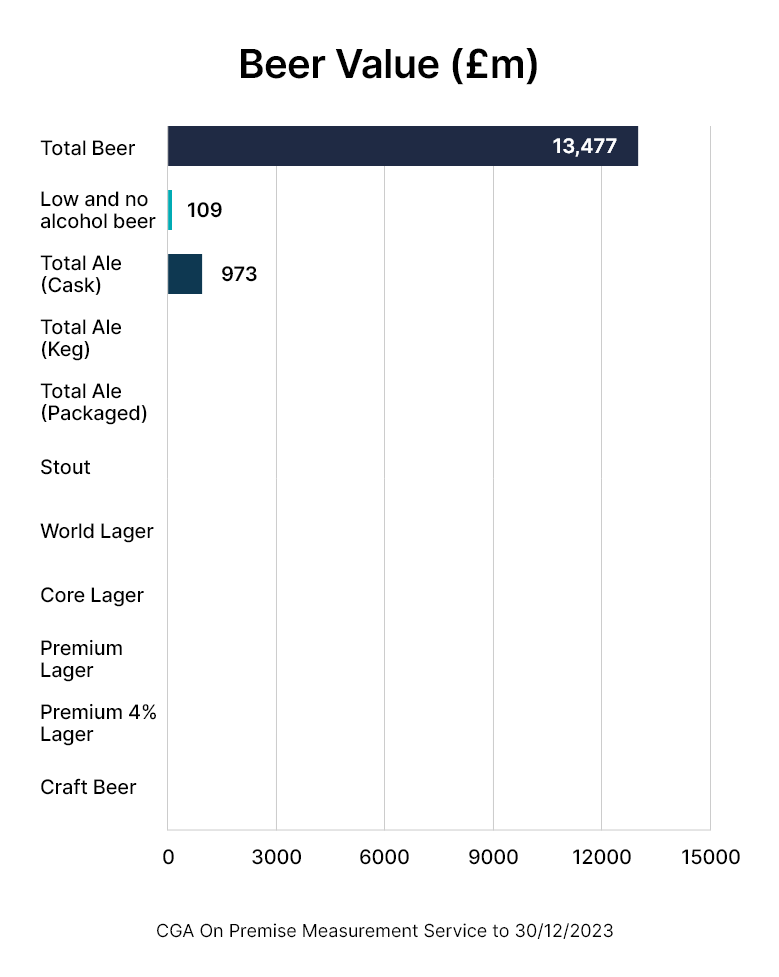

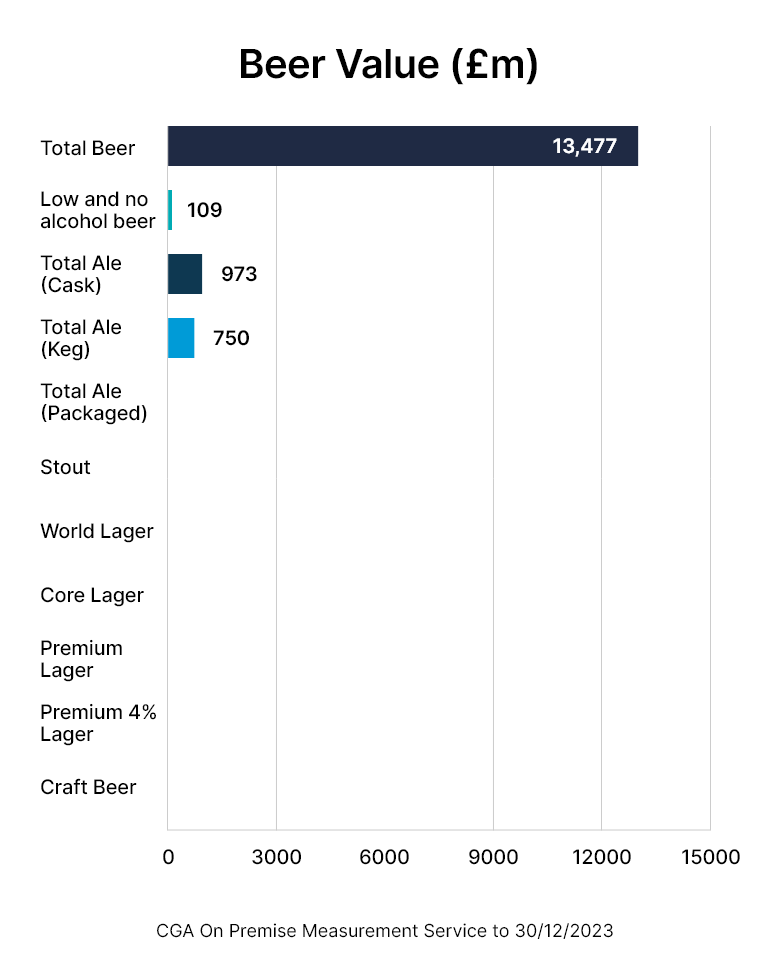

CGA by NIQ splits this category into cask ale, kegged ale and packaged ale as shown in the associated graphics.

Both cask and kegged ale continue to decline somewhat slowly, according to the statistics but Walker from SIBA has seen a brighter picture from the independent brewers in the UK.

The figures show volumes sales for cask ale stand at 1.4mHL for the 2023 year, which is down from 1.47mHL in 2022 and 2.02mHL pre-Covid.

Value sales for the category follow the same pattern with the on-trade being worth £1.24bn being the pandemic, £985m in 2022 and £973m in the most recent statistics.

Kegged ale has a smaller share of the market but the data is mirrored. Volumes are down to 1.27mHL from 1.47mHL in 2022 and 1.76mHL five years ago.

Value has been eroded too with £937m of sales pre-pandemic, £775m in 2022 and £750m for 2023.

Sterling of CGA by NIQ reveals: “Cask ale has suffered probably a little bit from stout’s success and there is still a pretty negative performance there.

“There’s some green shoots in terms of the trends from a volume perspective that it is in line or actually slightly better now than pre-Covid – so even though we’ve seen year-on-year decline for the past few years, there is the experience aspect fact that people are drinking a product they can only have in a pub. This has also helped sales not to completely collapse.

“There’s still lots of issues in the category around quality and pricing. I think pricing probably helps when we have a consumer who’s looking for something a bit cheaper or is looking to go out and have a treat because cask still sits, pretty much, at the bottom end of the pricing ladder, which we find it hard to get our heads around given the work that goes into it.

“But there’s still a high percentage of outlets that are not doing enough throughput to justify it and that ultimately leads to a consumer having a bad pint then not drinking that brand again or not drinking cask again – maybe even not going to that pub again – so it’s a vicious circle and it’s still not being tackled.

“The introduction of Fresh Ale (cask-style ale that is not a live product and keeps for 14 days in a keg rather than three days in cask) could be a game-changer for the overall ale category but we’ll see how it goes.

“Cask is a category that should be doing well and, in some ways, it’s started to recover slightly.

“Ale in general (kegged) is suffering in the same way as mainstream lager because people are trading up to craft and even into world lager.”

SIBA head of comms Walker argues: “We are definitely seeing big growth from independent breweries of 10%-plus growth on cask ale volumes and with kegged ale, we are definitely seeing independent breweries go back to that style that is interesting and loads of different styles of beer are possible in keg.”

Craft

The definition of craft is not a simple category to put one’s finger on and while CGA data can only be populated mainly with more mainstream craft offerings, SIBA has more information on smaller, independent breweries here.

CGA by NIQ has noted a 5.3% drop in volume sales from a year ago but a 0.9% rise from pre-Covid. Volume sales are 1.22m in the latest figures, 1.29m in 2022 and 1.21m five years ago.

Value sales have fallen 1.3% from £1.21bn in 2022 to £1.2bn in 2023 – however they are currently 14.7% higher than before the pandemic when the figure was £1.04bn.

Sterling at CGA by NIQ states: “Craft’s an interesting one. I don’t think the category is in dire straits by any means. It’s partly to do with how much world lager has grown and how much space is taken up on the bar but there’s some huge brands in craft that are doing really well.

“Its fortunes lie around the treat occasion with people having more quality drinks when they do go out and craft can play into that.

“You can find craft in mainstream pubs but also in city centre taprooms and they give experiences you can’t really get with it with any other category. There’s always going to be a place for it and we talk about experience so much in terms of that’s what consumers want when they go out.”

CGA by NIQ data for craft includes brands such as Beavertown, Camden and Brooklyn. Smaller brands are included but it is hard to measure these.

Meanwhile, Walker of SIBA explains: “In terms of the craft segment, what we’ve seen over the past couple of years is craft beer become part of the mainstream.

“It’s quite often a hop-forward beer and there’s lots of the global brewers that are now producing these. But people are moving towards independent products.

“During Covid, there was a massive trend for people to search out their local businesses and trying to support them. That really helped the independent brewery sector. People have found their local brewery. They’ve started buying independent craft beer and that’s continued.

“The craft beer segment is incredibly buoyant and is continuing to grow.

“In outlets, where there’s independent craft beer and mainstream beers available, beers from independent breweries will sell about 30% of the total volume. We’re currently at 6% in the overall on-trade market so clearly there’s some work to be done but there’s definitely that kind of consumer pull for independent craft beer.”

Trends

Sterling concluded: “It’s hard to look into the crystal ball but I think the key one will still be world lager yet stout has got more ground to move into along with no and low alcohol beer and there’s likely to be more proliferation in the on-trade.

“With the duty change, which is lower tax on alcoholic products at 3.4% ABV and under, it will be interesting to see the NPD that’s takes place. Are there going to be new brands that are going to break into that space to make the most of the lower duty rate?

“Craft and cask both have potential for a bit of a turnaround in performance. It will depend on the focus they get from brewers because, ultimately, that drives it in the end and sometimes it’s not necessarily consumer-led but brewer-led.

“Additionally, we know occasions are moving to earlier in the day – due to decline of the late-night economy – consumers are getting good experiences locally and are generally holding back more on big night out spending on spirits and cocktails, which has really benefited beer as a natural partner to earlier occasions.”

View From The Bar

Beer is a massive part of the typical pub offer, but how do operators themselves see the category? What are the key trends and influences impacting on bar operators?

As part of The Beer Report 2024, The Morning Advertiser editor Ed Bedington caught up with top freehouse operators Matt Todd, licensee of the Wonston Arms, near Winchester to get his assessment of the market.

Since buying the village pub in 2015, Todd has created an unashamedly wet only pub that has built an outstanding reputation for its beer offer, with a strong focus on cask, and is now a destination operation for miles around.

Watch Video

View From The Brewery

The Morning Advertiser associate features editor Gary Lloyd talks to Greene King head of brewery customer engagement John Malone about how a licensee should keep cask ale and what the pitfalls are that many fall into.

Malone expands on this to include how aspirators and coolers help maintain quality, how the brewery can help with making sure any pub cellar is kept in prime conditions and which types of ale should a pub stock.

He also explains why the category should be positive for the future.

Watch Video

Price Data

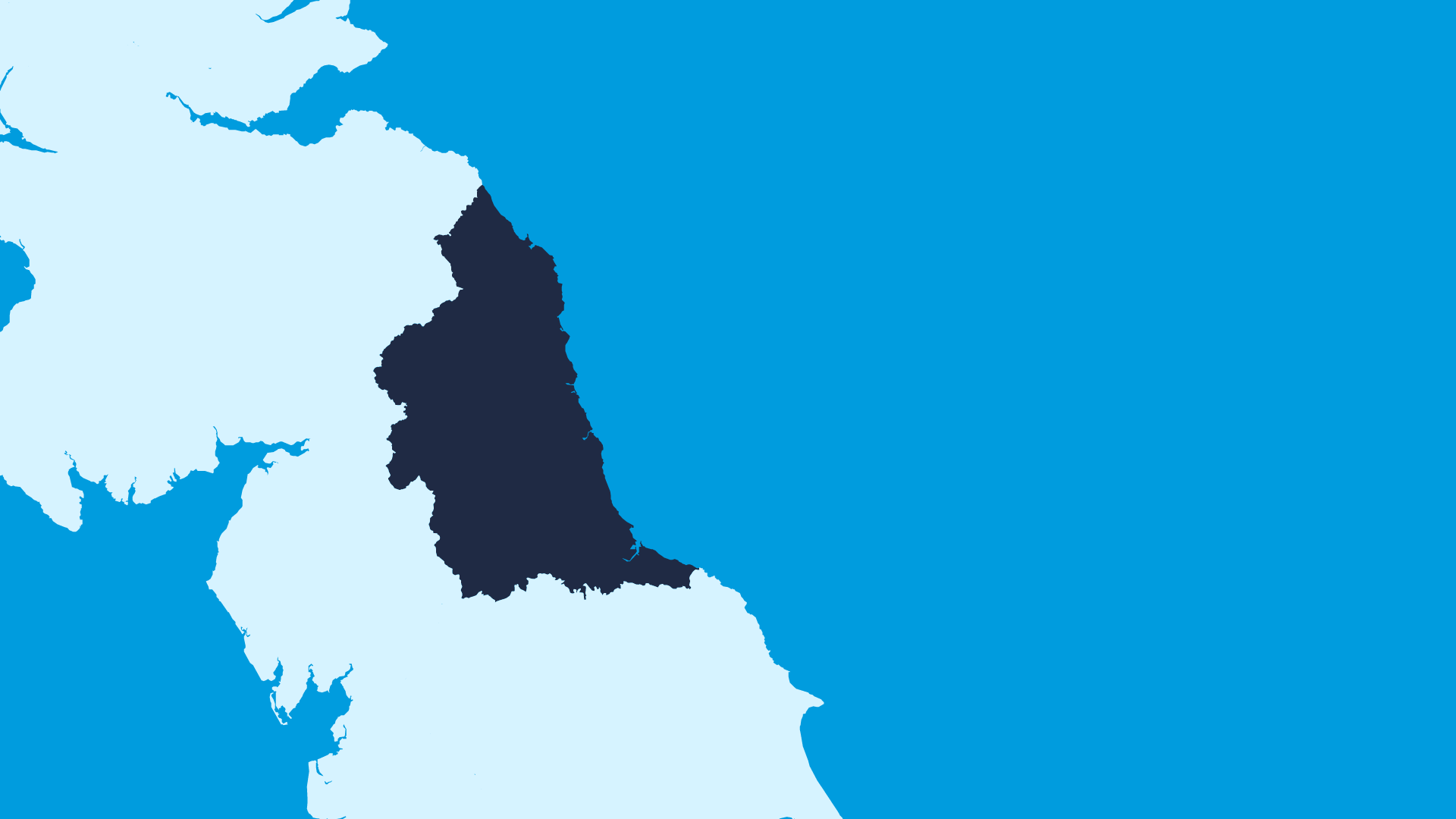

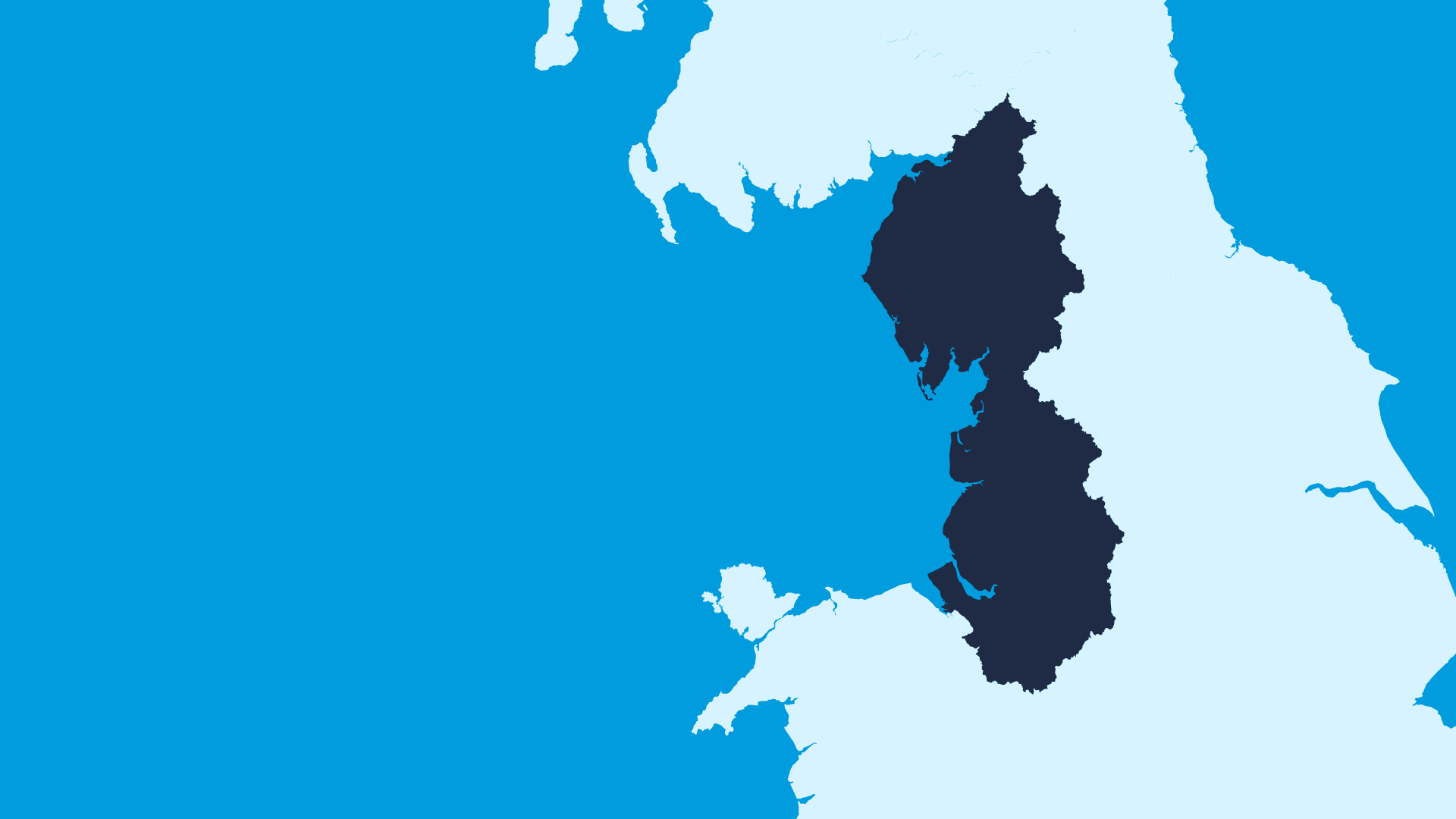

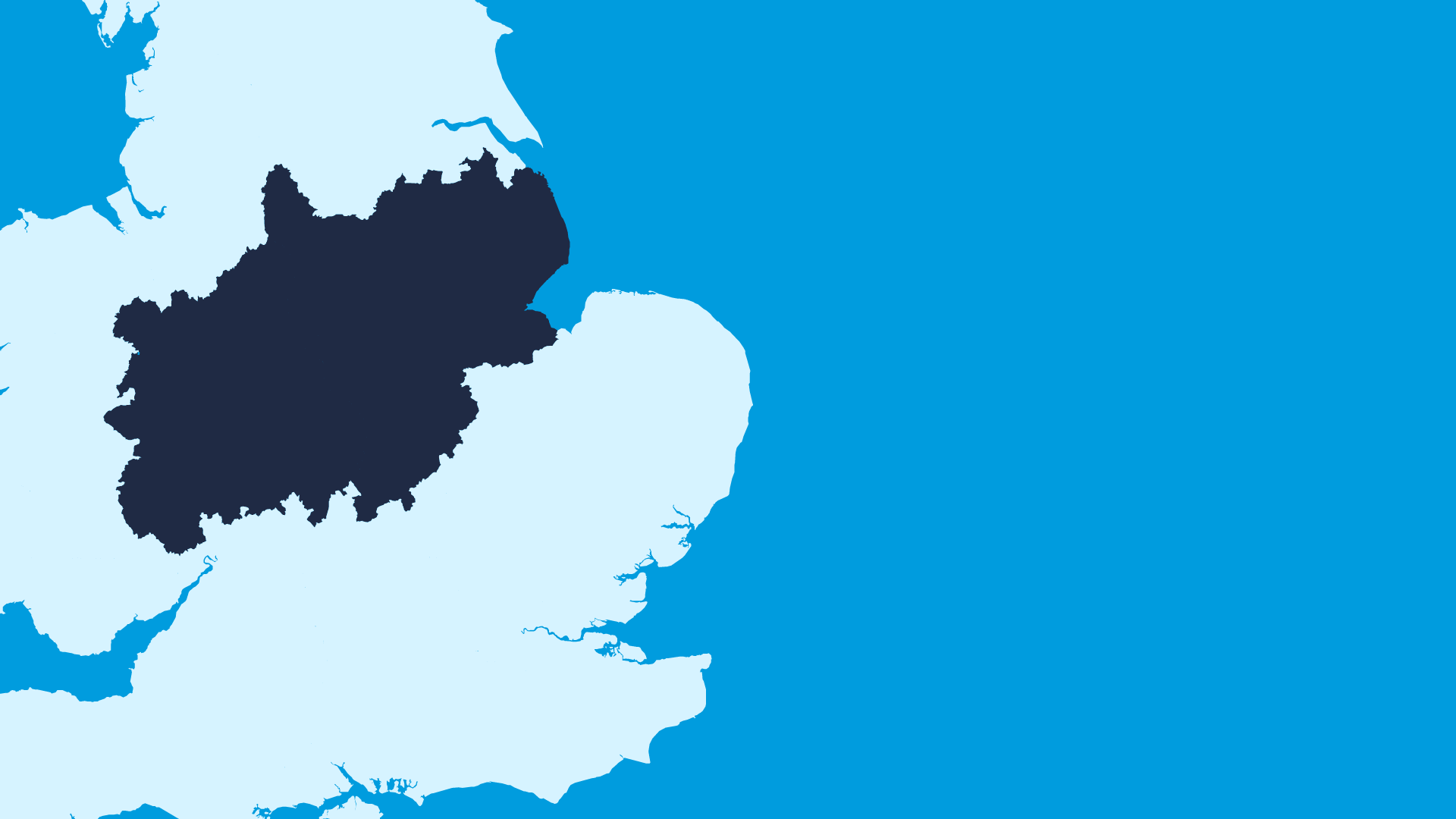

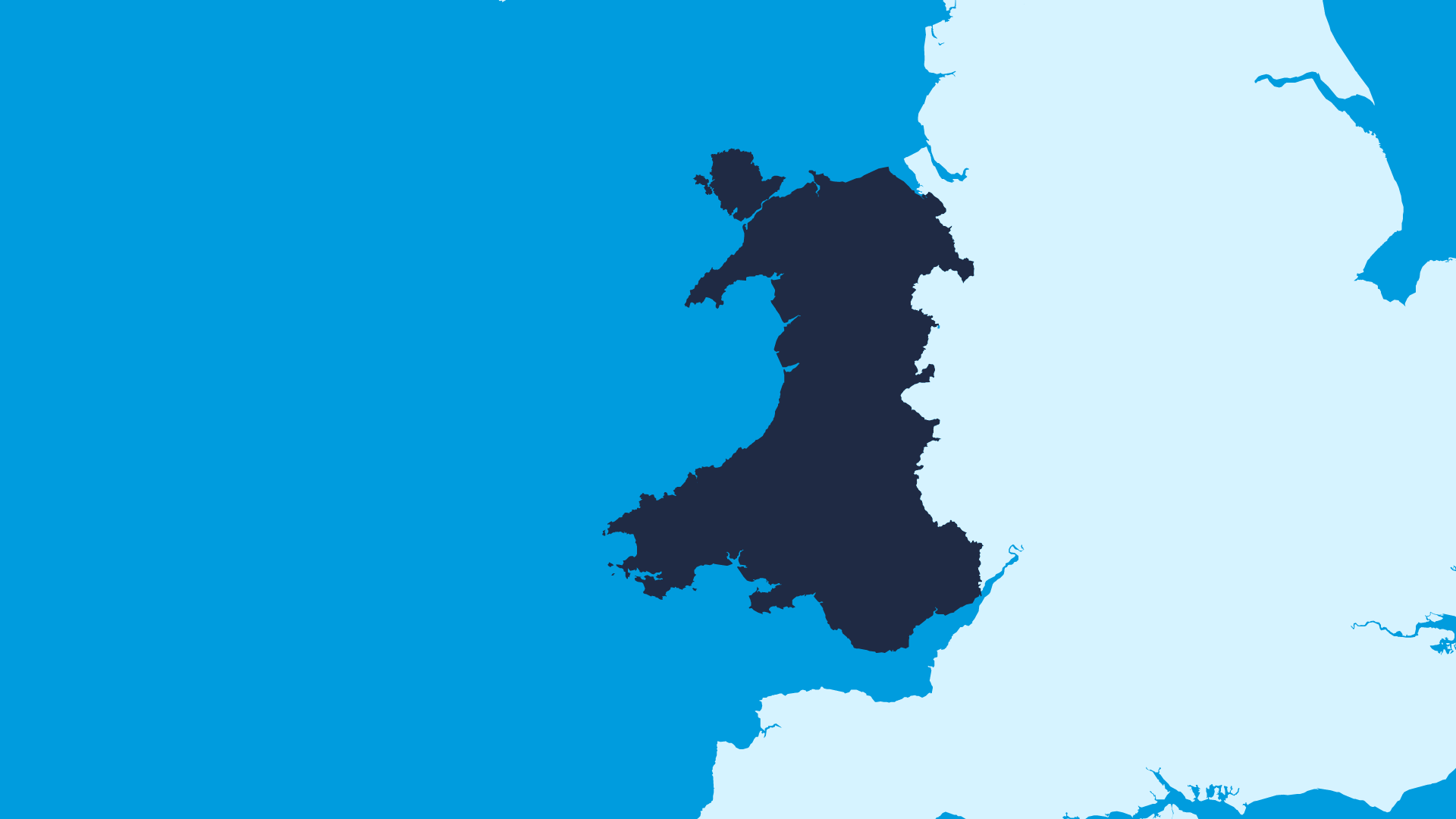

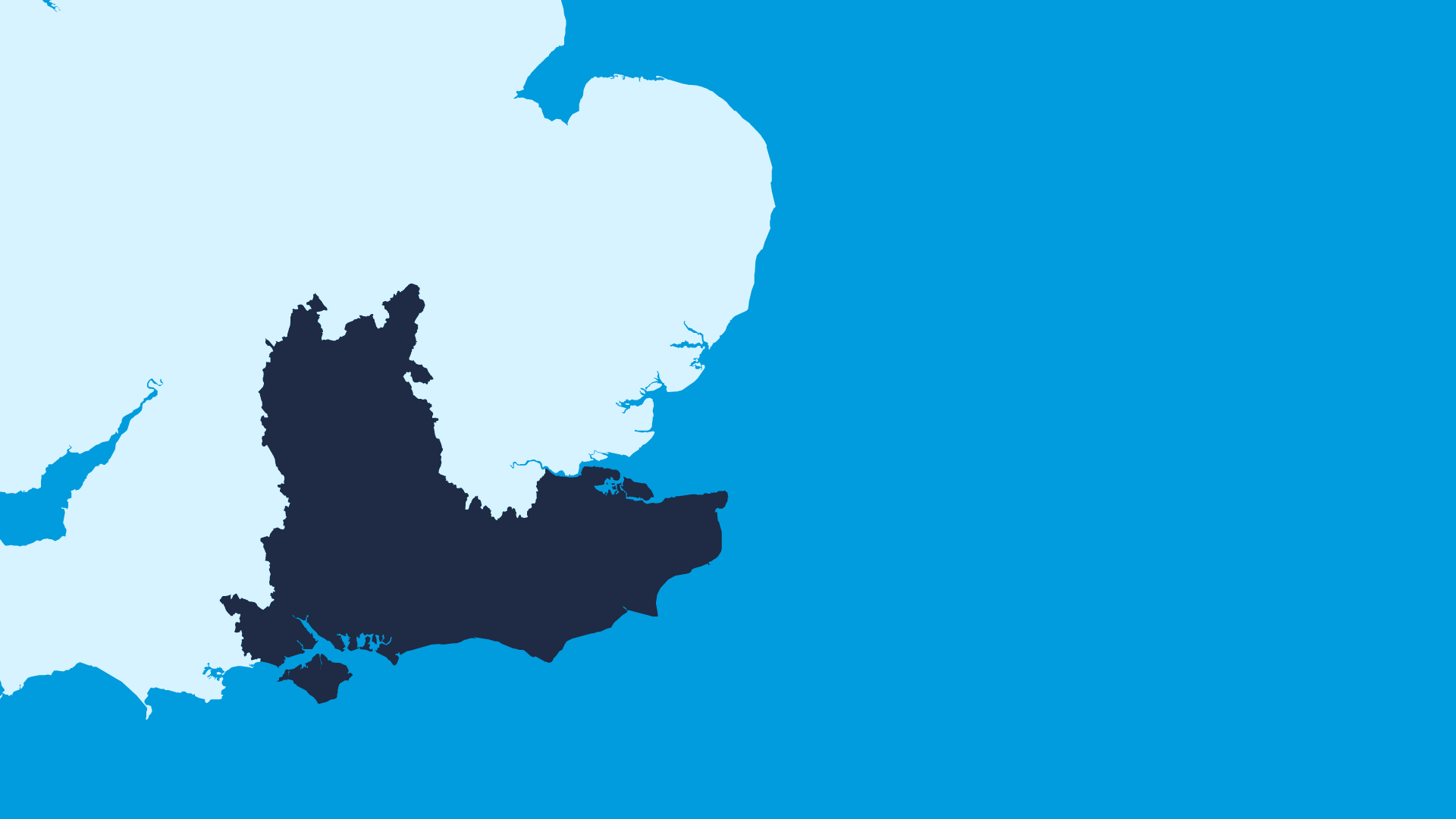

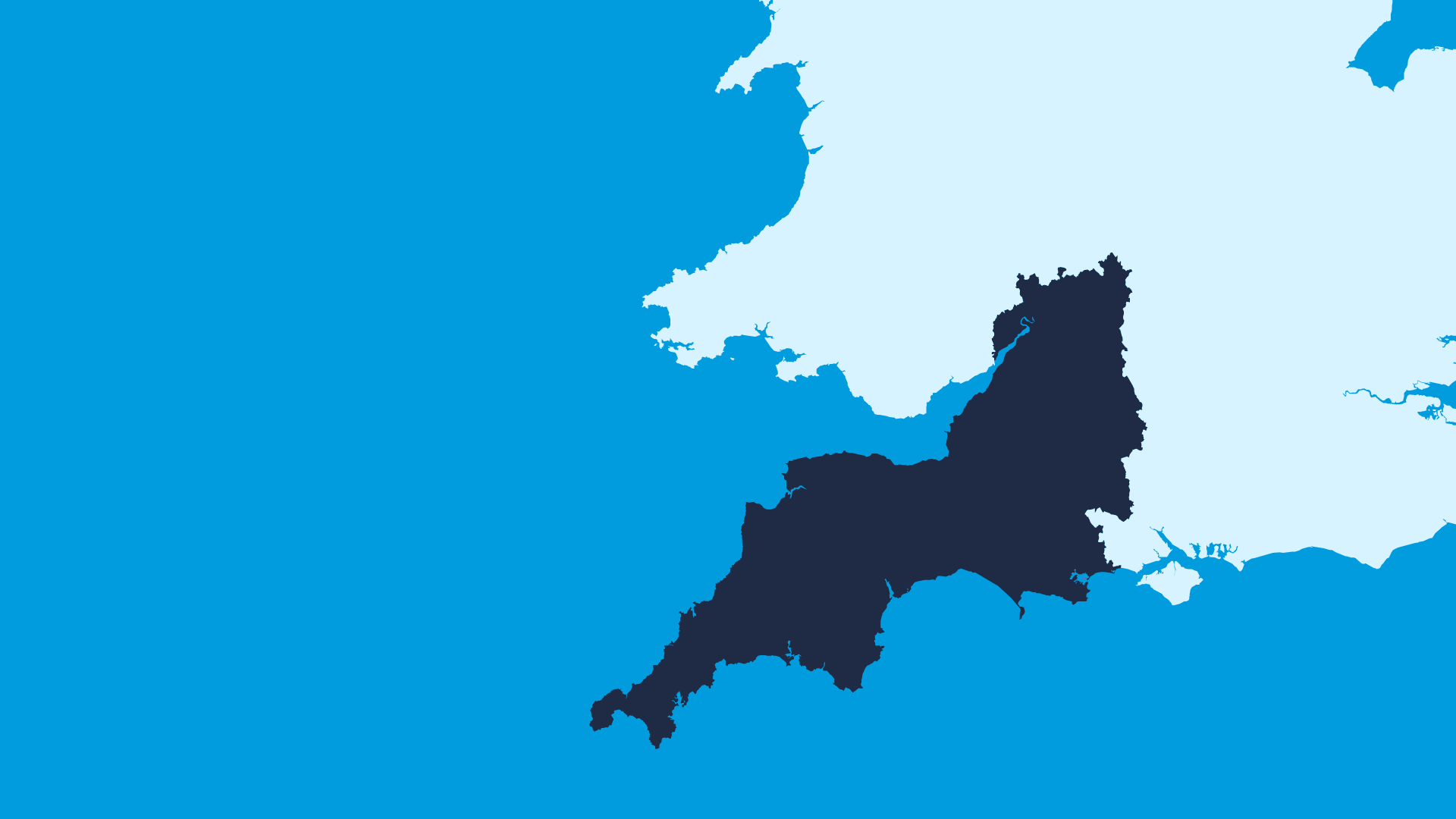

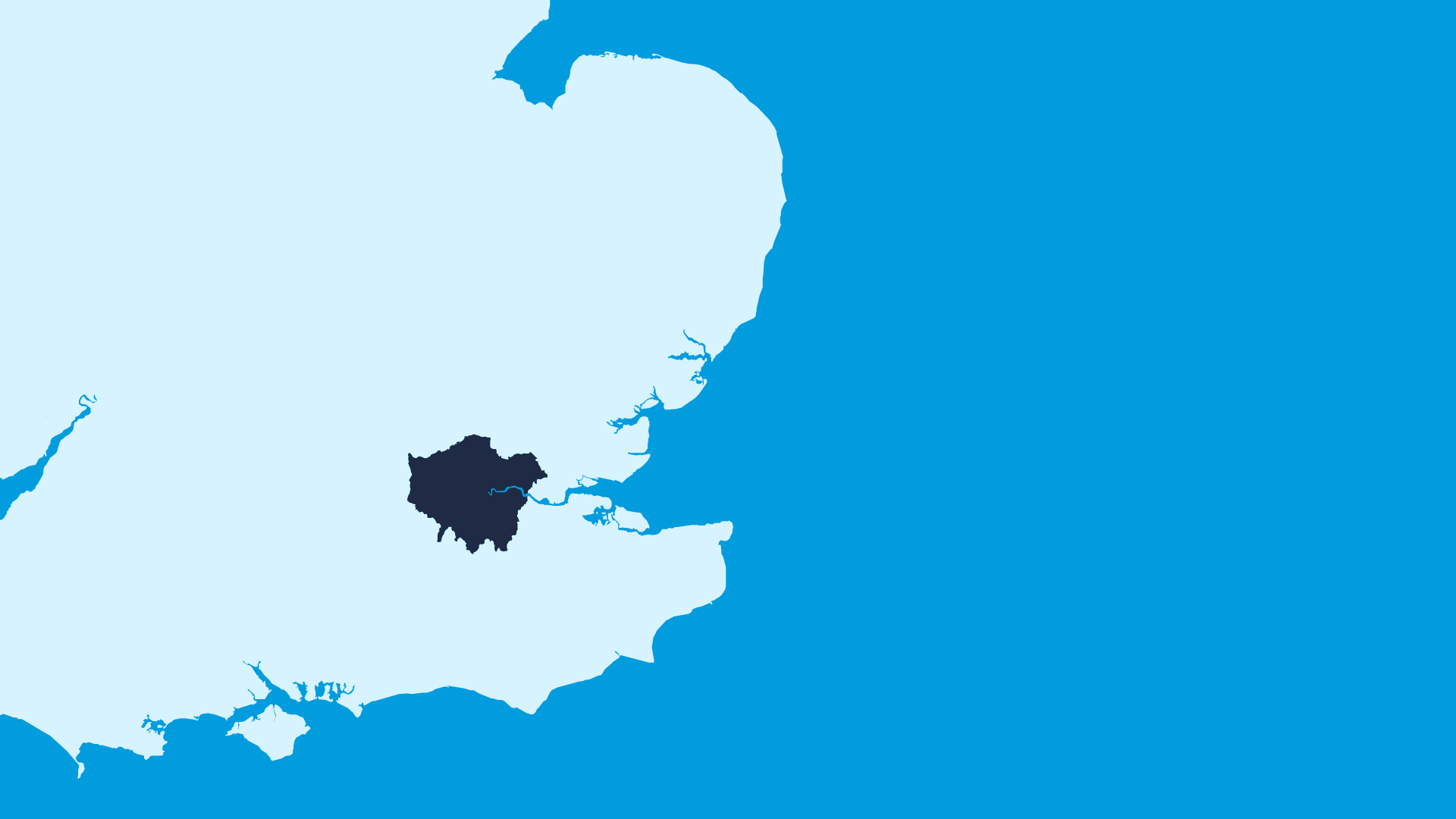

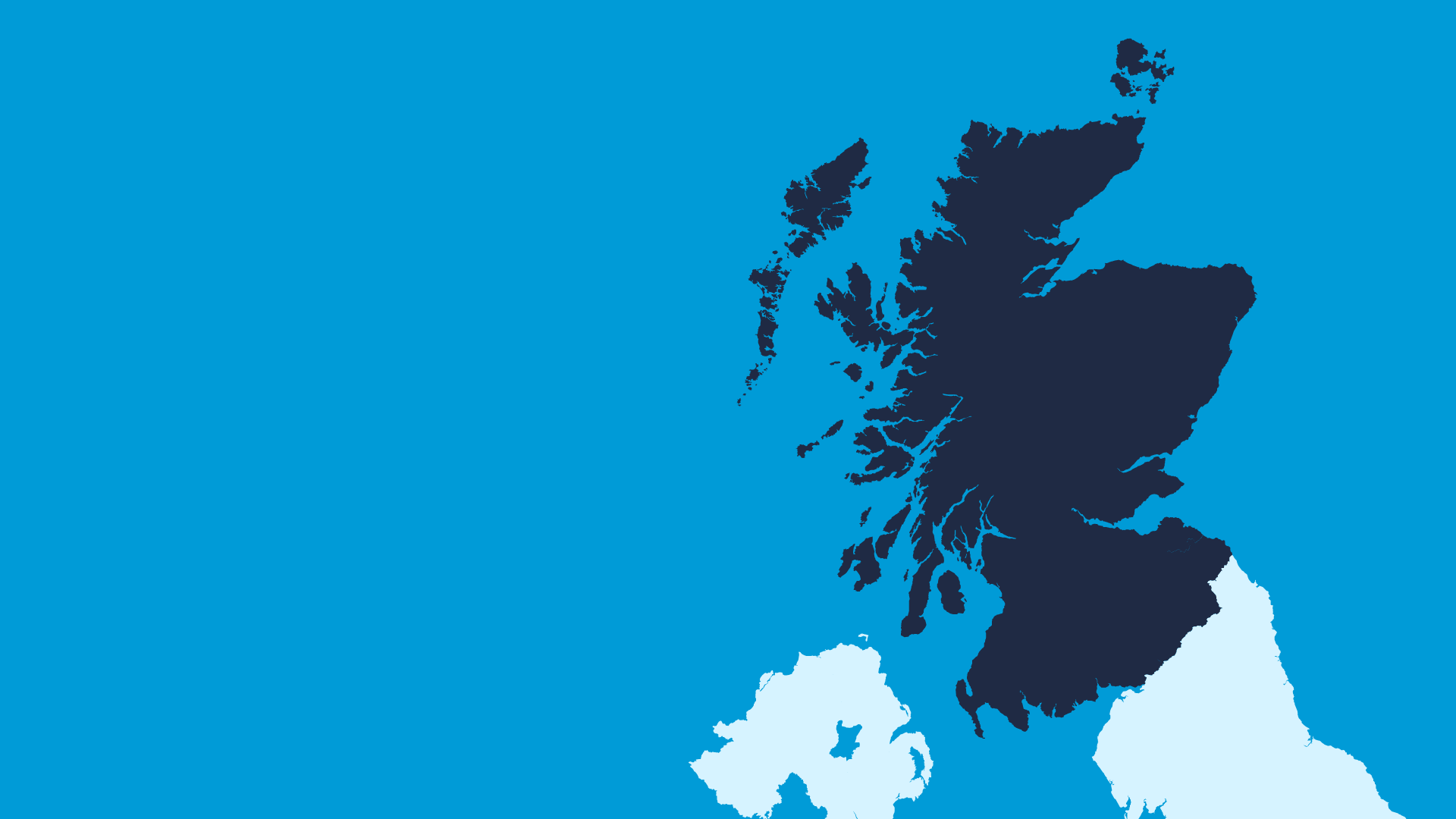

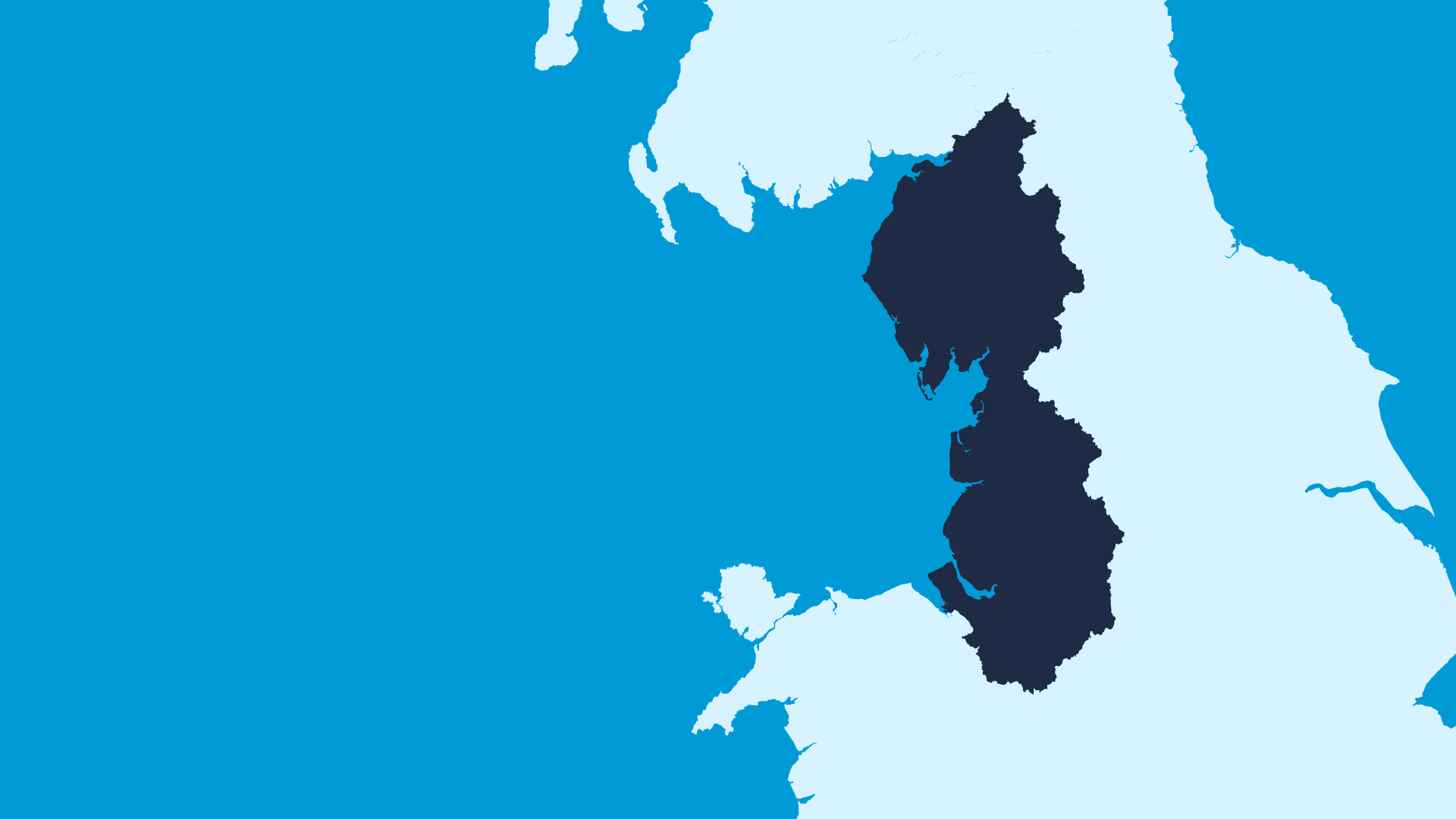

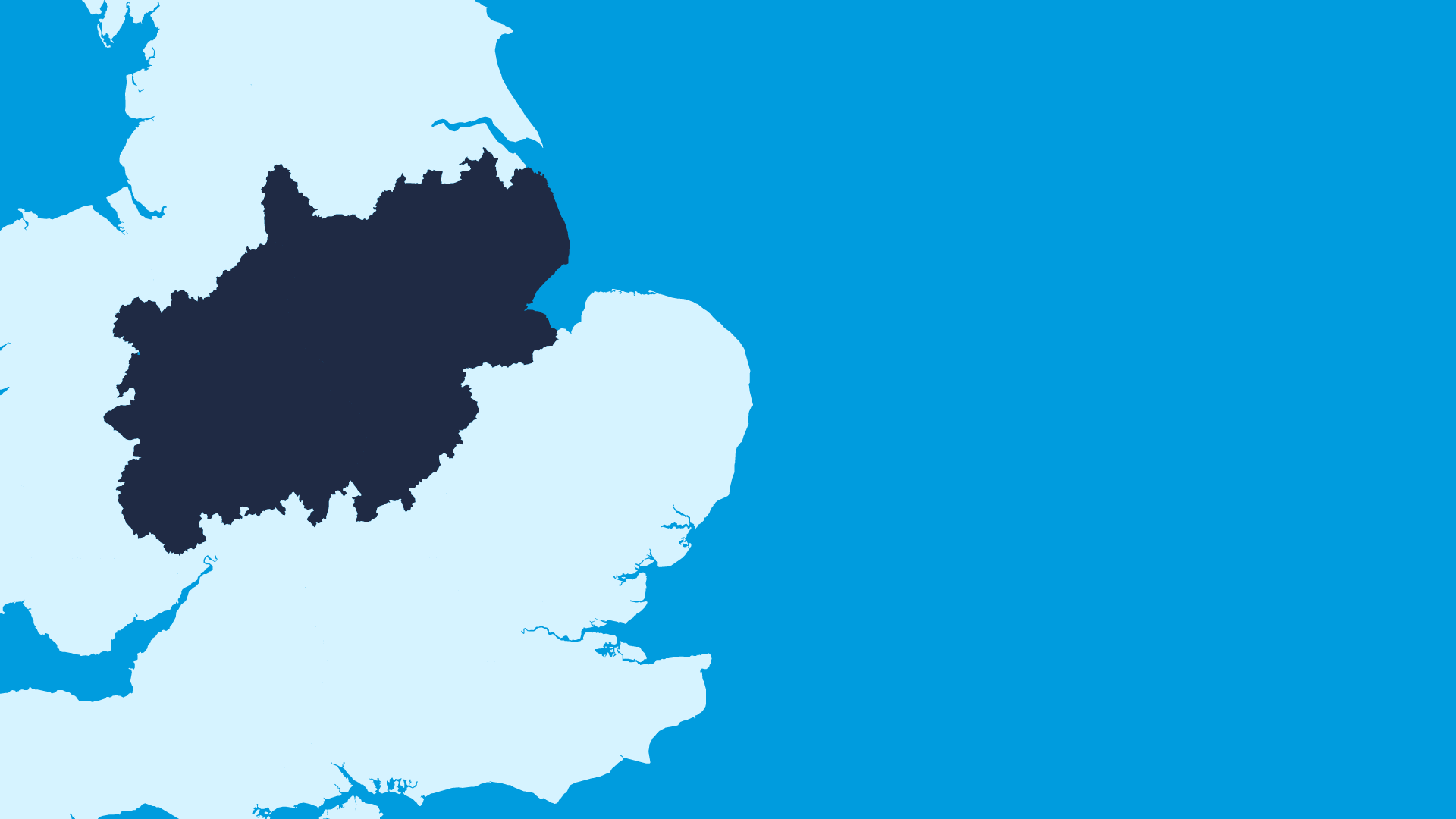

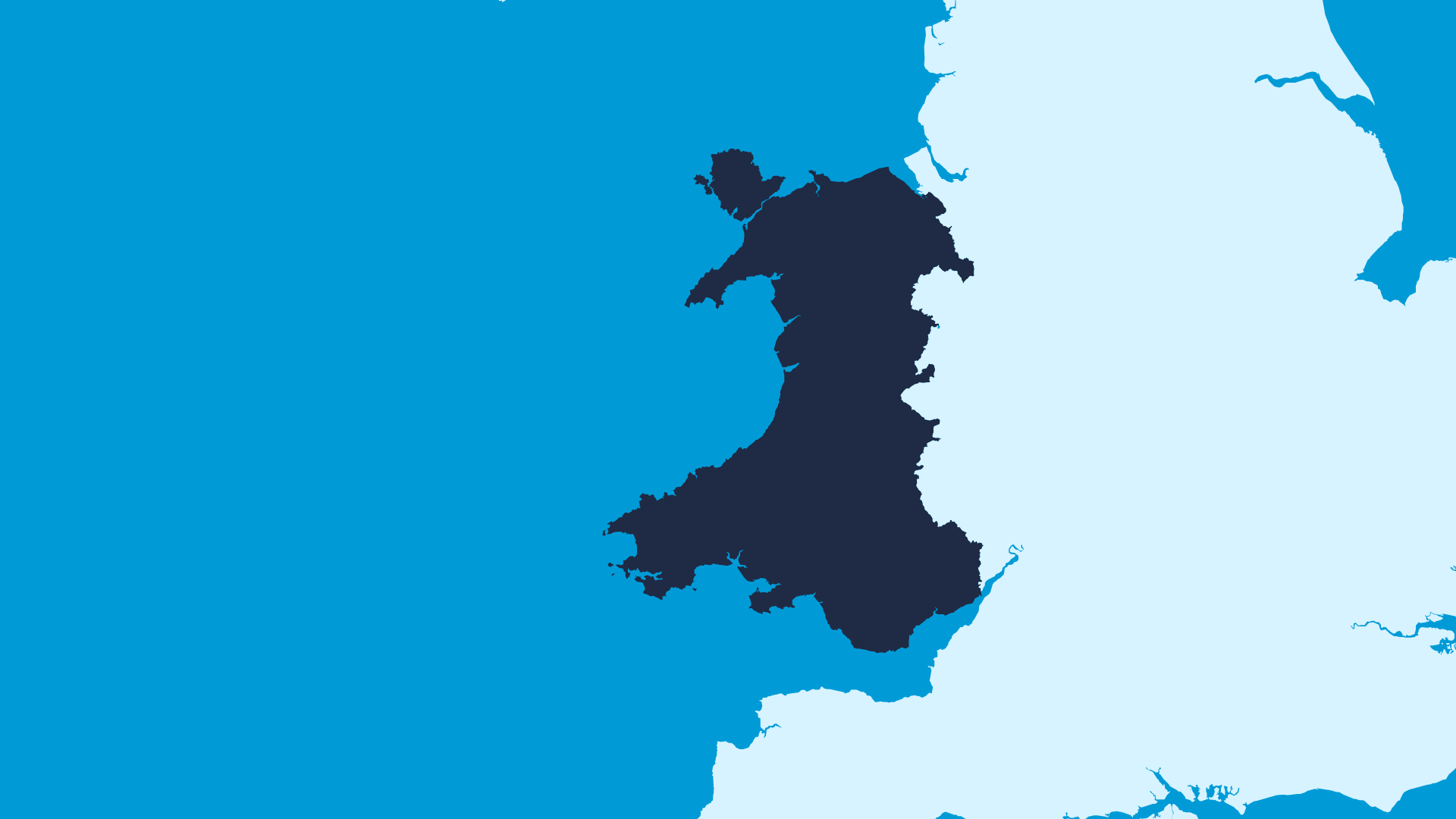

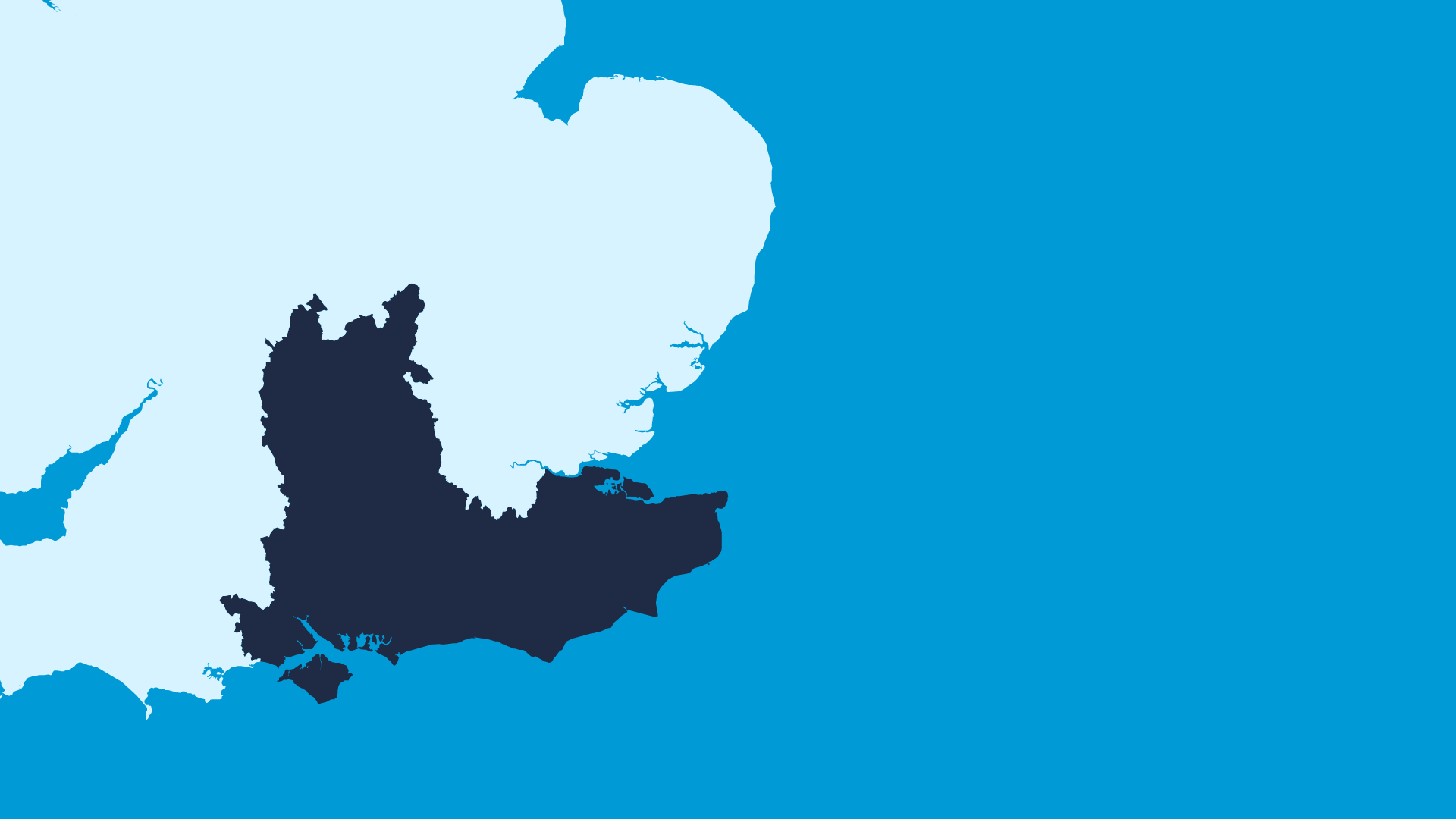

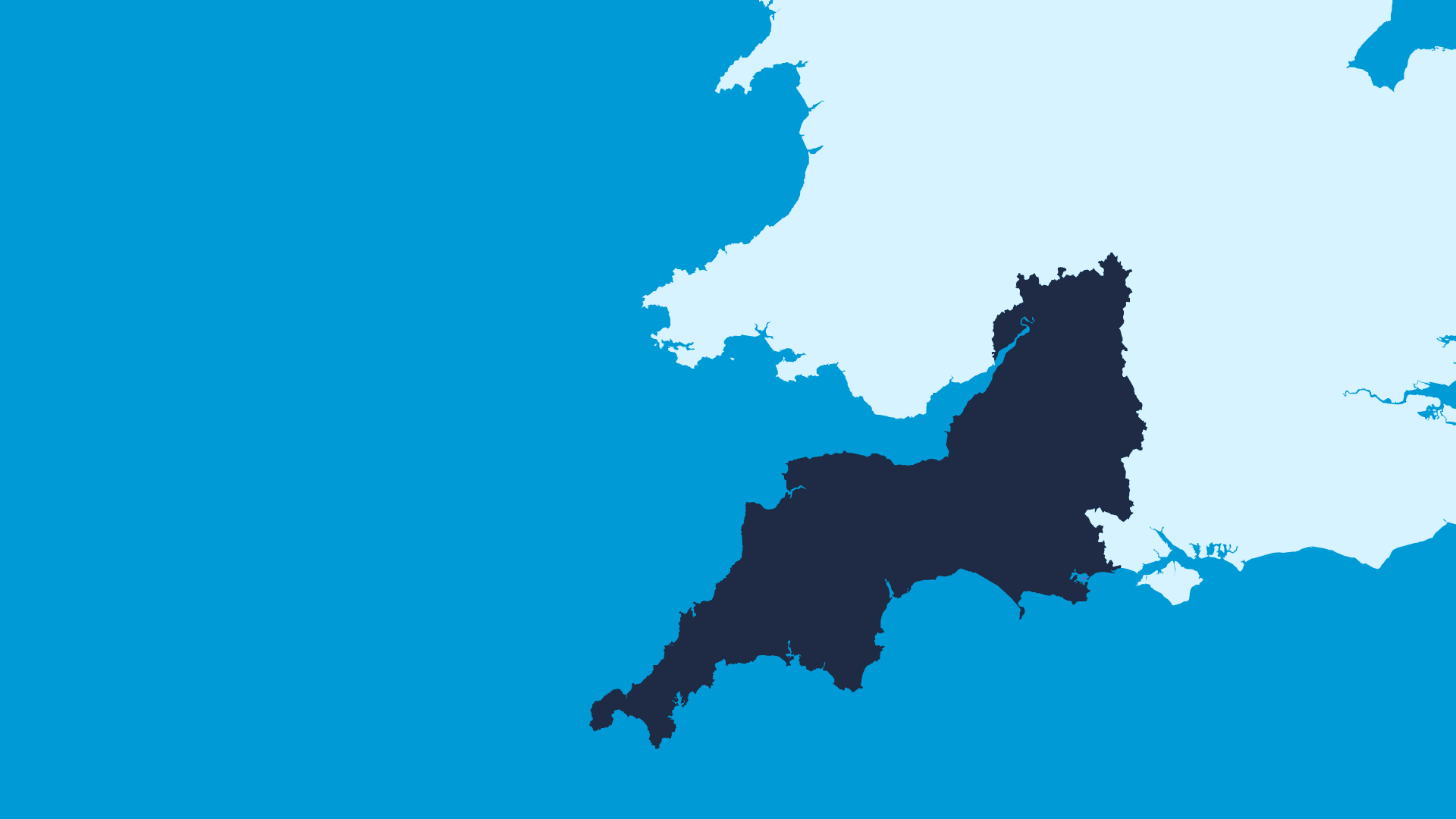

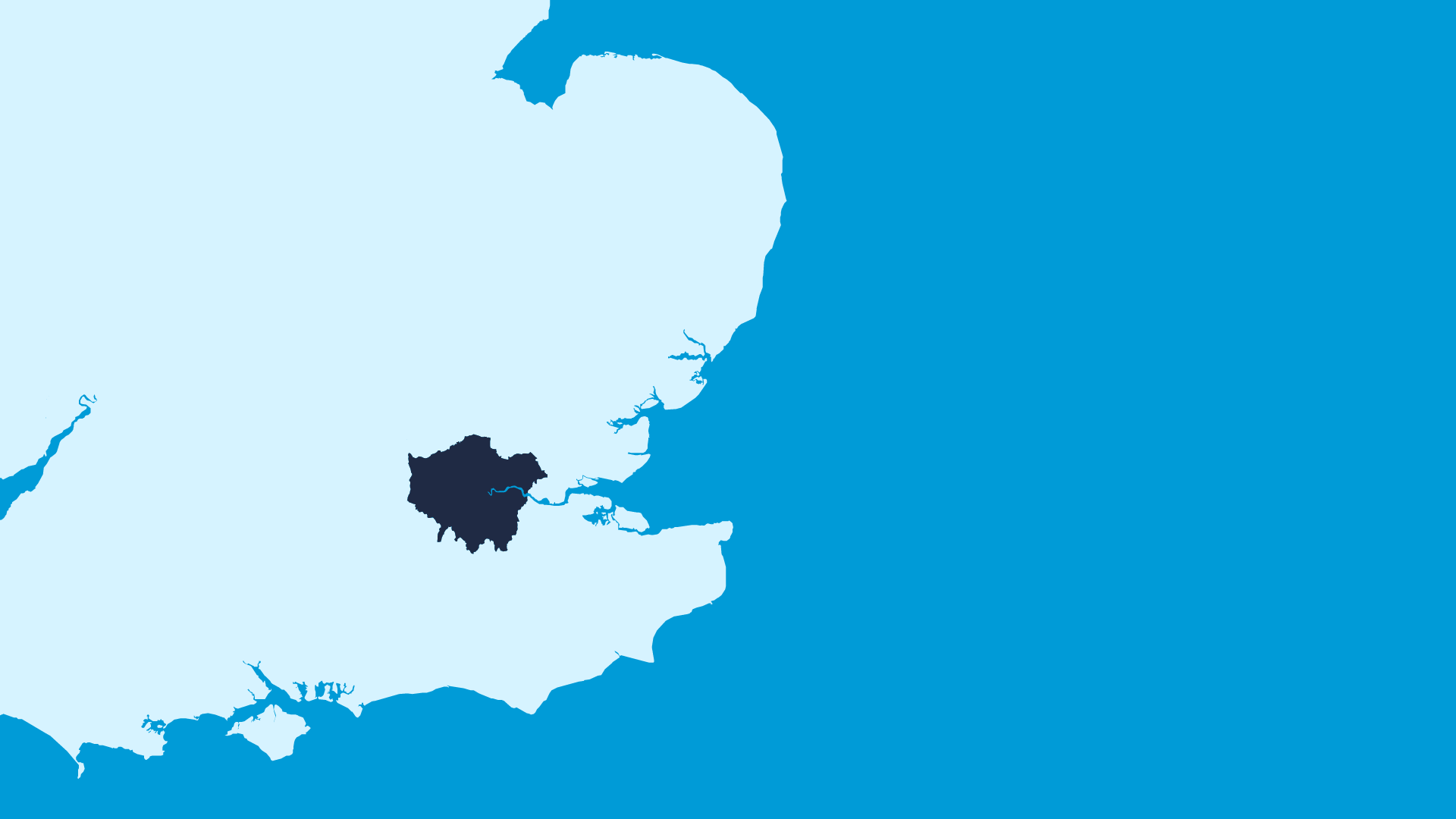

Exclusive data from a survey by The Morning Advertiser has discovered the average prices of pints across Great Britain.

As described throughout The Beer Report 2024, world lagers are enjoying high price points with nothing below £5.32 as shown in the maps here.

Premium lagers are costing the customer slightly less and core lagers making the lowest price point across the lager categories.

However, craft beers are priced even higher than World lagers at the pubs surveyed with Guinness retaining a high price point too.

Cask ales are taking the lowest prices across the board with Timothy Taylor’s Landlord highlighting the category with an average price of £4.79 per pint.

To view the average prices from the south-east of England up to Scotland and from the north-east of England to Wales, simply scroll through the maps.

Scotland

World Lager (Price per pint)

- Peroni (£) 6.25

- Madri (£) N/A

- Birra Moretti (£) 5.38

Premium Lager and Premium

- Staropramen (£) 5.35

- Stella Artois (£) 4.65

Standard Lager (Price per pint)

- Carling (£) 3.90

- Fosters (£) 4.30

Craft Beer (Price per pint)

- Camden Hells (£) 6.00

- Beavertown Neck Oil (£) 5.81

- BrewDog Punk IPA (£) 5.80

Cask Beer (Price per pint)

- Doom Bar (£) N/A

- Greene King IPA (£) 4.75

- London Pride (£) N/A

- Timothy Taylor's Landlord (£) 5.30

Stout (Price per pint)

Guiness (£) 4.96

North East

World Lager (Price per pint)

- Peroni (£) 5.48

- Madri (£) 4.73

- Birra Moretti (£) 5.04

Premium Lager and Premium

- Staropramen (£) 4.64

- Stella Artois (£) 4.29

Standard Lager (Price per pint)

- Carling (£) 3.88

- Fosters (£) 3.84

Craft Beer (Price per pint)

- Camden Hells (£) N/A

- Beavertown Neck Oil (£) 5.36

- BrewDog Punk IPA (£) 5.20

Cask Beer (Price per pint)

- Doom Bar (£) 4.39

- Greene King IPA (£) 3.77

- London Pride (£) 4.48

- Timothy Taylor's Landlord (£) 4.30

Stout (Price per pint)

Guiness (£) 4.65

North West

World Lager (Price per pint)

- Peroni (£) 5.74

- Madri (£) 5.04

- Birra Moretti (£) 5.45

Premium Lager and Premium

- Staropramen (£) 5.12

- Stella Artois (£) 4.20

Standard Lager (Price per pint)

- Carling (£) 4.23

- Fosters (£) 3.95

Craft Beer (Price per pint)

- Camden Hells (£) 5.75

- Beavertown Neck Oil (£) 5.86

- BrewDog Punk IPA (£) 6.40

Cask Beer (Price per pint)

- Doom Bar (£) 4.23

- Greene King IPA (£) 3.92

- London Pride (£) 4.24

- Timothy Taylor's Landlord (£) 4.67

Stout (Price per pint)

Guiness (£) 5.04

Midlands

World Lager (Price per pint)

- Peroni (£) 5.36

- Madri (£) 5.07

- Birra Moretti (£) 5.24

Premium Lager and Premium

- Staropramen (£) 4.81

- Stella Artois (£) 4.81

Standard Lager (Price per pint)

- Carling (£) 4.25

- Fosters (£) 4.20

Craft Beer (Price per pint)

- Camden Hells (£) 5.55

- Beavertown Neck Oil (£) 5.93

- BrewDog Punk IPA (£) 5.35

Cask Beer (Price per pint)

- Doom Bar (£) 4.09

- Greene King IPA (£) 4.33

- London Pride (£) 4.47

- Timothy Taylor's Landlord (£) 4.58

Stout (Price per pint)

Guiness (£) 5.02

Wales

World Lager (Price per pint)

- Peroni (£) 5.79

- Madri (£) 5.12

- Birra Moretti (£) 5.21

Premium Lager and Premium

- Staropramen (£) 5.50

- Stella Artois (£) 4.28

Standard Lager (Price per pint)

- Carling (£) 4.26

- Fosters (£) 4.00

Craft Beer (Price per pint)

- Camden Hells (£) 6.50

- Beavertown Neck Oil (£) 6.08

- BrewDog Punk IPA (£) N/A

Cask Beer (Price per pint)

- Doom Bar (£) 4.15

- Greene King IPA (£) N/A

- London Pride (£) 4.30

- Timothy Taylor's Landlord (£) 4.10

Stout (Price per pint)

Guiness (£) 4.91

South East

World Lager (Price per pint)

- Peroni (£) 5.76

- Madri (£) 5.38

- Birra Moretti (£) 5.94

Premium Lager and Premium

- Staropramen (£) 5.59

- Stella Artois (£) 5.03

Standard Lager (Price per pint)

- Carling (£) 4.27

- Fosters (£) 4.69

Craft Beer (Price per pint)

- Camden Hells (£) 5.96

- Beavertown Neck Oil (£) 6.35

- BrewDog Punk IPA (£) 5.30

Cask Beer (Price per pint)

- Doom Bar (£) 4.56

- Greene King IPA (£) 4.24

- London Pride (£) 4.73

- Timothy Taylor's Landlord (£) 5.00

Stout (Price per pint)

Guiness (£) 5.49

South West

World Lager (Price per pint)

- Peroni (£) 5.64

- Madri (£) 5.50

- Birra Moretti (£) 5.69

Premium Lager and Premium

- Staropramen (£) 5.59

- Stella Artois (£) 5.47

Standard Lager (Price per pint)

- Carling (£) 4.50

- Fosters (£) 4.78

Craft Beer (Price per pint)

- Camden Hells (£) 5.73

- Beavertown Neck Oil (£) 6.09

- BrewDog Punk IPA (£) 4.60

Cask Beer (Price per pint)

- Doom Bar (£) 4.56

- Greene King IPA (£) 4.34

- London Pride (£) 4.56

- Timothy Taylor's Landlord (£) 4.76

Stout (Price per pint)

Guiness (£) 5.41

London

World Lager (Price per pint)

- Peroni (£) 6.70

- Madri (£) 5.97

- Birra Moretti (£) 6.20

Premium Lager and Premium

- Staropramen (£) 5.76

- Stella Artois (£) 5.90

Standard Lager (Price per pint)

- Carling (£) 4.87

- Fosters (£) 4.65

Craft Beer (Price per pint)

- Camden Hells (£) 6.43

- Beavertown Neck Oil (£) 7.00

- BrewDog Punk IPA (£) 6.50

Cask Beer (Price per pint)

- Doom Bar (£) 4.56

- Greene King IPA (£) 4.63

- London Pride (£) 5.37

- Timothy Taylor's Landlord (£) 5.62

Stout (Price per pint)

Guiness (£) 6.01

Price Data

Exclusive data from a survey by The Morning Advertiser has discovered the average prices of pints across Great Britain.

As described throughout the Beer Report, World lagers are enjoying high price points with nothing below £5.32 as shown in the interactive map here.

Premium lagers are costing the customer slightly less and Core lagers making the lowest price point across the lager categories.

However, Craft beers are priced even higher than World lagers at the pubs surveyed with Guinness retaining a high price point too.

Cask ales are taking the lowest prices across the board with Timothy Taylor’s Landlord highlighting the category with an average price of £4.79 per pint.

To view the average prices from the south-east of England up to Scotland and from the north-east of England to Wales, simply scroll through the maps.

Scotland

World Lager (Price per pint)

- Peroni (£) 6.25

- Madri (£) N/A

- Birra Moretti (£) 5.38

Premium Lager and Premium

- Staropramen (£) 5.35

- Stella Artois (£) 4.65

Standard Lager (Price per pint)

- Carling (£) 3.90

- Fosters (£) 4.30

Craft Beer (Price per pint)

- Camden Hells (£) 6.00

- Beavertown Neck Oil (£) 5.81

- BrewDog Punk IPA (£) 5.80

Cask Beer (Price per pint)

- Doom Bar (£) N/A

- Greene King IPA (£) 4.75

- London Pride (£) N/A

- Timothy Taylor's Landlord (£) 5.30

Stout (Price per pint)

- Guiness (£) 4.96

North East

World Lager (Price per pint)

- Peroni (£) 5.48

- Madri (£) 4.73

- Birra Moretti (£) 5.04

Premium Lager and Premium

- Staropramen (£) 4.64

- Stella Artois (£) 4.29

Standard Lager (Price per pint)

- Carling (£) 3.88

- Fosters (£) 3.84

Craft Beer (Price per pint)

- Camden Hells (£) N/A

- Beavertown Neck Oil (£) 5.36

- BrewDog Punk IPA (£) 5.20

Cask Beer (Price per pint)

- Doom Bar (£) 4.39

- Greene King IPA (£) 3.77

- London Pride (£) 4.48

- Timothy Taylor's Landlord (£) 4.30

Stout (Price per pint)

- Guiness (£) 4.65

North West

World Lager (Price per pint)

- Peroni (£) 5.74

- Madri (£) 5.04

- Birra Moretti (£) 5.45

Premium Lager and Premium

- Staropramen (£) 5.12

- Stella Artois (£) 4.20

Standard Lager (Price per pint)

- Carling (£) 4.23

- Fosters (£) 3.95

Craft Beer (Price per pint)

- Camden Hells (£) 5.75

- Beavertown Neck Oil (£) 5.86

- BrewDog Punk IPA (£) 6.40

Cask Beer (Price per pint)

- Doom Bar (£) 4.23

- Greene King IPA (£) 3.92

- London Pride (£) 4.24

- Timothy Taylor's Landlord (£) 4.67

Stout (Price per pint)

- Guiness (£) 5.04

Midlands

World Lager (Price per pint)

- Peroni (£) 5.36

- Madri (£) 5.07

- Birra Moretti (£) 5.24

Premium Lager and Premium

- Staropramen (£) 4.81

- Stella Artois (£) 4.81

Standard Lager (Price per pint)

- Carling (£) 4.25

- Fosters (£) 4.20

Craft Beer (Price per pint)

- Camden Hells (£) 5.55

- Beavertown Neck Oil (£) 5.93

- BrewDog Punk IPA (£) 5.35

Cask Beer (Price per pint)

- Doom Bar (£) 4.09

- Greene King IPA (£) 4.33

- London Pride (£) 4.47

- Timothy Taylor's Landlord (£) 4.58

Stout (Price per pint)

- Guiness (£) 5.02

Wales

World Lager (Price per pint)

- Peroni (£) 5.79

- Madri (£) 5.12

- Birra Moretti (£) 5.21

Premium Lager and Premium

- Staropramen (£) 5.50

- Stella Artois (£) 4.28

Standard Lager (Price per pint)

- Carling (£) 4.26

- Fosters (£) 4.00

Craft Beer (Price per pint)

- Camden Hells (£) 6.50

- Beavertown Neck Oil (£) 6.08

- BrewDog Punk IPA (£) N/A

Cask Beer (Price per pint)

- Doom Bar (£) 4.15

- Greene King IPA (£) N/A

- London Pride (£) 4.30

- Timothy Taylor's Landlord (£) 4.10

Stout (Price per pint)

- Guiness (£) 4.91

South East

World Lager (Price per pint)

- Peroni (£) 5.76

- Madri (£) 5.38

- Birra Moretti (£) 5.94

Premium Lager and Premium

- Staropramen (£) 5.59

- Stella Artois (£) 5.03

Standard Lager (Price per pint)

- Carling (£) 4.27

- Fosters (£) 4.69

Craft Beer (Price per pint)

- Camden Hells (£) 5.96

- Beavertown Neck Oil (£) 6.35

- BrewDog Punk IPA (£) 5.30

Cask Beer (Price per pint)

- Doom Bar (£) 4.56

- Greene King IPA (£) 4.24

- London Pride (£) 4.73

- Timothy Taylor's Landlord (£) 5.00

Stout (Price per pint)

- Guiness (£) 5.49

South West

World Lager (Price per pint)

- Peroni (£) 5.64

- Madri (£) 5.50

- Birra Moretti (£) 5.69

Premium Lager and Premium

- Staropramen (£) 5.59

- Stella Artois (£) 5.47

Standard Lager (Price per pint)

- Carling (£) 4.50

- Fosters (£) 4.78

Craft Beer (Price per pint)

- Camden Hells (£) 5.73

- Beavertown Neck Oil (£) 6.09

- BrewDog Punk IPA (£) 4.60

Cask Beer (Price per pint)

- Doom Bar (£) 4.56

- Greene King IPA (£) 4.34

- London Pride (£) 4.56

- Timothy Taylor's Landlord (£) 4.76

Stout (Price per pint)

- Guiness (£) 5.41

London

World Lager (Price per pint)

- Peroni (£) 6.70

- Madri (£) 5.97

- Birra Moretti (£) 6.20

Premium Lager and Premium

- Staropramen (£) 5.76

- Stella Artois (£) 5.90

Standard Lager (Price per pint)

- Carling (£) 4.87

- Fosters (£) 4.65

Craft Beer (Price per pint)

- Camden Hells (£) 6.43

- Beavertown Neck Oil (£) 7.00

- BrewDog Punk IPA (£) 6.50

Cask Beer (Price per pint)

- Doom Bar (£) 4.56

- Greene King IPA (£) 4.63

- London Pride (£) 5.37

- Timothy Taylor's Landlord (£) 5.62

Stout (Price per pint)

- Guiness (£) 6.01

Asahi UK

Asahi UK is a subsidiary of Asahi Europe & International and is responsible for sales, marketing and customer operations across the UK and Ireland.

With its portfolio of super-premium beer brands, Asahi UK enriches consumer experiences through innovation, high-quality service and an exceptional portfolio of premium beer, ale, and cider brands, which include Peroni Nastro Azzurro (PNA), Asahi Super Dry (ASD), Meantime, Fuller’s London Pride and Cornish Orchards.

In the on-trade, premium lager is currently the only price segment in the lager category experiencing growth, at 2.7%, and now makes up 38% of the category by volume sales.[1] In lager, Asahi Super Dry and Peroni Nastro Azzurro are significant profit drivers for the category, with an average price per pint of £6.11 and £5.87 respectively, vs the average price of a premium lager at £5.40.1

The business is focused on creating profitable partnerships with premium outlets through its quality brands and delivering commercial value in the marketplace.

We urge any operator who is passionate about growing their sales of quality beer and cider to get in touch on communications@asahibeer.co.uk